Single-Family Building & Permits Jump As ‘Renter Nation’ Fades

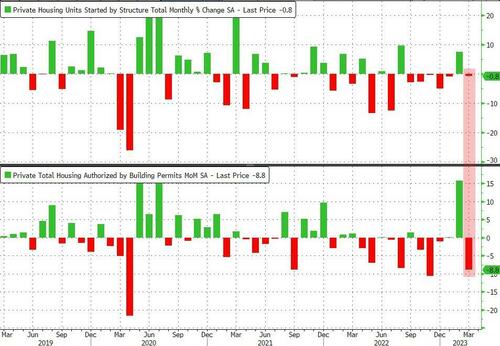

After February’s surprise surge in Housing Starts and Permits, driven largely by a brief dip in mortgage rates, the housing market’s data was expected to slide significantly in March data released today… and they did. However, while housing starts fell, it was less than expected (-0.5% MoM vs -3.5% exp but Feb’s 9.8% jump was revised down to +7.3%) but Building Permits plunged 8.8% MoM (vs 6.5% MoM drop) and Feb’s data was revised higherto 15.8% (from 13.8% MoM)…

Source: Bloomberg

So a mixed bag but overall lower permits and starts…

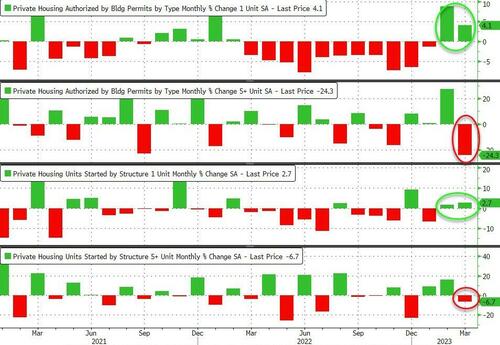

Source: Bloomberg

Notably, multi-family starts and permits both fell in March while single-family home starts and permits saw an increase…

-

single family housing starts +2.7% to 861K SAAR, highest since December 22

-

multi-family housing starts -6.7% to 542K SAAR, lowest since Jan 23

-

single family permits +4.1% to 818K SAAR, the highest since Oct 2022

-

multi-family permits tumble 29.7% to 543K from 717K, the lowest since November 2022

Source: Bloomberg

Mortgage rates are higher now (since March) and post-SVB we suspect credit tightening has been dramatic…which is unlikely to sustain this single-family home starts growth.

Finally, note the chart below which shows housing starts lead the downturn, then housing completions… and then construction employment…

The number of homes completed declined 0.6% to a 1.54 million pace.

The level of one-family properties under construction dropped to the lowest since August 2021, suggesting it will take time to boost inventory.

Is housing starts’ reversal signaling the downturn in the housing market that will eventually hit employment.

Loading…

[ad_2]

Source link