Gold posts solid gains on bank crisis, rescue plan

Fed suddenly reinstates quantitative easing

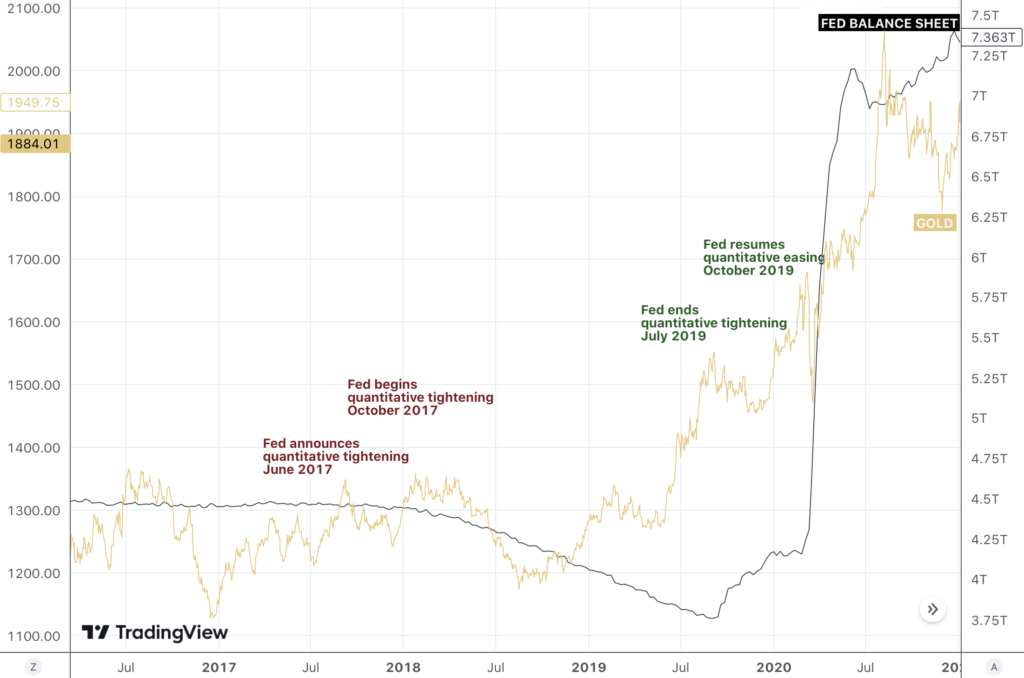

(USAGOLD –3/13/2023) – Gold posted solid gains for the second straight trading session as the Fed suddenly reinstated quantitative easing to forestall a burgeoning system-wide bank crisis. It is up $30 at $1900. Silver is up 83¢ at $21.45. In addition to the sudden injection of liquidity, gold is also reacting to the prospect of a rate pivot coming back into play. At the very least, it would be difficult to envision the FOMC raising rates under these conditions. It will take some time for the markets to fully sort out the implications of what the central bank and federal government put into play over the weekend,* but gold market analysts will likely look to the 2019 reinstatement of quantitative easing for guidance. (See chart below.)

“If the Fed is now backstopping anyone facing asset/rates pain,” says Rabobank’s Michael Every in a Bloomberg article this morning, “then they are de facto allowing a massive easing of financial conditions as well as soaring moral hazard. The market implications are that the US curve may bull steepen on the view that the Fed will soon actively pivot to line up its 1-year BTFP loans with where Fed funds rates then end up; or it may bear steepen if people think the Fed will allow inflation to get stickier with its actions.”

“So, if I have this right, the Fed will make loans on some of the collateral at a par valuation that is worth 40 percent less. Yikes.” – Jeffrey Gundlach, DoublieLine Capital

“More banks will likely fail despite the intervention, but we now have a clear roadmap for how the govt will manage them.” – Bill Ackman, Pershing Square

*Statement issued by the Federal Reserve Board of Governors yesterday.

Gold price and Fed balance sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Annotations by USAGOLD • • • Click to enlarge