We Are Seeing ‘Blind Panic’ – US Jobs Data Upstaged By Fears Of What Else May Be Out There

Even though, for now, there seems to be little indication of a wider systemic risk from the distress surrounding Silicon Valley Bank, Bloomberg cross-asset strategist Ven Ram notes that traders are selling anything associated with risk first and asking questions later.

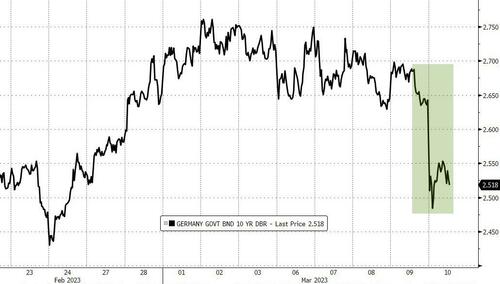

Euro-area government bonds are rallying pretty much across the spectrum in the classic flight to safety, with German yields down about 12 basis points or more across the curve.

2Y UST yields are down a stunning 30bps from yesterday’s highs…

Ram reminds market participants that it’s worth keeping in mind that banks’ capital adequacy ratios have vastly improved both in the US and across the Atlantic after the global financial crisis, so what we are seeing at the moment with the financial markets is more one of blind panic, not one backed by anything that we know about the wider implications.

The situation is different from 2008, when several lenders and financial institutions were in distress around the same time.

However, as the Bloomberg strategist notes, like an unintended side show upstaging the main act, the saga around Silicon Valley Bank has pretty much eclipsed the typical limelight reserved for non-farm payrolls.

That distress story means that the markets are likely to see an asymmetric reaction from the jobless data: a bigger rally in rates on a weaker-than-forecast print and not-so-emphatic moves on any confirmation that the labor market is still tight.

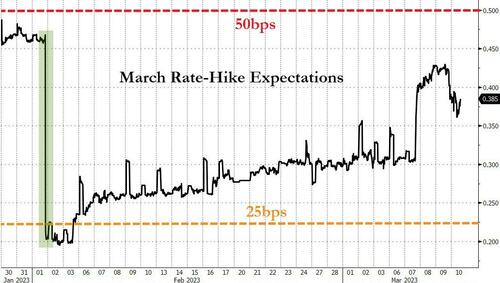

Interest-rate traders, who earlier this week were factoring in an 85% chance of a 50-basis point move from the Fed later this month, now only see a 74% chance.

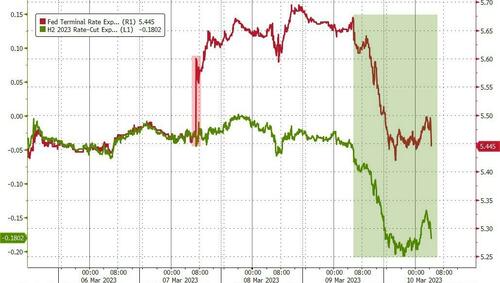

The market’s terminal rate expectations have plunged 25bps in the last 24 hours and rate-cuts in H2 2023 are now a 50-50 bet…

Clearly, the markets’ concerns have moved on from parsing the minutiae of non-farm payrolls to fears rippling through from the SVB saga: are there any other skeletons hidden in the cupboard, possibly in other corners of the real economy?

Finally, for today’s implied post-payrolls move, JPM’s Bram Kaplan estimates the options market is pricing a ~1.4% S&P 500 move for NFP.

The bank’s chief economist, Mike Feroli, sees NFP to print around 200k vs 225k survey vs 517k prior and February UR to be same as Jan’s 3.4%, in line with consensus.

Looking at today’s session, yesterday and overnight, we have seen the OIS forwards adjusted their March FOMC rate expectations from 42bp post-Powell to 37bp, meaning the market is back to even odds between 25bp and 50bp.

Given this adjustment in rates, we see the risks from both sides for today’s releases:

If NFP prints hotter than expected but less than January’s level, we do not see a strong case for the market to start pricing in 75bp at the next meeting. That said, with a slight hawkish print, we may see the OIS forwards repricing towards 50bp, but may not be fully priced as we are still waiting for CPI. Recall that the move from 31bp to 42bp (11bp) led to a 1.5% decline, while these numbers are not linear correlation, this shows that the downside may not be as large as people are thinking.

On the other hand, in case for a light NFP or downward revision to Jan’s number, we may see a reversal to rate hike expectation back to 25bp. Consensus for next CPI is still at 6.0% (a 40bp decline from prior month). A light NFP alongside a 40bp decline in CPI would set up a strong case for 25bp.

Positioning Intelligence reminds us that the recent uptrend in US Equities could be sustained by a shift away from the fairly risk-off tone in ETF and HF flows over the past month.

Uncertainty is never a friend of the markets, and we have been reminded of that yet again.

Loading…

[ad_2]

Source link