A “Debt Doom Loop” Is Now Fully Engaged

Submitted by QTR’s Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on the state of macro heading into 2023.

I truly believe Larry to be one of the muted voices that the investing community would be better off for considering. He’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

You can listen to his most recent public podcast appearance on Palisades Gold Radio, from about 3 weeks ago, here.

But for this week, Larry was kind enough to allow me to share his thoughts heading into Q1 2023. His letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is part 2 of his letter. Part 1 can be read here.

RIVETS ARE POPPING

We have seen this movie before. The Fed tightens, things break, the Fed reacts by opening the monetary flood gates and the cycle begins all over again. Before things break you generally see signs that trouble is coming. We call this rivets popping.

There is always a lag effect between monetary policy and economic results. This current period reminds us of Summer 2007 when the Bear Stearns CDS funds failed. The GFC was 15 months later in the second half of 2008.

One very large rivet that has already popped is Great Britain as we described above. Another hugely important rivet that has not popped yet, but in our opinion is close is the US Stock Market.

We think the pain has just started. Particularly in the stock market where as the chart below shows, street estimates (blue bars) are looking for continued earnings growth as if no recession is imminent. Green bars show earnings decline in recessions. The economy is slowing rapidly and will almost surely enter a recession given the record inversion in the yield curve as seen in the 2year/10year bond spread. With softening demand and increased labor costs, earnings will suffer. The Wall Street analysts who are projecting further earnings growth are on drugs in our opinion. Additionally, with higher interest rates, price multiples to earnings will compress.

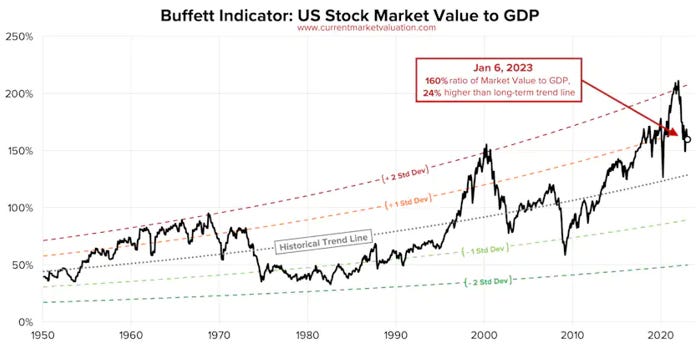

As you can see in Warren Buffett’s key market indicator in the chart below, compared to GDP stocks are still valued at 2000 levels. Recall that from that level the stock market declined 50% when the Dotcom bubble burst. Stocks are not cheap.

Additional rivets include the US Housing and Used Car Markets both of which show significant evidence of an economic slowdown as described in charts we have already covered above.

Some more recent rivets are as follows…(READ THIS FULL LETTER HERE).

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link