Death Spirals and Speculative Frenzies

There is an element of inevitability in play, but it isn’t about central bank bailouts, it’s about Death Spirals and

the collapse of unsustainable systems.

The vapid discussions about “soft” or “hard” landings for the economy are akin to asking if the Titanic’s

encounter with the iceberg was “soft” or “hard:” either way, the ship was doomed, just as the global economy

is doomed by The New Normal of Death Spirals and Speculative Frenzies.

Death Spirals are the inevitable result of entrenched interests clinging on to the status quo and thwarting any

adaptation or evolution that might threaten or diminish their share of the swag–and that includes any real change

because any consequential modification has the potential to upset the gravey train.

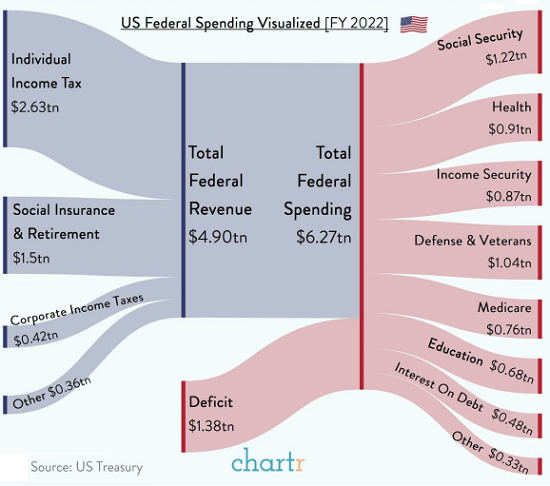

The status quo “solution” is to borrow and blow whatever sums are needed to satisfy every entrenched interest.

Filling the federal slop-trough for all the hogs now requires borrowing a staggering $1.4 trillion every year, and

billions more in municipal, county and state bonds (borrowing money via selling bonds) on the local level.

This borrow and blow strategy avoids any uncomfortable discipline and difficult trade-offs: everybody gets everything

they demand.

This strategy looks “unsinkable” until the iceberg looms dead ahead. History suggests that fiscal and political

discipline is eventually imposed by the real world in one fashion or another when diminishing returns enter

a Death Spiral.

Any limit on debt is of course “impossible,” just as it was “impossible” for the Titanic to sink. But

history is rather implacable in this regard. The self-serving hubris of “impossible” limits on largesse tend to

collapse on contact with currency devaluation, structural inflation or a systemic crisis of legitimacy that

sweeps away the entire worm-eaten facade of stability.

In other words, the entrenched interests benefitting from the status quo will continue to do what worked in the past

until it all implodes. The pain of discipline and modest sacrifices is too great to bear, so let’s collapse the

entire system.

Autocracies excel at Death Spirals because they eliminate dissent, transparency and competing nodes of power.

Nobody’s left to push back on disastrous policy decisions, so autocratic regimes race toward the iceberg at full speed.

Rather than invest in real long-term solutions, everyone is in the casino, buying options that expire in a few hours.

Rather than invest for an entire quarter–whew, three whole months!–speculators now consider a week an unbearably long

time to hold a trade.

Speculative frenzies create their own Death Spirals, as gamblers front-run the “guaranteed” bailout of speculators

by central banks. This is the consequence of moral hazard being elevated to “guaranteed”: there is no need to

actually wait for the inevitable central bank bailout of bets gone bad, we can place bets before the bailout because we

know it’s as assured as the sun rising tomorrow morning.

Nice, except central banks and bailouts also reach diminishing returns and enter Death Spirals. Doing more of

what’s failed seems to work once, then twice, if you give it enough juice, but the third time is iffy and the

fourth time collapses the speculative casino that the status quo was trying to save.

No one who benefits from the Moral Hazard Casino Economy believes it’s no longer sustainable. All the gamblers,

big and small, are confident the Federal Reserve and other central banks can cover any losses and make good

whatever befalls the casino. The hubris of the punters, big and small, is essentially infinite.

I’ll get out before the house of cards collapses, everyone tells themselves. In the meantime, I’m going to front-run

the inevitable bailout of this speculative frenzy.

There is an element of inevitability in play, but it isn’t about central bank bailouts, it’s about Death Spirals and

the collapse of unsustainable systems. Death Spirals and speculative frenzies have now been completely normalized.

We can’t imagine any other way to operate. But this New Normal won’t last as long as punters believe. Doing more of

what worked in the past is only accelerating the casino’s demise.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, G.D. T. ($100), for your outrageously generous contribution |

Thank you, Mike S. ($5/month), for your monstrously generous pledge |

[ad_2]

Source link