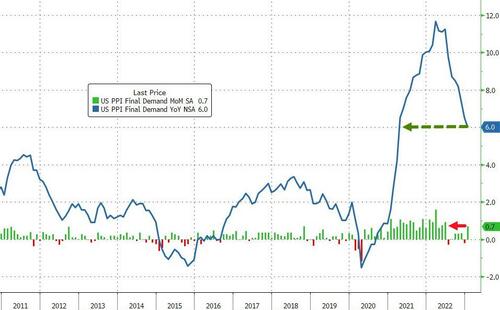

Producer Prices Surge More Than Expected In January As Gas Prices Rebound

After hotter than expected consumer price inflation, consensus estimates are for a notable rebound in producer prices in January after a big surprise 0.4% decline MoM in December. In fact, like CPI, PPI came in hotter than expected, up 0.7% MoM, which pushed the YoY rise to +6.0% (down from +6.5% in December)…

Source: Bloomberg

That is the biggest MoM jump in the headline since June 2022, but lowest YoY print since March 2021.

Core PPI rose even more than expected (+0.5% MoM vs +0.3% MoM exp) to +5.4% YoY.

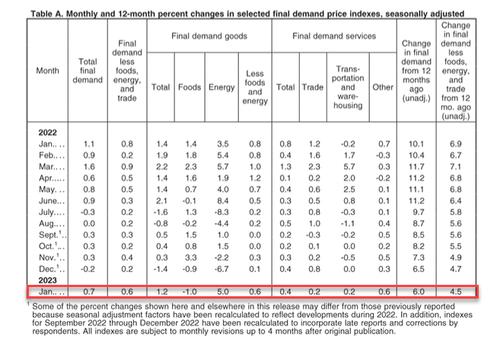

The index for final demand goods moved up 1.2 percent in January, the largest increase since rising 2.1 percent in June 2022.

Most of the January advance is attributable to a 5.0-percent jump in prices for final demand energy. The index for final demand goods less foods and energy increased 0.6 percent. In contrast, prices for final demand foods fell 1.0 percent.

Nearly one-third of the January rise in the index for final demand goods can be traced to prices for gasoline, which increased 6.2 percent. The indexes for residential natural gas, diesel fuel, jet fuel, soft drinks, and motor vehicles also moved higher. Conversely, prices for fresh and dry vegetables decreased 33.5 percent. The indexes for residual fuels and for basic organic chemicals also declined.

The index for final demand services advanced 0.4 percent in January, the same as in December.

Over 80 percent of the broad-based increase in January is attributable to prices for final demand services less trade, transportation, and warehousing, which rose 0.6 percent.

Margins for final demand trade services moved up 0.2 percent. Prices for final demand transportation and warehousing services also advanced 0.2 percent.

A major factor in the January rise in prices for final demand services was the index for hospital outpatient care, which jumped 1.4 percent. The indexes for automobiles and automobile parts retailing; health, beauty, and optical goods retailing; portfolio management; chemicals and allied products wholesaling; and airline passenger services also moved higher. In contrast, margins for fuels and lubricants retailing fell 17.5 percent. Prices for long-distance motor carrying and for securities brokerage, dealing, and investment advice also declined.

The positive news is that the pipeline for inflation looks like its continuing to decline with intermediate demand inflation down to +4.71% YoY…

Source: Bloomberg

This is not good news for Mr.Powell at all.

Loading…

[ad_2]

Source link