They Can’t Even: A Generation Avoids Facing Its Finances: WSJ

April 18, 2023

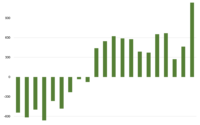

Some tune out bank and credit-card balances, lose track of their spending and rack up debt. Average credit-card debt rose 29% to $5,800 in March from a year earlier for millennials and increased 40% to $2,800 for Gen Z, Credit Karma said. Younger people were also more likely to have paid late fees or taken advances from their credit cards, a survey from NerdWallet found.

[ad_2]

Source link