US Leading Economic Indicators Tumble For 10th Straight Month, Signal Recession Imminent

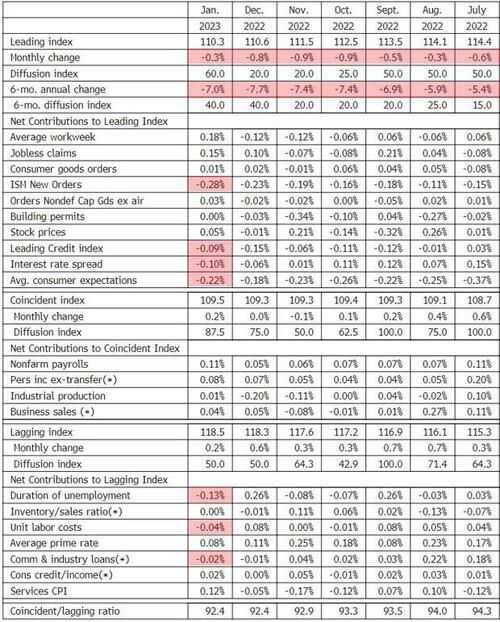

The Conference Board’s Leading Economic Indicators (LEI) continued its decline in January, dropping 0.3% MoM (vs -0.3% exp).

This is the 10th straight monthly decline in the LEI (and 11th month of 13) – the longest streak of declines since ‘Lehman’ (22 straight months of declines from June 2007 to April 2008)

“The US LEI remained on a downward trajectory, but its rate of decline moderated slightly in January,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board.

“Among the leading indicators, deteriorating manufacturing new orders, consumers’ expectations of business conditions, and credit conditions more than offset strengths in labor markets and stock prices to drive the index lower in the month. The contribution of the yield spread component of the LEI also turned negative in the last two months, which is often a signal of recession to come. While the LEI continues to signal recession in the near term, indicators related to the labor market—including employment and personal income—remain robust so far. Nonetheless, The Conference Board still expects high inflation, rising interest rates, and contracting consumer spending to tip the US economy into recession in 2023.”

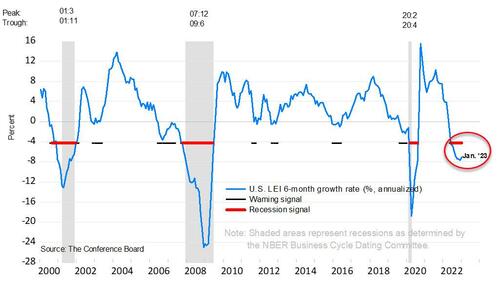

Despite ‘soft landing’ hype, the LEI is showing no signs at all of ‘recovering’, hitting its lowest since Feb 2021…

And on a year-over-year basis, the LEI is down 6.03% (a smidge better than the revised 6.22% decline in Dec) – but still close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse…

Not a good sign for GDP.

The trajectory of the US LEI continues to signal a recession over the next 12 months

Is this the cleanest view of The Fed’s tightening impact on the US economy?

Loading…

[ad_2]

Source link