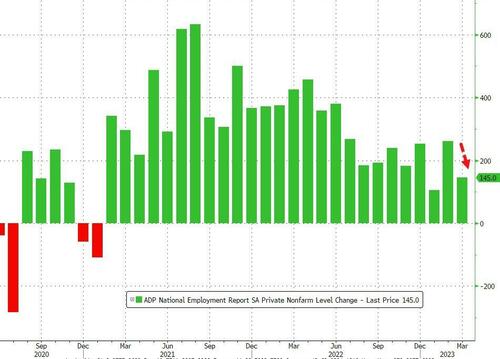

ADP Employment Report Confirms Labor Market Weakness In March

Following yesterday’s ugly JOLTS data, and the employment weakness under the surface in the ISM Manufacturing report, expectations were still for just a small slowdown in job additions in March (+210k exp vs +242k in Feb). However, as JOLTS and ISM hinted at, things are changing fast and ADP printed just +145k (a big miss)

Source: Bloomberg

As ADP’s Chief Economist Nela Richardson notes:

“Our March payroll data is one of several signals that the economy is slowing. Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

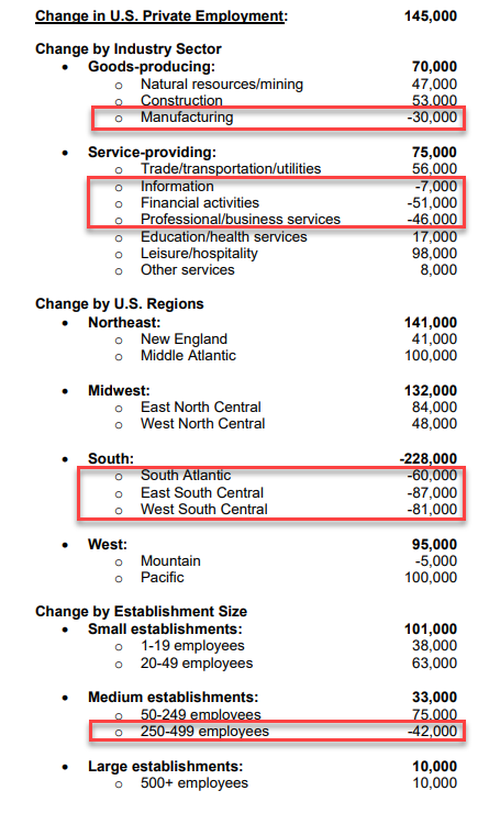

Manufacturing and Financial Activities (regional banking collapse) dominated the job losses with The Southern region seeing major job losses (as well as medium-sized companies)…

The miss-beat-miss sequence continues as ADP goal-seeks…

Source: Bloomberg

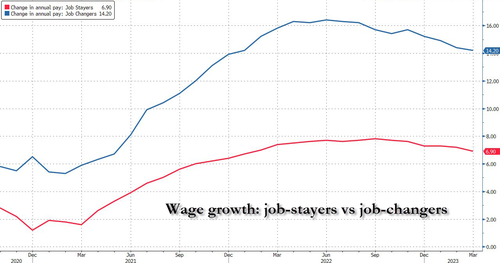

Pay growth decelerated for both job stayers and job changers.

-

For job stayers, year-over-year gains fell to 6.9 percent from 7.2 percent in February.

-

Pay growth for job changers was 14.2 percent, down from 14.4 percent.

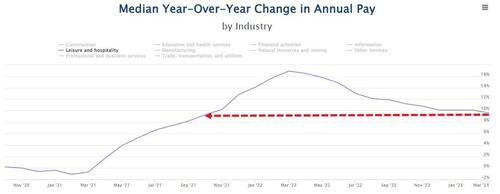

Wage growth in Leisure and Hospitality remained the highest of all the sectors but is slowing dramatically…

But we do note that “Women” (for any definition of the word “women”) are seeing wage gains outpace men’s in every age group…

Finally, as a reminder, it has been the labor market data that has materially supported the ‘strong’ macro argument among market participants, dominating the weakness in ‘soft’ survey and industrial data in recent weeks. But the last week has seen reality starting to set in on that ‘lagging’ labor market data…

Source: Bloomberg

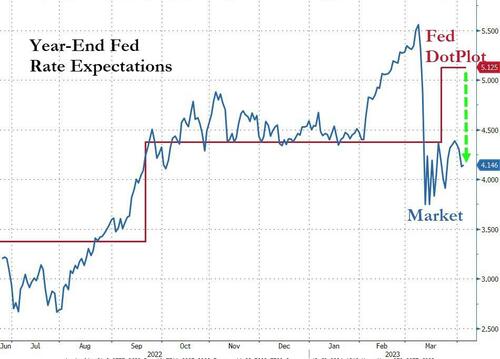

Is the job market now just lagging the rest of the macro data to the downside? Or, is it all too smoothed and ‘adjusted’ to be of any use at all? For sure, while Fed speakers continue to talk about a terminal rate above 5% and holding for a while, the market is absolutely not buying it at all (pricing in a year-end rate 100bps below The Fed’s dotplot)…

Source: Bloomberg

What could prompt The Fed to cut rates 3 times by the end of the year? Recession, Banking Crisis, both?

Loading…

[ad_2]

Source link