Market Confidence Is At Mercy Of Central Banks

By Michael Msika, Bloomberg Markets Live reporter and strategist

On both sides of the Atlantic, central bankers have been busy putting out banking sector fires. Now they must address investors’ other major concern — how much further interest rates might rise at a time of fragile market confidence.

The resolution of the Credit Suisse problem and the support measures for US regional banks have eased some of the banking turmoil, sparking the best two-day rally in European stocks since early-January. But the recent troubles do not appear to have swayed central banks from hiking rates, with the Federal Reserve expected to emulate the European Central Bank and raise rates on Wednesday. That’s left investors bracing for a further sharp tightening in credit conditions.

For BlackRock Investment Institute strategists Jean Boivin and Wei Li, that’s a reason to stay underweight equities in developed markets. “More financial cracks from rapid rate hikes are emerging,” Boivin and Li warn clients, predicting a Fed rate rise this week. “We don’t see central banks coming to the rescue with rate cuts, but using other tools to ensure financial stability.”

A credit event has become investors’ biggest fear, according to BofA’s latest fund manager survey published on Tuesday. Cash holdings are running high and recession gloom is rising again — analysis by Goldman Sachs shows market-implied recession risk has picked up to above 50% for the coming year, driven mainly by Fed interest rate pricing.

The BofA survey found 57% of investors expect a fall in short-term rates, the highest proportion since March 2020. But until that materializes, many strategists advise clients to keep their powder dry. JPMorgan’s Mislav Matejka, for instance, reiterates his call to tilt portfolios toward defensives, while cutting exposure to value stocks. He also recommends selling into any relief rally. “It is unlikely that we will have a fundamental low reached until the Fed is well advanced with rate cuts,” he says.

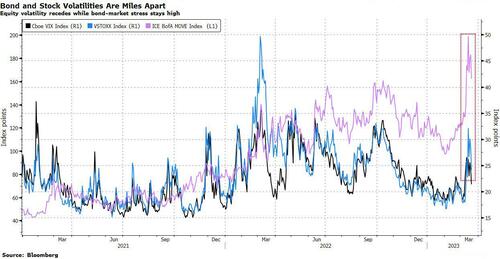

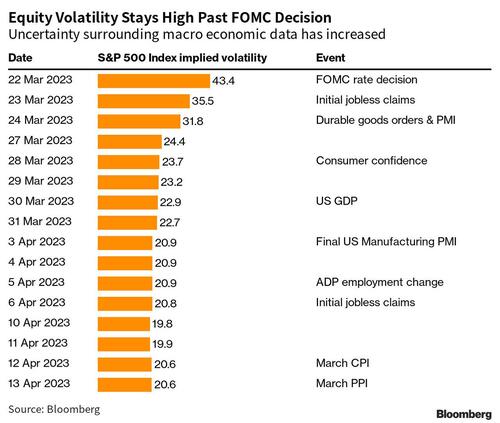

Meanwhile, strategists at Tier 1 Alpha point to an unusual feature that’s showing up on the S&P 500 volatility options curve — the curve typically shows vol rising before a Fed meeting, then sliding after Chairman Jerome Powell’s news conference. This time, the curve shows no sign of that post-Fed vol decline, suggesting punters are steeling themselves for a prolonged period of swings. Possibly, policy is already too tight, and the Fed only continues to hike because it “doesn’t want to suggest they’re not in control,” they write.

There is one immediate bright spot — technicals. The Stoxx 600 has bounced off its 200-day moving average, while the Euro Stoxx 50 rebounded off major support levels around 4,000 points. Markets could still eke out some gains, but sustaining the bounce beyond Wednesday will hinge on what Powell says.

According to Mark Grant, head strategist at Colliers Securities, central banks are already “pushing too hard on the gas pedal,” with higher borrowing costs biting every sector of the economy. “I think that the ECB and the Fed should both just stop. They should stop raising interest rates and let things cool down and let the economy adjust,” Grant says.

Loading…

[ad_2]

Source link