Fed Survey Shows Inflation Expectations Re-Accelerated In March, Credit Access Worst Ever

This feels very stagflationary.

As the labor market starts to finally crack (the most lagged economic signal), and consumer credit growth slows (at their limits), The Fed has a problem as, according to the New York Fed’s March Survey of Consumer Expectations, inflation expectations are on the rise once again, especially the short-term.

Median inflation expectations increased by 0.5 percentage point at the one-year-ahead timeframe to 4.7%, the first increase in the series since October 2022. Median inflation expectations for the three-year-ahead horizon edged up 0.1 pp to 2.8%.

Source: Bloomberg

The oldest cohorts among the respondents were the ones expecting the highest inflation ahead…

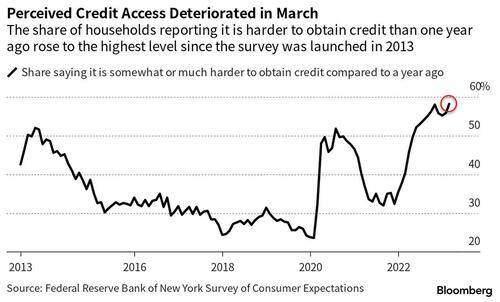

Perhaps even more notably, the share of households reporting that it’s harder to get credit than a year ago rose, reaching a series high.

Additionally, The NY Fed said they were also more pessimistic about future credit availability, which makes sense given that real estate loan growth is collapsing.

Finally, expect delinquencies to rise as a larger percentage of consumers, 10.87% vs 10.63% in prior month, expect to not be able to make minimum debt payment over the next three months.

Loading…

[ad_2]

Source link