Gold surges past $2,000 for third time in 3 years as global markets still worry about Credit Suisse

March 20, 2023

Gold, as a safe haven, has historically proven to be one that moves higher whenever any instability is seen across stock markets. And that’s also to believe why prices of the yellow metal are now spiking above $2,000 per ounce.

Markets worldwide continue to remain in turmoil as uncertainty prevails as to where the banking industry is headed. Although Swiss lender UBS sealed a deal to buy peer Credit Suisse in a rescue effort to contain a banking crisis and stabilise financial markets, the deal only provided brief respite for stocks, chiefly banking, as investor focus shifted to some of the underlying risks of the deal.

There’s been a sudden loss of confidence in the financial system amid new worries on write-off-related risks of the deal, particularly when the Swiss regulator decided that Credit Suisse debt with a value of $17 billion will be valued at zero.

This not only infuriated some of the holders of that debt, analysts opine that it dampened wider market sentiment as well. Also, Credit Suisse investors will merely get about 0.76 francs per share – much lower than their closing price on Friday of 1.86 francs.

However, volatility in gold prices is expected to last only as long as more clarity emerges on the rescue of Credit Suisse, the second-biggest wealth manager in Asia, behind only its acquirer, and the updates in turn settle Asian stocks, and the rest of the world’s markets as well.

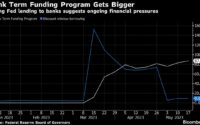

Given that investor nerves globally were already on edge after the recent collapse of US markets, whose moves are largely mirrored elsewhere, on the SVB bankruptcy, it’s only natural that confidence in the banking system be prone to vulnerabilities and stay low for now. In the long run, however, the rescue deal can only fuel hopes of stability.

Markets worldwide continue to remain in turmoil as uncertainty prevails as to where the banking industry is headed. Although Swiss lender UBS sealed a deal to buy peer Credit Suisse in a rescue effort to contain a banking crisis and stabilise financial markets, the deal only provided brief respite for stocks, chiefly banking, as investor focus shifted to some of the underlying risks of the deal.

There’s been a sudden loss of confidence in the financial system amid new worries on write-off-related risks of the deal, particularly when the Swiss regulator decided that Credit Suisse debt with a value of $17 billion will be valued at zero.

This not only infuriated some of the holders of that debt, analysts opine that it dampened wider market sentiment as well. Also, Credit Suisse investors will merely get about 0.76 francs per share – much lower than their closing price on Friday of 1.86 francs.

However, volatility in gold prices is expected to last only as long as more clarity emerges on the rescue of Credit Suisse, the second-biggest wealth manager in Asia, behind only its acquirer, and the updates in turn settle Asian stocks, and the rest of the world’s markets as well.

Given that investor nerves globally were already on edge after the recent collapse of US markets, whose moves are largely mirrored elsewhere, on the SVB bankruptcy, it’s only natural that confidence in the banking system be prone to vulnerabilities and stay low for now. In the long run, however, the rescue deal can only fuel hopes of stability.

– Justin Varghese, Editor – Your Money

[ad_2]

Source link