USAGOLD note: This article is written in a straightforward style that gives non-economists a real sense of the precarious position in which banks find themselves. Sinn also delves into the moral hazard likely to result from the authorities’ rescue operations. “Make no mistake,” he says, “bank executives will be motivated to take on a lot more risk.” Takatoshi is the former deputy vice minister of finance for Japan.

USAGOLD note: This article is written in a straightforward style that gives non-economists a real sense of the precarious position in which banks find themselves. Sinn also delves into the moral hazard likely to result from the authorities’ rescue operations. “Make no mistake,” he says, “bank executives will be motivated to take on a lot more risk.” Takatoshi is the former deputy vice minister of finance for Japan.

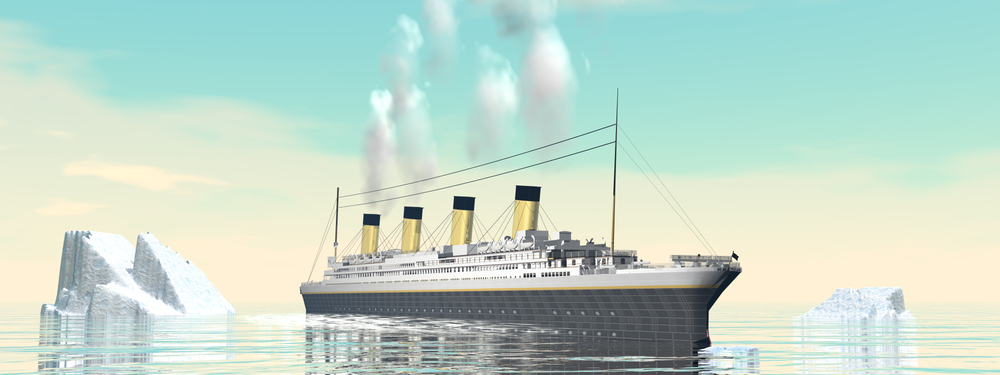

An insolvency iceberg? | Today’s top gold news and opinion

April 6, 2023

Project Syndicate/ Takatoshi Ito/3-28-2023

“What will happen next? It is reasonable to assume that as interest rates in the United States and Europe continue to rise, more banks will experience greater unrealized losses from their long-term bond holdings. As with SVB, all it will take is a rumor or a whiff of fear about the bank’s solvency to trigger another run, especially if there is still uncertainty about how far regulators are willing to go in responding..”

[ad_2]

Source link