The Perfect Storm of Crises is Converging in 2023

Let me get straight to the point.

There has rarely been a more dangerous perfect storm…

That’s because severe crises are brewing on multiple fronts and converging.

2023 will be a pivotal year with profound investment implications.

If I had to condense it down to the single most important theme, it would be, without a doubt, rampant currency debasement.

It’s an unstoppable investment trend you can bet on in 2023.

This trend rests on the biggest distortion that has ever existed in the history of financial markets and the global economy. As I’ll discuss, the unwinding of this distortion has long been inevitable, but now it’s imminent.

That distortion is that most of mankind does not know what good money is.

Although people use money every day, few consider what it actually is or what makes for a good money.

Asking people, “what is money?” is like asking a fish, “what is water?”

The fish probably doesn’t even notice the water unless it becomes polluted or something is wrong.

Money is a good, just like any other in an economy. And it isn’t a complex notion to grasp. It doesn’t require you to understand convoluted math formulas and complicated theories—as the gatekeepers in academia, media, and government mislead many folks into believing.

Understanding money is intuitive and straightforward.

Money is simply something useful for storing and exchanging value. That’s it.

People have used stones, glass beads, salt, cattle, seashells, gold, silver, and other commodities as money at different times.

Think of money as a claim on human time. It’s like stored life or energy.

Unfortunately, today most of humanity thoughtlessly accepts whatever worthless digital and paper scrips their governments give them as money.

However, money does not need to come from the government. That’s a total misnomer that the average person has been hoodwinked into believing.

It would be similar to transporting yourself back in time and asking the average person in the Soviet Union, “Where do shoes come from?”

They would say, “Well, the government makes the shoes. Where else could they come from? Who else could make the shoes?”

It’s the same mentality here regarding money today—except it’s much more widespread with much bigger implications.

Those entrusting government currencies with their life savings will soon experience a harsh economic reality check as this longstanding delusion gives in to reality… like the one former Soviet citizens received as communism crumbled.

This trend of rampant currency debasement is already in motion, accelerating, and unstoppable.

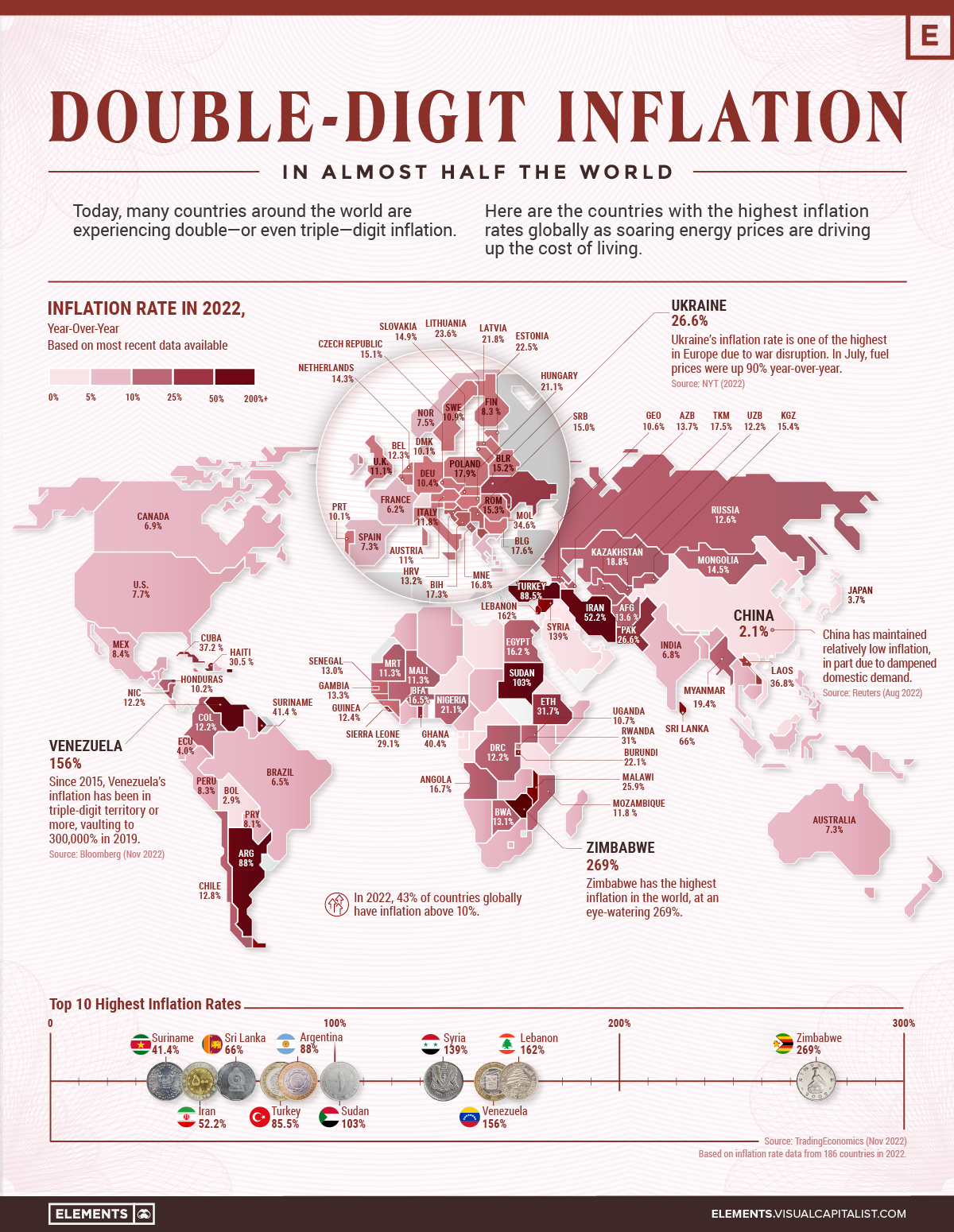

As the graphic from Visual Capitalist shows below, almost half of the world’s population lives in countries with double-digit inflation.

There is no doubt the actual number is even higher as the chart below cites official government statistics, which always understate reality.

Many consider the US dollar the best of all the fiat currencies.

However, even according to the crooked official statistics which understate reality, the US dollar is shedding 7-8% of its purchasing power each year.

The means everyone holding US dollars will lose 50% of their purchasing power every nine years.

And that’s the BEST case scenario.

Those holding other fiat currencies will see their purchasing power melt away even faster.

And that is just how things look right now. It’s set to get much worse.

2023 could be the year the trend of rampant currency debasement reaches a crescendo.

Michael Saylor captured the essence of the situation when he said, “The road to serfdom consists of working exponentially harder to earn a currency that is growing exponentially weaker.”

Government Inflation Statistics Are Rigged

Inflation is one of the most misused words in the English language. The original and correct meaning of inflation is an increase in the money supply.

However, the government and their court economists in academia and the mainstream media have redefined inflation over the years.

Since its founding in 1828, Webster’s Dictionary had defined inflation as “an increase in the money supply.” Then in 2003, it changed the definition to “a rise in the general price level.”

The difference might seem subtle, but it’s not. It’s a deliberate deception.

Redefining inflation in this way confuses cause and effect, and that is exactly the point.

Price increases are not inflation. Instead, they are an effect of inflation—an increase in the money supply.

When inflation is redefined as “a rise in the general price level,” many people are confused about what is happening and who is causing it. Inflation seems to come out from nowhere.

It would be like redefining robbery to mean “a mysterious property loss,” as if there was no robber.

The reality is that inflation is 100% a political phenomenon.

Neither the local grocery store, the pharmacy, the restaurant owner, nor foreign scapegoats are responsible for inflation. The government—with its monopoly control over the currency—is.

Governments inflate the money supply to generate more money than they could through direct taxation and issuing debt. In short, inflation is a hidden tax the government takes from its citizens without their consent.

There are two main ways to measure inflation:

#1. based on the government’s definition of inflation (increase in the general price level)

#2. based on the correct definition of inflation (increase in the money supply)

The former is prone to political manipulation and consistently understates reality. The latter gives an accurate picture.

When you hear about inflation in the mainstream media, academia, or from some government official, they are talking about the Consumer Price Index (CPI). The CPI measures changes in the price level of a weighted average basket of consumer goods and services.

However, there are several significant flaws with the CPI.

First, it assumes that “a rise in the general price level” can be distilled to a single number.

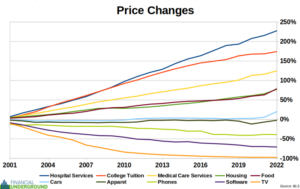

However, prices do not increase uniformly across the board, as seen with big-ticket items like medical care, college tuition, and housing, which tend to rise much more rapidly than other things.

As shown in the chart above, it is evident that price increases are unevenly distributed and cannot be condensed into a single number. The rise in prices is a vector that is unevenly distributed, with prices of scarce goods and services rising faster.

Moreover, every individual has their own preferences, meaning their desired basket of goods and services will differ. For example, someone in Los Angeles will have a different basket than someone in rural Montana.

Trying to quantify a general increase in prices as a single number for over 334 million people—as the CPI claims to do—is an impractical task. It’s even more ridiculous than using a national average weather temperature to indicate what clothes you should wear for the day.

Second, the government gets to determine what items are included in the CPI and their weightings in the index. They can cherry-pick the items to show the least possible price increases. It’s like letting students grade their own papers.

In short, the CPI is a worthless statistic. It’s misleading government propaganda intended to conceal the government’s hidden inflation tax.

Yet, most people incorrectly equate inflation to the CPI because government officials, the mainstream media, and academics repeat this falsehood, and most people thoughtlessly accept it as gospel.

The real way to calculate inflation is intuitive and uncomplicated.

You don’t need to perform complex math calculations or have an advanced degree in economics—anyone can do it.

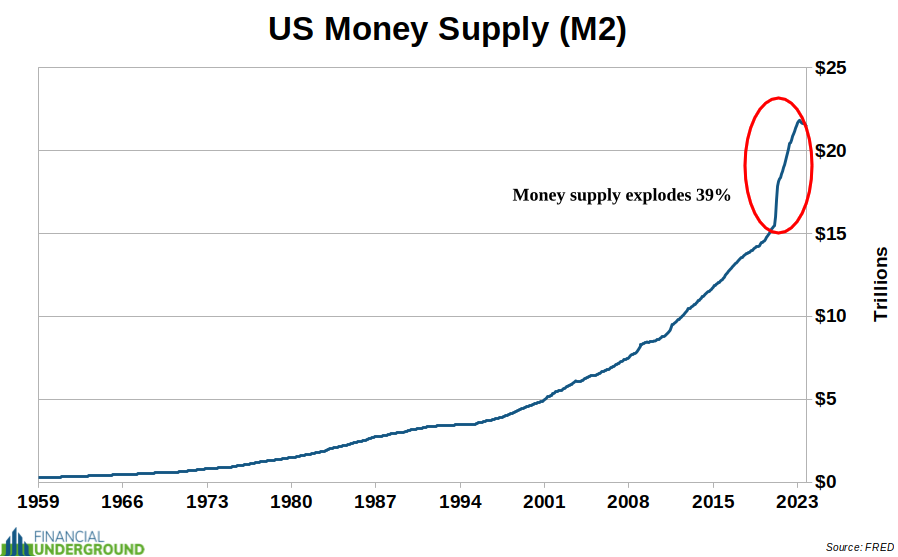

All you need to do is look at the change in the money supply. Doing so eliminates much of the noise, political manipulation, and propaganda of the CPI to get a clear picture of what is occurring.

It is no surprise that the government prefers people to focus on a nebulous statistic like the CPI rather than the change in the money supply.

That’s because when you look at the change in the money supply, it becomes clear that the government is engaging in a staggering amount of currency debasement.

In short, the Federal Reserve has recently created more money out of thin air than at any other point in US history. Since the start of the Covid hysteria in March 2020, the US money supply has increased by an incredible 39%.

If your after-tax wealth has not increased by 39% since March 2020, then you are not keeping up with the Fed’s monetary debasement. You are losing ground and on the road to serfdom.

It’s just an anecdote, but I don’t know anyone whose after-tax wealth has grown by 39% since March 2020. I imagine that most people don’t know anyone, either.

Here’s the bottom line…

There’s an excellent chance more inflation and financial chaos is coming soon.

Are you ready for it?

That’s why we just released an urgent PDF guide, “Survive and Thrive During the Most Dangerous Economic Crisis in 100 Years.” Download this free report to discover the top 3 strategies you need to implement today to protect yourself and potentially come out ahead.

With the global economy in turmoil and the threat of a “Great Reset” looming, this guide is a must-read. Click here to download it now.

[ad_2]

Source link