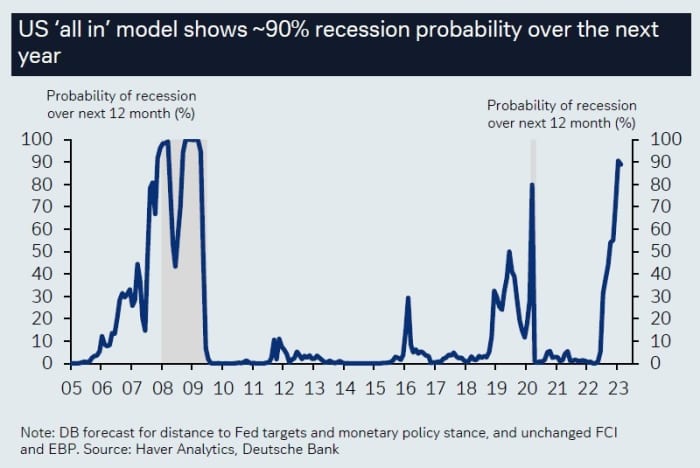

One of Wall Street’s most pessimistic banks is conceding that the economic outlook has improved. But Deutsche Bank, in a new update of its house view, still says there’s a 90% chance of a U.S. recession this year.

It says that while there’s evidence inflation has peaked, it’s still well above central-bank targets and likely to be persistent, and neither the Federal Reserve nor the European Central Bank will tolerate it. Historically, once inflation spikes above 8%, it takes two years to fall beneath 6%, according to strategists Marion Laboure, Cassidy Ainsworth-Grace and Jim Reid.

The fallout from Fed tightening is still to be felt. It’s expecting a moderate recession in the U.S. beginning in the second half of the year, lasting three or four quarters.

The analysts also noted the renewed tensions between the U.S. and China, including the shooting down of a large alleged Chinese spy balloon, but also extending to the decision to stop providing licenses to export to Huawei and an expected agreement with key semiconductor-equipment making countries Japan and the Netherlands to expand the reach of a U.S. technology export ban.

Deutsche Bank is sticking with its call that the S&P 500

SPX,

will finish the year at 4,500 in what it anticipates to be a volatile year, with the S&P 500 falling to 3,250 as the recession begins. But halfway through the expected recession, Deutsche Bank expects stocks to recover.

The S&P 500, up 7% this year, ended Wednesday at 4,118.

If there is no recession, the Deutsche Bank team says, the S&P 500 would end the year near the top of its band — at 5,000.

The analysts say the yield on the 10-year

TMUBMUSD10Y,

will end the year at 3.65%. It’s expecting further weakening in the U.S. dollar, with the euro

EURUSD,

reaching $1.10 by the second quarter.