Is Your State Gold-Friendly? – John Rubino

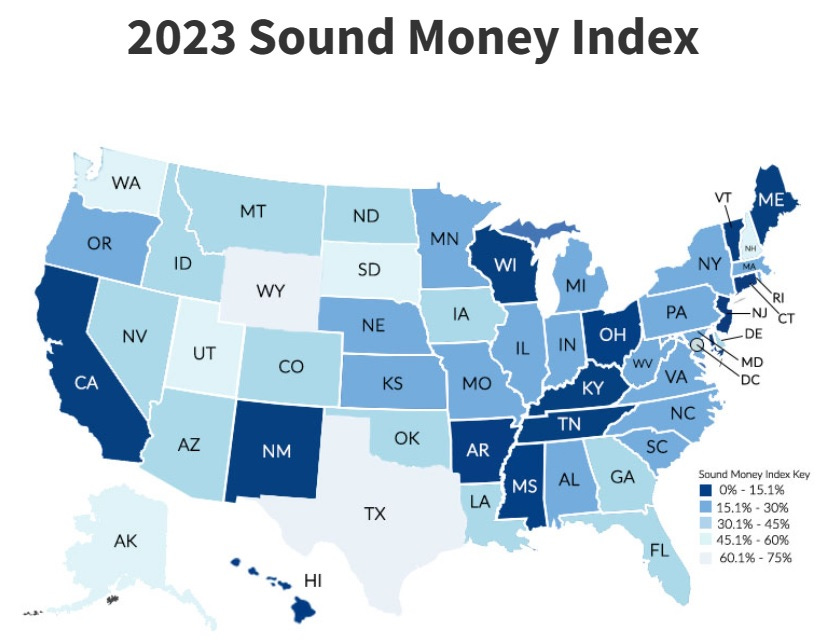

This morning I discovered an index that ranks states by how they treat gold. It’s called the Sound Money Index and is maintained by the Sound Money Defense League (SMDL). Here’s a map of the overall index rankings, with lighter being more favorable towards gold:

To calculate the index the SMDL uses this Methodology:

State Sales Tax on Gold and Silver (16 possible points)

-

Gold and silver coins: 8 points for no sales tax, 4 points for partial sales tax, 0 points for full sales tax

-

Gold and silver bullion: 8 points for no sales tax, 4 points for partial sales tax, 0 points for full sales tax

State Sales Tax on Platinum and Palladium (4 possible points)

State Sales Tax Rate (2 possible points)

State Income Tax (16 possible points)

-

Gold and silver coins: 8 points for no income tax, 4 points for partial income tax, 0 points for full income tax

-

Gold and silver bullion: 8 points for no income tax, 4 points for partial income tax, 0 points for full income tax

State Income Tax Rate (2 possible points)

Gold and Silver’s Status as Money (8 possible points)

Gold and Silver Clause Contracts (4 possible points)

State Gold and Silver Bullion Depository (8 points possible)

State Reserve Funds (8 possible points)

-

At least 10% of reserve funds held in gold and silver: 8 points

-

Some gold and silver held in reserve funds: 4 points

-

No gold and silver held in reserve funds: 0 points

State Public Pension Funds (8 possible points)

-

At least 10% of pension funds held in gold and silver: 8 points

-

Some gold and silver held in pension funds: 4 points

-

No gold and silver held in pension funds: 0 points

State Gold Bonds (4 possible points)

Precious Metals Dealer and Investor Harassment Laws (8 possible points)

-

Dealers not forced to collect unusually invasive and sensitive information from innocent customers: 2 points

-

No mandatory, automatic submission to law enforcement of sensitive information on innocent customers: 2 points

-

No arbitrary holding period required on purchased inventory: 2 points

-

No ban on using cash in precious metals transactions: 2 points

Each state receives a rating across these 12 different categories for a maximum of 88 possible points.

Why should you care?

There are at least two reasons to care about a state’s attitude towards gold. First, if you own or intend to own a lot of gold (which obviously you do), paying all kinds of taxes and jumping through numerous legal hoops makes acquiring and using your holdings harder and more expensive.

Second, if you’re thinking about moving to a place in which to weather the coming authoritarian/inflationary storm, a state’s stance on gold is a good shorthand indicator of its overall attitude about individual freedom, state control, and self-determination. In other words, the above map is a shopping list for states that are both better places to live in general and safer places to be in a SHTF scenario.

[ad_2]

Source link