Stocks, Bonds, Gold Puke After ‘Good’ Jobs Data; Rate-Hike Odds Soar

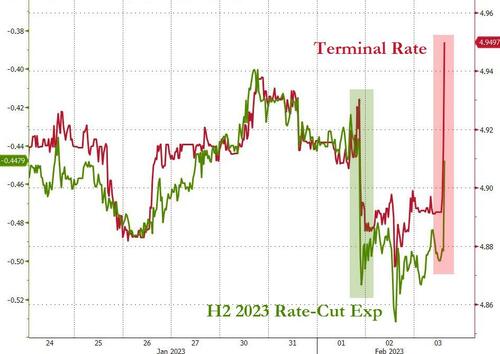

‘Good’ news on the labor market (lowest unemployment rate since 1969… after 450bps of rate-hikes?!) is a disaster for the ‘soft landing’ narrative and sent rate-hike expectations soaring above pre-Powell levels…

Source: Bloomberg

Bloomberg Intelligence Chief US Interest Rate Strategist Ira Jersey says the much stronger-than-expected payrolls report may finally be the data point that convinces the market the Fed won’t be cutting this year.

“As such, we think the long-end range may once again be re-tested with the 10-year Treasury topping 3.75% again, but we think a more pronounced selloff unlikely. Meanwhile a re-test of 4.4% on the two-year note seems possible if 2023 rate cuts are priced out.”

This sent stocks tumbling…

And bond yields are soaring back to pre-Powell levels…

Gold tumbled back to $1900…

The only thing flying high is the dollar…

Source: Bloomberg

Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., says on Bloomberg TV: “This is a reminder of what Powell tried to say, but the market wasn’t listening.”

Loading…

[ad_2]

Source link