The Global Liquidity Downturn Is Not Yet Finished

Authored by Simon White, Bloomberg macro strategist,

Global liquidity conditions remain the tightest they have been for several decades, continuing to pose a formidable headwind for risk assets.

Liquidity is probably the most important short- and medium-term driver of risk assets. The fundamental value of an asset becomes moot as in extremis, with no liquidity, there can be no transactions. This means catching turns in liquidity is of paramount importance.

After falling for over a year, a turn higher in liquidity may already have arrived according to some – but I’ll show why it is too early to sound the all clear.

First we have to be clear what we mean by liquidity. It can be measured in many ways, but from a trading and investment standpoint all that should matter are those indicators that can give us a lead on asset prices.

One of the simplest measures of liquidity that does this is the annual growth in real M1. There is often too much focus on M2, but M2 is counter-cyclical. M1 is a much better measure of future activity, as it is M1 that rises when a bank creates the demand deposit which is the counterpart to a new loan.

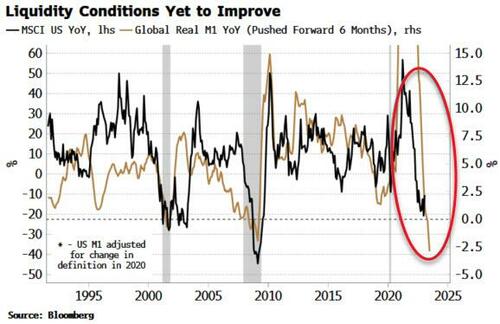

Global real M1, i.e. real M1 of the G10, remains very depressed as it continues to retreat from the spike seen after the extraordinary easing measures during the pandemic. The chart below shows that global real M1 leads US equity prices by about nine months. There is no sign yet of an upturn.

Real M1 growth is a “quantity” view of liquidity. A “price” view of liquidity is sending the same message.

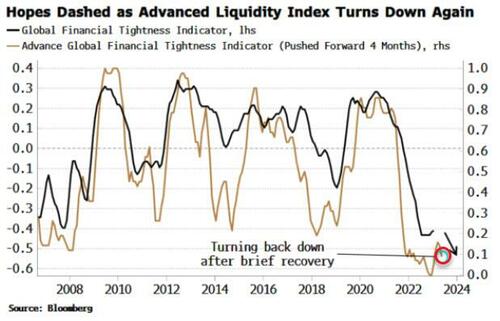

The Global Financial Tightness Indicator (GFTI) is a diffusion of credit and money-market spreads and global central-bank rate hikes. The GFTI remains lower than it was in the depths of the 2008 financial crisis.

There was a glimmer of light at the end of tunnel as central banks looked to be nearing the end of their tightening cycles. But that has been snuffed out with a renewed hawkish zeal from Australia to the US over the last few weeks.

The Advanced Global Financial Tightness Indicator (AGFTI), which showed that the GFTI should soon start rising, is now falling again (see chart above).

There are no green shoots for liquidity.

That’s not all.

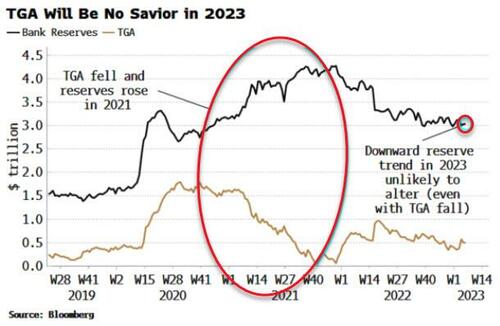

The Treasury drawing down its account at the Fed (the TGA) has been cited as another imminent fount of asset-boosting liquidity. But here too optimism is getting the better of a more prosaic reality.

Opinion is being colored by the experience of 2021 when the TGA fell by over $1.5 trillion, helping fuel the “everything rally.” Then, the TGA’s decline led to a rise in bank reserves, supporting asset prices. The reason was that the Treasury was in the midst of reducing net issuance from the sky-high levels seen in the pandemic, meaning the TGA drawdown wasn’t immediately “sterilized” by further net government borrowing.

Today, the Treasury looks unlikely to alter its projected coupon (i.e. non-bill) issuance for this year. This is despite the debt-ceiling limit, with the government able to use “extraordinary measures” that will allow it to keep borrowing. Ongoing reserve-destruction from QT and a stubbornly high RRP facility ensures that any rise in bank reserves from a fall in the TGA (which currently sits at $500 billion) is likely to be fleeting at best.

There are some specks of good news, for instance the credit upturn in China. But we would need to see this reflected in the global measures of liquidity shown above before making a claim. We are not there yet.

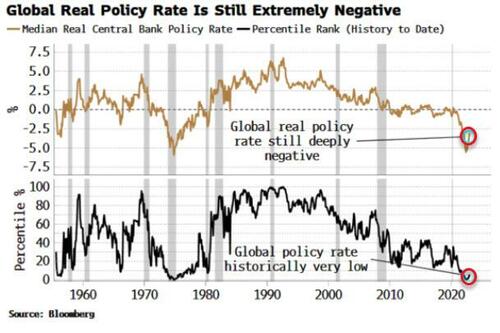

We could be forgiven for thinking that on any historical measure, monetary conditions must be very tight, given the daily bombardment of hawkish central-bank rhetoric, one of fastest global synchronized rate-hiking cycles yet seen, and interest rates at multi-year highs.

In fact, the median global real central-bank policy rate remains deeply negative, even after rising from its near all-time lows of -5.5%, to -3% currently. That still leaves it historically very negative, and in the bottom 6% of all readings going back to the mid 1950s.

This is worth bearing in mind when looking for an upturn in liquidity, as by some measures global tightening has barely begun.

Loading…

[ad_2]

Source link