Used-Vehicle Auction Prices Rise Again on Strong Retail Sales, after 2022 Plunge. Buyers’ Strike Over? “Core” Inflation at Risk

These price increases “were not typical” for January: Manheim auction house.

By Wolf Richter for WOLF STREET.

OK, this was quick. Used vehicle wholesale prices, when they’re sold at auction, had gone through a craziest spike ever that maxed out in December 2021. Then prices plunged by the most ever through November 2022. But in December they turned around, and in January they jumped – when seasonally they usually don’t change much, according to Manheim, the largest auto auction house in the US and a unit of Cox Automotive.

Price increases in January 2023 from December 2022:

- Not seasonally adjusted: +1.5%.

- Seasonally adjusted: +2.5%, second month in a row of increases (+0.8% in December).

- Six of the eight segments showed price increases. Pickup trucks up the most, +3.6%.

- Rental risk units: +2.8%. Vehicles that rental fleets have to sell themselves, rather than returning them to the manufacturer under their fleet programs.

- Three-Year Old index: +1.2%, normally little changed in January.

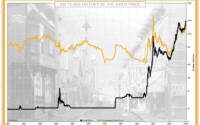

These price increases “were not typical” for January, Manheim said. We’re looking at the seasonally adjusted (green) and not seasonally adjusted (red) Manheim Used Vehicle Value index in dollars (both adjusted for changes in the mix and mileage of vehicles that sold at auction:

More indications of rising demand and prices.

The average daily sales conversion rate rose to 59.4%, well above normal for January. For example, in January 2019, it was 57.7%. “The higher conversion rate indicated that the month saw sellers with more pricing power than what is typically seen for this time of year,” Manheim said.

The upward pressure on prices was driven by dealers more eager to acquire inventory, as same-store retail sales of used vehicles jumped by 16% in January from December and by 5% year-over-year, according to initial estimates based on data from Dealertrack, a service of Cox Automotive.

Year-over-year, used vehicle wholesale prices were still down by 11%, but that decline was less than two months ago (-13.1%).

Days’ supply dropped amid sales increase.

Wholesale supply fell to 26 days in January, from 32 days in December and from 31 days in January a year ago.

Retail supply on dealer lots fell to 44 days, from 56 days in December and from 50 days in January 2022, as retail sales rose 16% from December and 5% from a year ago, based on vAuto data, a service of Cox Automotive.

End of Buyers’ strike.

Retail prices of used vehicles dropped a lot last year, though they were still very high at the end of the year, and it seems consumers, armed with hefty pay increases, and seeing a deal compared to the ridiculous prices a year ago, emerged from their buyers’ strike and started buying used vehicles in larger numbers.

Impact on “core” inflation measures.

With raging inflation all around, consumers have gotten used to paying high prices, but feel good about it because those high used-vehicle prices are down from where they’d been, and consumers feel like they got a deal? Seems like it. And so they’re starting to push up prices again with elevated demand? Seems like it. If I were Powell, I’d be getting the willies just about now.

Falling used vehicle retail prices exerted big downward pressure on the “core CPI” and on the “core PCE price index,” which is the Fed’s yardstick for measuring inflation.

That downward pressure from used vehicles in the pipeline (wholesales) is now abating, and we may be seeing the first signs of it even reversing. This trend will show up in used vehicle retail prices with the usual lag of a month or two.

If those trends in the January wholesale market continue and transfer to retail – rising used vehicle retail prices amid rising demand – they’re bad news for the month-to-month “core” inflation measures coming this spring and summer.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link