Bank Deposit Flight Seals Deal For US Recession

Authored by Simon White, Bloomberg macro strategist,

The collapse of SVB and the turmoil at Credit Suisse will turbo-charge the effects of QT, sealing the case for a US recession that remains underpriced by equity and credit markets.

Remember QT? To misquote Dirty Harry: in all this excitement, it’s easy to lose track of what’s going on. But quantitative tightening’s effects are now likely to accelerate as banking stress causes a steeper fall in bank reserves, tipping the economy into a potentially deep recession.

The Fed is therefore now more likely to end QT and the rate-hiking cycle early. It will not be enough, however, to save credit and equities, which are materially underpricing an economic slump.

Key to understanding QT is that it is both a duration and a velocity transformation: the Fed gives back duration to the market through asset sales and redemptions, and takes out velocity as it absorbs reserves.

Falling velocity leads to lower inflation, but to get there the market’s interest-rate risk rises as it takes back duration from the Fed. SVB is the most dramatic casualty of this effect so far, with Credit Suisse also bearing the impact. Sentiment was eviscerated Wednesday as its shares tanked, and has been partially restored today as the bank gained access to a liquidity facility at the SNB.

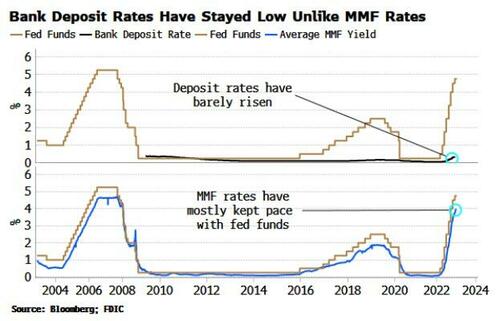

Nonetheless, there’s a real risk that lingering concern around banks could lead to a large migration of bank deposits into money-market funds (MMFs), or directly into T-bills.

Many will have woken up to the much higher rates on offer in MMFs. Even with the FDIC’s decision to make all depositors in SVB whole, deposits could migrate from smaller, regional banks – likely more risky, with greater relative exposure to less liquid assets such as CRE – direct into MMFs, especially if larger banks are slow to raise their deposit rates.

A fall in bank deposits will lead to less “high-powered” money, i.e. bank reserves, in the system, which means considerably tighter financial conditions than hitherto experienced. That would be the final straw for an economy that was already highly likely to enter a recession as soon as the summer.

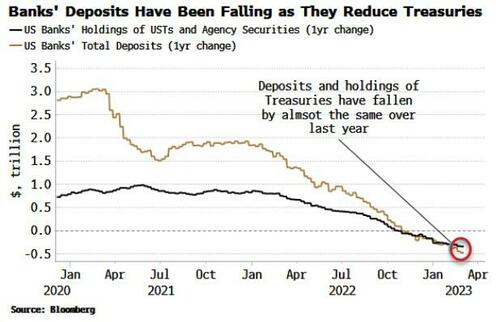

The trickle has already begun, with bank deposits falling since last summer, almost by the same amount as banks’ holdings of Treasuries and agency securities have declined. This is because banks have on net been selling their securities to non-banks, meaning a reduction in total bank deposits.

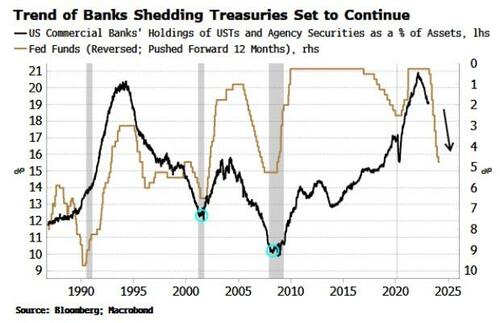

We should expect this trend to continue. The chart below shows that banks typically reduce their Treasury holdings as a percentage of assets as the Fed raises rates, with the ratio falling before – and troughing during – a recession.

This trend could now be magnified as yield-seeking deposit holders – or even those who just don’t want to be around if they think bank issues will become systemic – take their deposits out of the banking system, reducing bank reserves further.

As the tide of deposits leaving banks for MMFs rises, higher-velocity bank reserves are likely to fall more sharply. Total assets at MMFs have clmbed more than $400 billion since the summer, almost exactly the same as bank deposits have fallen over the same period to March 3 (although the number is likely to be higher in the wake of SVB).

And we shouldn’t expect bank lending to countervail the effects of falling deposits. Thus far banks have allowed their loan-to-deposit ratios to rise, meaning bank balance-sheets have barely shrunk despite the loss of deposits.

But this is unlikely to persist as banks continue to tighten their lending standards, which invariably leads to fewer loans being made overall. Outright bank balance-sheet contraction represents a powerful headwind which the economy has not yet had to contend with in this cycle.

QT’s second goal – reducing velocity – has thus far been absent. This was indicated by the yield-curve’s relentless flattening. But now as shorter-term yields drop as crisis-fever grips, steepening is in play with a vengeance. This will lead to a fall in velocity, and some easing in inflation.

Yet the drop in velocity is likely to be too violent for the economy to avoid a recession or face more upheaval in the financial sector. The odds have now risen that the Fed steps back early from its hiking cycle, with even a March hike of 25 bps in the balance. QT is also very likely to face a premature end as the pace of reserve depletion quickens.

As of Thursday morning the S&P is only 4% lower than its March high. But a much deeper selloff lies ahead as recession risks rise materially. Gamma in the S&P has recently shifted into negative territory, meaning market moves – especially to the downside – are prone to being exacerbated by option dealers’ delta-hedging.

Rate rises and QT are showing that reversing years of zero interest-rates and large central-bank balance sheets will be fraught with difficulty.

Loading…

[ad_2]

Source link