Consumer Debt Soars By $394BN, Most In 20 Years, To Record $16.9 Trillion As Young Borrowers Struggle To Repay

While it won’t tell us anything we don’t know – since it is two months delayed and we already get monthly updates from the Fed via the G.19 statement – this morning the NY Fed published its quarterly Household Debt and Credit report, which showed that total household debt in the fourth quarter of 2022 rose by 2.4% or $394 billion, the largest nominal quarterly increase in twenty years, to a record $16.90 trillion. Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession.

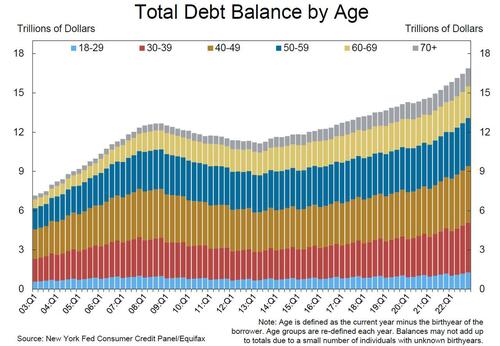

And the same chart broken down by age:

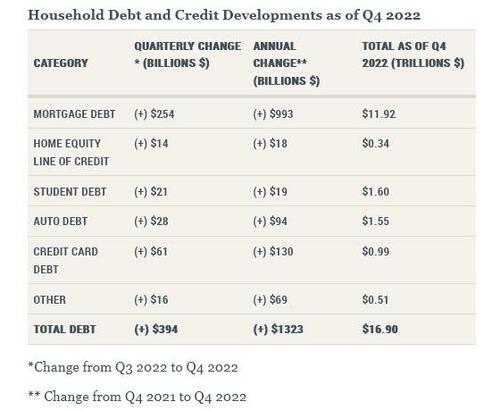

Every type of consumer credit increased in Q4, and here is a detailed breakdown:

- Mortgage balances rose by $254 billion in the fourth quarter of 2022 and stood at $11.92 trillion at the end of December, marking a nearly $1 trillion increase in mortgage balances in 2022.

- Home equity lines of credit rose by $14 billion to $340 billion.

- Student loan balances now stand at $1.60 trillion, up by $21 billion from the previous quarter. In total, non-housing balances grew by $126 billion.

- Auto loan balances increased by $28 billion in the fourth quarter, consistent with the upward trajectory seen since 2011.

- Credit card balances increased $61 billion in the fourth quarter to $986 billion, surpassing the pre-pandemic high of $927 billion.

“Credit card balances grew robustly in the 4th quarter, while mortgage and auto loan balances grew at a more moderate pace, reflecting activity consistent with pre-pandemic levels,” said NY Fed economic research advisor Wilbert van der Klaauw.

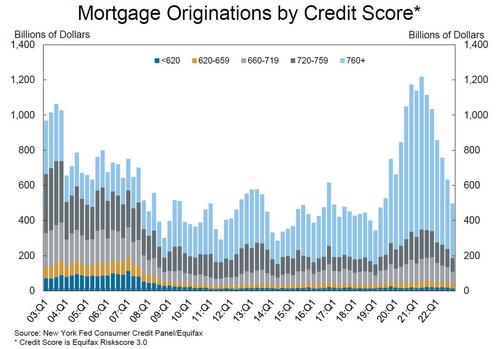

On the other end, mortgage originations, which include refinances, fell to $498 billion in the fourth quarter as a result of soaring rates.

Yet despite record high auto loan rates, the volume of newly originated auto loans was $186 billion, representing a slight increase from the previous quarter. This is something for the Fed to look into as it clearly shows that there is a breakdown in the (tighter) credit channel which is only impacting housing and not purchases of other debt-funded goods.

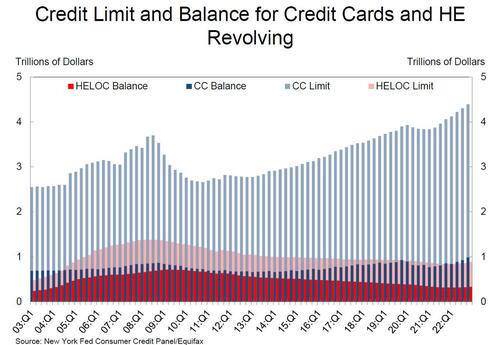

Aggregate limits on credit card accounts increased by $88 billion in the fourth quarter and now stand at $4.4 trillion, just to make sure the debt serfs can always access money they don’t have, and have to repay at a record high APR.

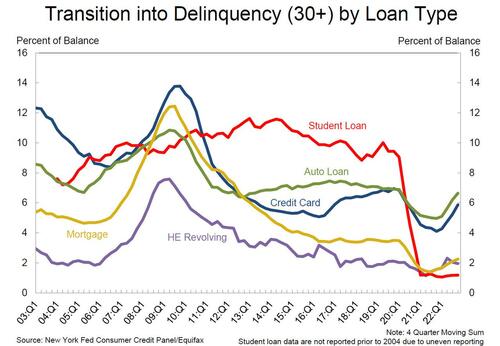

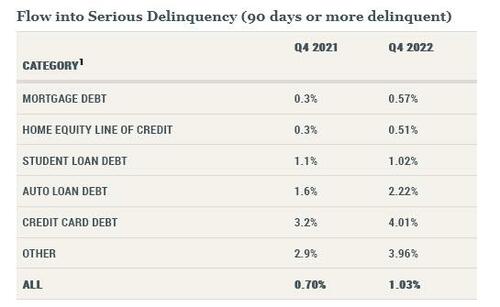

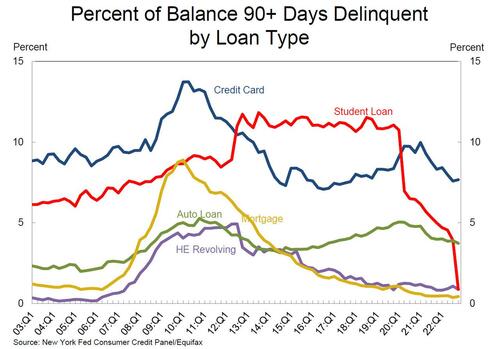

Separately, and also as a result of the surge in interest rates, the share of current debt becoming delinquent increased again in the fourth quarter for nearly all debt types, following two years of historically low delinquency transitions.

Mortgage loans considered in “serious delinquency” of 90 days or more rose to a rate of 0.57%, still low but nearly double where they were from the year prior. Auto loan debt delinquencies rose 0.6 percentage point to 2.2%, while credit card debt jumped 0.8 percentage point to 4%. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.4 percentage points, respectively.

“Although historically low unemployment has kept consumer’s financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers’ ability to repay their debts”, warned van der Klaauw.

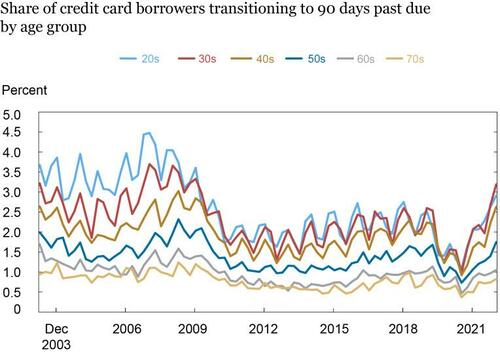

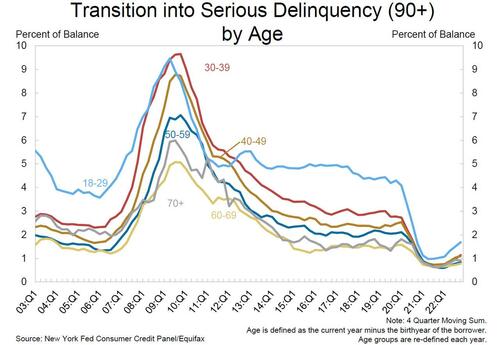

The New York Fed also issued an accompanying Liberty Street Economics blog post examining credit card and auto loan delinquency, with a focus on borrowers by age. While delinquency transition rates appear relatively small, a closer look at the uptick reveals some signs of stress amongst younger borrowers who are beginning to miss some credit card and auto loan payments.

Indeed as shown in the chart below, where the NY Fed changes the focus from balances to borrowers, by measuring the percentage of borrowers that transition into late delinquency during the quarter, credit catd delinquencies are becoming a major issue for young people. [the numerator is the number of borrowers who became 90+ days past due, and the denominator is the number of borrowers who were less than 90 days past due in the previous quarter]. Specifically, credit card borrowers are missing their payments and transitioning to 90+ day delinquency at a rate higher than they had before the pandemic. (These rates are higher than the balance-weighted ones shown in the Quarterly Report because low-balance borrowers are generally more likely to become delinquent.)

The chart disaggregates these rates by age, and we see that this is particularly true for younger borrowers who have surpassed their pre-pandemic rates, while for older borrowers, the rates are rising but have not yet reached their pre-pandemic levels.

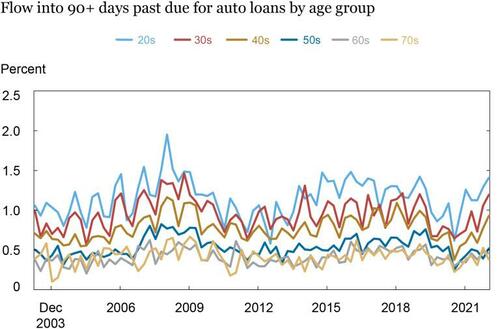

The next chart shows the same calculation, but for auto loans. We see that there’s a similar trend, although auto loan performance at the person level remains slightly healthier than it had just before the pandemic for most age groups, but younger borrowers are struggling relatively more.

The Quarterly Report includes a summary of key takeaways and their supporting data points. Overarching trends from the report’s summary include:

Housing Debt

- There was $498 billion in newly originated mortgage debt in Q4 2022. After two years of historically high volumes of mortgage originations, the Q4 volume more closely resembles pre-pandemic volumes.

- Although the foreclosure moratoria have been lifted nationally, new foreclosures have stayed very low since the CARES Act moratorium was put into place. About 34,000 individuals had new foreclosure notations on their credit reports.

Student Loans

- Outstanding student loan debt stood at $1.60 trillion in Q4 2022.

- Less than 1% of aggregate student debt was 90+ days delinquent or in default in Q4 2022. The sharp drop in the student debt delinquency reflects the beginning of the Fresh Start program, which marked over $34 billion defaulted loans as current, amid the continued repayment pause on student loans.

And here is why the US consumer is “so strong” – when you don’t have to worry about repaying your student debt, well… you spend that money on other useless stuff.

Finally, who benefits from no longer paying student loans? Everyone

Here is the full NY Fed presentation (pdf link).

HHDC_2022Q4 by Zerohedge

Loading…

[ad_2]

Source link