A $3 trillion threat to global financial markets looms in Japan

Bloomberg/Ruth Carson, Masake Kondo and Michael Mackenzie/3-29-2023

“Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.”

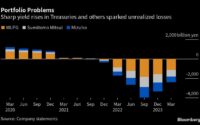

USAGOLD note: The high level of Japanese ownership of foreign bonds will shock many investors. Beyond the $1.1 trillion it owns in U.S. Treasures, itself a formidable figure, it owns 10% of the Dutch and Australian sovereign bond issue, 8% of New Zealand’s outstanding debt, and 7% of Brazil’s. Now with the BOJ seemingly poised to raise rates and normalize monetary conditions bond market experts expect much of that position to be sold off and the capital returned to Japan. With China already selling off US treasuries and the Fed reducing its holdings through its quantitative tightening program, as well as natural market attrition as rates continue to climb, one wonders if the bond market can withstand Japan becoming a seller. A monetary Pearl Harbor may be ahead of us.

USAGOLD note: The high level of Japanese ownership of foreign bonds will shock many investors. Beyond the $1.1 trillion it owns in U.S. Treasures, itself a formidable figure, it owns 10% of the Dutch and Australian sovereign bond issue, 8% of New Zealand’s outstanding debt, and 7% of Brazil’s. Now with the BOJ seemingly poised to raise rates and normalize monetary conditions bond market experts expect much of that position to be sold off and the capital returned to Japan. With China already selling off US treasuries and the Fed reducing its holdings through its quantitative tightening program, as well as natural market attrition as rates continue to climb, one wonders if the bond market can withstand Japan becoming a seller. A monetary Pearl Harbor may be ahead of us.

[ad_2]

Source link