Chart Of The Week – Intriguing Properties…

This email gives you a brief overview of what was covered in the latest Weekly Insights report including of course, the Chart Of The Week.

Check out the full archives of the Chart Of The Week for more charts.

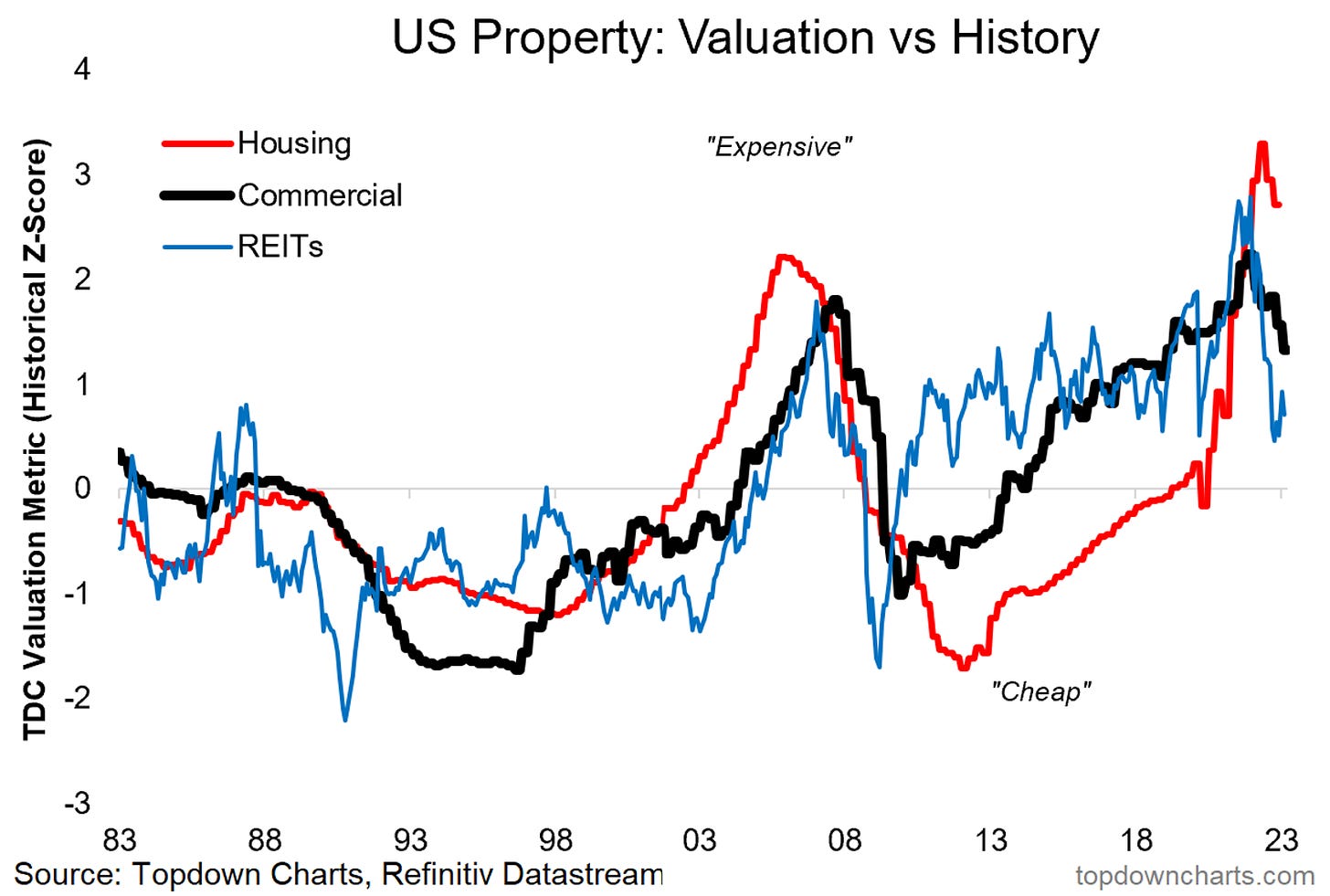

Property Market Valuations: Another casualty (and cause) of banking stress is likely going to be all flavors of property… particularly given that all 3 of REITs, commercial real estate, and housing market valuations reached record highs in the wake of the pandemic emergency stimulus measures.

This is probably going to be one of those charts we look back at and think why didn’t we see it coming?

While the housing market is showing up as the most overvalued in this chart, I think it is particularly worth pondering the path of commercial real estate, particularly as it pertains to the banking sector.

Not only did commercial real estate valuations get launched to lofty heights in the wake of the pandemic, but they also face considerable uncertainty in the post-pandemic world where vacancy rates are soaring as the new reality of work-from-home leaves offices empty and work-from-anywhere sees migration away from big cities. Add to that the cyclical downdrafts, policy tightening, and bank stress + credit tightening, and the outlook is not good.

This will add further strain to an already stressed regional/small bank backdrop as it is the smaller banks that dominate commercial property lending (and it is commercial property lending that dominates their loan books).

So keep an eye on property, and especially commercial real estate, because when I look at a chart like this and consider all that’s going on, it seems logical to conclude that the downside risks are not over yet.

Key Point: Property faces significant downside risk coming off record valuations.

NEW: Like these charts? Check out our paid service with a 7-day Free Trial

Aside from the chart above, we looked at several other charts, and took a bite out of some really important macro/asset allocation issues right now:

-

Bank Stocks: risks vs opportunities, digging into the valuation picture.

-

Credit Spreads: all signs point in one direction…

-

Commercial Real Estate: the next shoe to drop for the banking sector.

-

Treasuries: an attractively priced diversifier (what we always look for!).

-

Commodities: technical risk outlook following the crude crash.

-

Market Update: yield curve steepening and implications.

Subscribe now to get instant access to the report so you can check out the details around these themes, as well as gaining access to the full archive of reports.

For more details on the service check out this recent post which highlights:

a. What you Get with the service;

b. the Performance of the service (results of ideas and TAA); and

c. What our Clients say about it.

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Head of Research and Founder at Topdown Charts

Follow me on Twitter

Connect on LinkedIn

[ad_2]

Source link