“This Is Sheer Idiocy”: Capital Gains Tax Can Exceed 100 Percent Under Biden Proposal

Authored by Liam Cosgrove via The Epoch Times (emphasis ours),

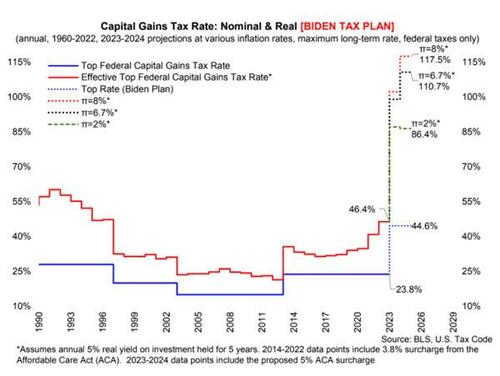

President Joe Biden’s proposed capital gains tax increase could result in an effective tax rate of over 100 percent after adjusting for inflation, according to estimates by economist Arthur Laffer, a former adviser to Ronald Reagan. The increase would more than double the tax investors pay on investments held longer than one year.

The proposal, outlined as part of Biden’s $6.8 trillion budget plan for 2024, seeks to increase the capital gains tax rate for individuals earning more than $1 million a year, to 39.6 percent, up from the current rate of 20 percent. In addition, it would increase the Affordable Care Act surcharge to 5.0 percent, bringing the total tax rate for high-income investors to 44.6 percent.

This would imply that investors could face an effective tax rate of 86 percent on after-inflation profits from holding an investment, assuming inflation returns to the Fed’s 2 percent goal, according to economist Stephen Moore, author of the Committee to Unleash Prosperity newsletters.

If the inflation rate remains at current levels, the real capital gains tax could reach above 110 percent, Moore explained in a note, referring to a chart prepared by Laffer.

“What’s the right and fair tax to levy on investments?” Moore asked. “Should the government take it all and then some?”

To illustrate how an investor might pay more money than he or she has earned, he offered another way of looking at it.

“If you buy a stock for $100 a share and then it rises to $120 per share five years later, but the accumulated inflation rate over that period was, say, 24 percent, then you lost money owning the stock after adjusting for inflation,” he wrote. “You would still owe Uncle Sam a 40 percent tax on the phantom ‘gain’ of $20 per share. This is sheer idiocy.”

Read more here…

Loading…

[ad_2]

Source link