US Annualized Debt Costs Exceed $800 Billion

Authored by Mark Cudmore, Bloomberg macro strategist,

US yields have ongoing upside pressure from the debt-ceiling debate. Even if a one-year extension is achieved this year, as House Speaker Kevin McCarthy is reported to be proposing, that just creates a far greater problem in a presidential-election year.

Everyone cites 2011 as the playbook for debt-ceiling stress: While those fraught negotiations may be the closest precedent we have, the 2023 episode is likely to be far worse for markets.

The backdrop for 2011 was that everyone viewed the debt ceiling as a purely technical issue. The US government debt pile back then was less than 100% of GDP and yields were low. The estimated annualized payments to service the debt were less than $450b per year. That sounds a lot, but it was a much smaller amount than four years earlier, so the path wasn’t worrying anybody.

It’s a very different situation now. US debt is above 120% of GDP and, far more importantly, the estimated annualized payments to service that debt rose to $773b, as of the end of January. Even more worryingly, they are rising at an almost parabolic rate due to what’s happening to yields — that number is has risen by more than $300b in just a year!

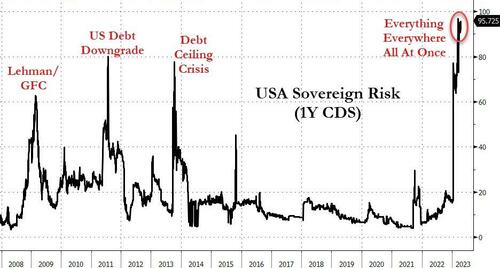

[ZH: Which may help explain why the cost of insuring US sovereign debt has exploded to a record high]

On the majority of days, it’s an issue for Treasuries that’s entirely dominated by other trading factors — but it will lead to random yield-blowouts in the future.

The estimated annual costs of servicing the US debt exceeded $800b as of the end of March — that’s more than 40% higher than any time prior to the past year.

One large extra warning: The chart above is only until the end of January. Since then, US yields have risen more than 20bps all the way out the curve.

The costs are still rising almost parabolically, so expect headline excitement when the $1t figure is likely reached later this year.

Loading…

[ad_2]

Source link