Does Anyone Care About Drowning in Debt?

James Rickards’ article, The Accelerating Countdown to Armageddon tells us:

James Rickards’ article, The Accelerating Countdown to Armageddon tells us:

“Those who focus on the U.S. national debt (and I’m one of them) keep wondering how long this debt levitation act can go on.

We’re accumulating debt at a substantially greater rate than we’re

growing the economy. Basically, the United States is going broke!

…. When is the debt-to-GDP ratio too high? When does a country reach the point that it either turns things around or reaches the point of no return?”

Up popped John Mauldin’s letter, Deficits Forever. He explains the “debt levitation:” (Emphasis mine)

“Here is an updated version of the budget chart…. It uses data from CBO’s 10-year spending and revenue projections.

…. Adding 2033 shows, for the first time, mandatory spending plus defense consuming all tax revenue.

…. The mandatory spending accounts for most of the spending growth, and most of that is Social Security and Medicare as the rest of the Boomer Generation reaches retirement age.

Just eyeballing the chart …. If we could just return spending to 2019 levels and keep tax revenue where it is, the budget would balance and we’d have a surplus to begin paying down the debt. But that would require benefit cuts for current retirees, not just future ones. There is no political will to make benefit cuts.

…. Very few people truly care about government debt anymore,…especially in Washington, DC, and Congress. And almost no one even talks about the drastic changes it would take to actually balance the budget-much less begin paying down the debt.

…. We are going to reckon with this debt for a long time.”

Bill Bonner agrees: (Emphasis mine)

“All empires must die. In our view, the US is now in decline, and has been losing muscle mass since 1999. Of course, a national renewal is not out of the question; a few major policy changes – major cuts to Social Security, Medicaid, and the Pentagon, balanced budgets, a solid dollar, honest interest rates, and a more modest foreign policy – could restore real growth and prosperity.

But for now, if there’s one thing our elites all agree about, it’s that no major changes are urgently needed. They like the system as it is. No redistribution of power…or money…required.”

Pam & Russ Martin explain the significance of 1999: (Emphasis mine)

“At the end of 1999,…President Bill Clinton’s Wall Street-friendly administration repealed the 66-year-old Glass-Steagall Act – ushering in an era where Wall Street’s trading casinos could buy federally-insured banks…. The number of federally-insured banks and savings institutions has collapsed from a total of 10,220 to 4,746. …. That’s a startling decline of 54 percent in banking competition.

…. The decline in the number of overall banks fails to capture the magnitude of the concentration of assets at just four banking behemoths: JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup’s Citibank. …. Just four banks own…39 percent of the total $23.6 trillion in assets owned by all 4,746 federally-insured banks and savings associations in the country.

To put it more starkly, those four banks represent just 0.08 percent of all the banks and savings associations in the United States while controlling 39 percent of the assets.

…. In short, the Fed has effectively seized control of the nation’s economic future, transferring wealth from the farms, small businesses and factory floors of America to the trading floors on Wall Street – which …. include two trading floors operated by the New York Fed.”

The Fed’s cheap money not only concentrated power in the “too big to fail” banks, they also enabled the government to borrow and spend to historic proportions. If the government couldn’t borrow in the free market at artificially low rates, the Fed created money out of thin air and added US debt to their balance sheet.

The Fed’s cheap money not only concentrated power in the “too big to fail” banks, they also enabled the government to borrow and spend to historic proportions. If the government couldn’t borrow in the free market at artificially low rates, the Fed created money out of thin air and added US debt to their balance sheet.

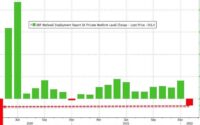

The Fed’s graph adds “recession shading:” the political excuse behind the trillion-dollar 2008 bailout of the “too big to fail banks” and the 2020 pandemic excuse, more than doubling the debt in around two years; primarily covering historical increases in government spending.

The Fed’s graph adds “recession shading:” the political excuse behind the trillion-dollar 2008 bailout of the “too big to fail banks” and the 2020 pandemic excuse, more than doubling the debt in around two years; primarily covering historical increases in government spending.

The bulk of the Fed’s balance sheet is US government debt and Mortgage-Backed (MBS) Securities bought from the big banks.

These policies punished savers; particularly baby boomers.

Mauldin added: (Emphasis Mine)

“Low interest rates starve retirees and investors of reasonable returns.

…. Not so long ago one could accumulate a nest egg, invest it in simple, low-risk bonds and generate good income. That became impossible under ZIRP and still is today since inflation has overwhelmed the benefit of higher yields.

It’s left many retirees in desperate positions, and it wasn’t an accident. It was a planned, intentional policy that started badly and only got worse.”

The double-digit inflation impacted the housing market.

Wolf Street tells us, Why the Fed Can Let the Housing Bust Rip: …. Delinquencies, Foreclosures, and Who’s on the Hook: (Emphasis mine)

“Over the three-year period that covers the Fed’s pandemic-era money-printing binge and interest-rate repression, mortgage balances exploded by 25%…. Over the same period, the median home price ballooned by 34%,…even after the 11% drop from the peak in June 2022.

The chart shows mortgage debt as a percent of disposable income (green), a measure of the aggregate burden of this mortgage debt on households.”

Wolf Richter says foreclosures still remain low:

“The Financial Crisis, which was triggered by the Mortgage Crisis, put the entire US banking system, and thereby the global banking system, at risk, and a big mess ensued. This was kind of a special event.

There may be other special events coming at the US financial system, but it’s unlikely to come from mortgages. …. The way the mortgage market has been changed since the Financial Crisis tells us that – because now it’s the taxpayer that is on the hook for much of the mortgage debt, and nearly all of the risky mortgage debt, and not the banks.

…. The biggest part of the damage will be absorbed by taxpayers because they’ve been shanghaied into guaranteeing the majority of mortgages that have been securitized into MBS, and into guaranteeing subprime mortgages, and low-down-payment mortgages (via FHA, VA, etc.), and no one cares about the taxpayer anymore, not even the taxpayers themselves.”

|

Recommended! I have been reading Richard Maybury’s Early Warning Report for many years. As you know, I quote his newsletter often. He has graciously agreed to offer Miller on The Money readers a special deal. Richard is unique, his letter provides great education you will not find elsewhere! Click here right now and you will get $102 off the regular subscription price, get the current issue, and these 4 FREE Special Reports:

|

A New Era Of Government Debt

Our nation used to go into debt to pay for wars and then pay the debt down shortly thereafter. When Nixon took us off the gold standard, it removed the restraints on government deficit spending and debt accumulation.

| “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

— Ludwig von Mises |

Today’s government deficit spending finances government programs to help politicians get elected.

The US Debt Clock tells us, in addition to the nearly $32 trillion in outstanding debt, the government has over $182 trillion in unfunded political promises.

Something has to give….

If the voters and politicians don’t start addressing the huge debt, the rest of the world will.

Kitco recently wrote about a dire forecast from Andy Schectman, President and Owner of Miles Franklin, an expert on monetary and economic history:

“Schectman told…Kitco News, that the dollar’s ‘weaponization’ during the Russian war with Ukraine has hastened the move to ‘dump’ dollars. …. Western sanctions on Russia, as well as expelling Russia from the SWIFT payment system, has had a chilling effect, deterring other nations from using the dollar.

‘Since the weaponization of the dollar in 2022, it [de-dollarization] seems to be spinning much, much faster,’ Schectman observed.

…. The BRICS (Brazil, Russia, India, China, and South Africa) are meeting in Durban, South Africa in August, and one of their agenda items is the development of an alternative to the U.S. dollar.

He pointed to Saudi Arabia, who has recently stated that it is open to accepting other currencies in exchange for its oil, as a potential catalyst for massive de-dollarization.

‘All it would take [for de-dollarization] would be for Saudi Arabia to stand up on the stage…[and say,] we’re now going to consider taking up other currencies for oil,’ he claimed. ‘And all of a sudden, bang, all of the countries that had to hold dollars for the last fifty years, no longer have an interest in holding them. And if they all start to dump dollars, and I think it would happen quickly, you would have a tsunami of inflation hitting the shores of the West.’”

What Me Worry?

What Me Worry?

When I was a kid, I loved the Mad Magazine cartoon character, Alfred E. Neumann. I had one of these buttons, a satire about voting for him for president.

Will our government stop the political sham and start acting like adults – who should be damn concerned about the debt and unfunded political promises? A recent poll showed many Americans are not only worried about debt, but they’re really worried about the possibility of WWIII; something I doubt the public would favor.

If the government doesn’t reinstate Glass-Steagall, break up the big banks, avoid needless war and stop the ridiculous spending we will all suffer. I agree with John Mauldin, we’re going to reckon with this debt for a long time…

The entire political class seems to have gone mad! I’m worried and I’d bet Alfred (now a senior citizen) is too!

|

A little help means a lot! Eight years ago, I vowed to keep our newsletter FREE! I plan to keep my promise. It’s an expensive, time-consuming hobby, but also a labor of love. Recently a reader asked why I didn’t charge for our weekly letter. I explained that I want it available for everyone. Some readers may be on limited budgets and may benefit the most from our advice. He pressed on with his questions. How much does your letter cost? How many readers do you have? He concluded, “If each reader paid $10/year, you would be fine. I responded, “Yes, $10 per reader would work, BUT I am committed to keeping it FREE even if it costs me money.” Several readers suggested we add a donations button to help us offset the cost of our publication. It helps when people pitch in and we certainly appreciate it. If readers want to donate, it sure helps out, however, it’s strictly voluntary – no pressure – no hassle! Click the DONATE button below if you’d like to help. You do not have to sign up for PayPal to use your credit card. And thank you all! |

On The Lighter Side

Speaking of inflation…. Daughter Holly & family went to Universal Studios for spring break. She was lamenting about the outrageous prices everywhere.

She reports every meal for her family of four cost well over $100, even a breakfast buffet. A trip to Disney, Universal Studios, Harry Potter World, you name it, will cost a family a few thousand dollars. I’m sure many families spend close to 10% of their annual income for a week of “entertainment.”

Speaking of entertainment…. Jimmy Buffett came to Phoenix and I looked into tickets. I struggle with lots of stairs, so lower-level tickets would be appealing. For Jo and I to have dinner and see them play for an hour or so would have cost several hundred dollars. I think they sold out, but we passed on Margaritaville.

Anyone who thinks inflation is not out of control should price food, entertainment or airline tickets. Jo sent me an article about an egg producer whose profits went from $39 million to $390 million in one year. I’d bet the chickens didn’t get a raise either.

Quote of the Week…

These quotes about debt apply not only to individuals, but also nations….

“Debt, n. An ingenious substitute for the chain and whip of the slavedriver.”

— Ambrose Bierce

“The borrower is the servant to the lender.”

— The Bible

“When you get in debt you become a slave.”

— Andrew Jackson

“A creditor is worse than a slave owner; for the master owns your person, but a creditor owns your dignity and can command it.”

“A creditor is worse than a slave owner; for the master owns your person, but a creditor owns your dignity and can command it.”

— Victor Hugo

“Debt is like any other trap, easy enough to get into, but hard enough to get out of.” — Henry Wheeler Shaw

And Finally…

Subscriber Charles C. shares some clever thoughts:

- Nothing messes up your Friday like finding out it’s only Thursday.

- What a time to be alive. It’s like the collapse of Rome, but with Wi-Fi.

- I thought growing old would take longer.

- Some say I don’t play well with others. I say it depends on who it is and what they want to play.

- Never ask a woman how she’s doing when she is eating ice cream directly from the carton!

And my favorite:

- I told my wife she should embrace her mistakes, so she hugged me.

Until next time…

Dennis Miller

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure – This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

[ad_2]

Source link

I encourage you to click here and take advantage of his special offer.

I encourage you to click here and take advantage of his special offer.