Taps Coogan – March 23rd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Since collapse of SVB a couple of weeks ago, the 10-year-2-year Treasury yield inversion has re-steepened from -1.03% to -0.48%.

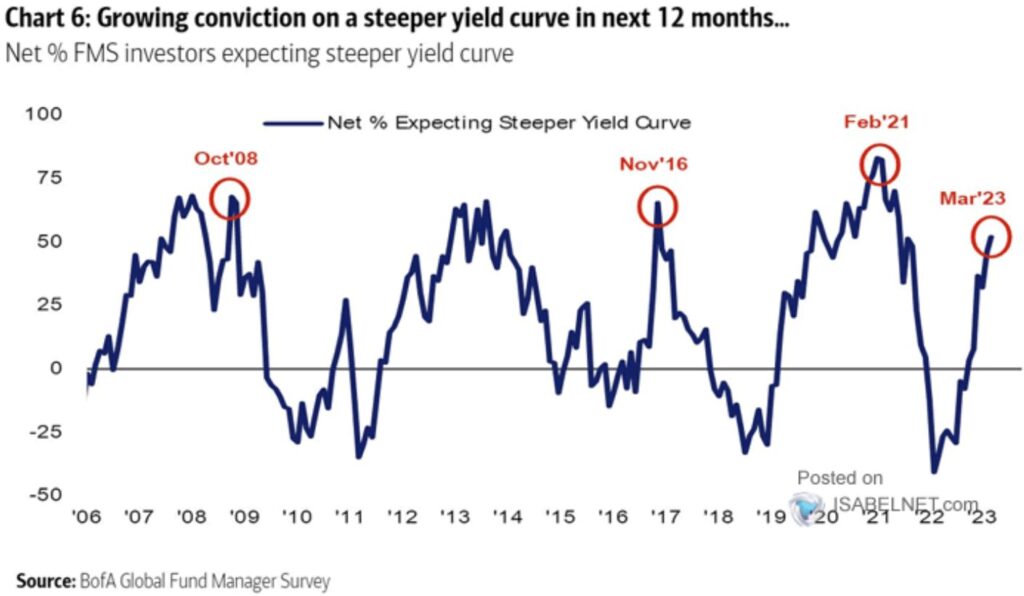

Along those same lines, the following chart from Bank of America via Isabelnet, shows the increasing expectation among fund managers that the yield curve will steepen from here on out.

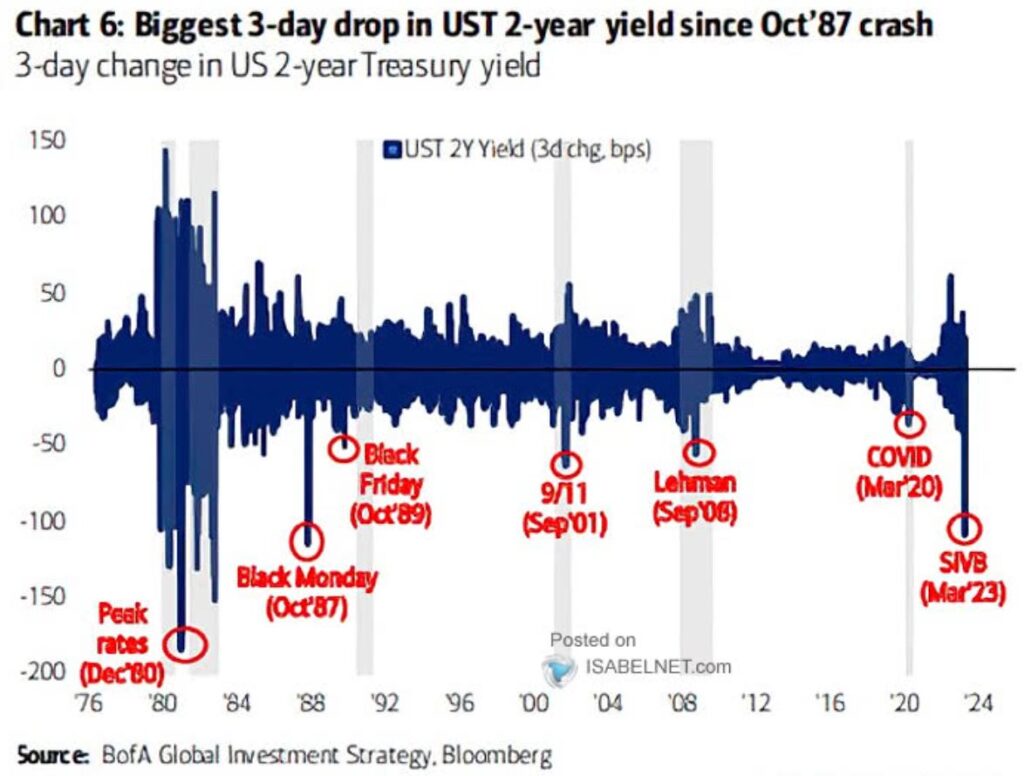

As we noted a few days ago, the steepening so far has been a result of short-term treasury yields plunging by the largest amount in decades as investors anticipate Fed rate cuts due to emerging banking and economic fragilities.

10-year-2-year yield curve inversions have lead recessions by an average of about one year since World War II and, more often than not, the yield curve is re-steepening by the time a formally recognized recession has started.

While this has not been a normal recession/bear market cycle, yield curve steepening has historically been bearish at this stage of the cycle unless it is due to yields rising at the long end of the curve, which is not happening.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

DISCLAIMER