US Leading Economic Indicators Tumble For 12th Straight Month, Signal Recession Imminent

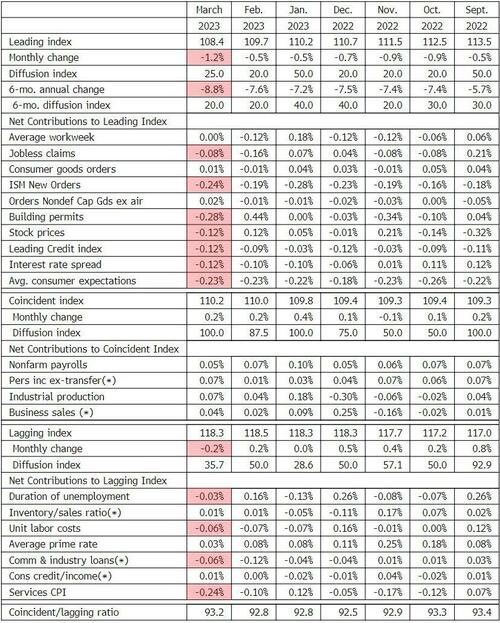

The Conference Board’s Leading Economic Indicators (LEI) accelerated its decline in March, dropping 1.2% MoM (far more than the 0.7% decline expected).

-

The biggest positive contributor to the leading index was orders for non-defense capital goods ex aircraft at 0.02

-

The biggest negative contributor was building permits at -0.28

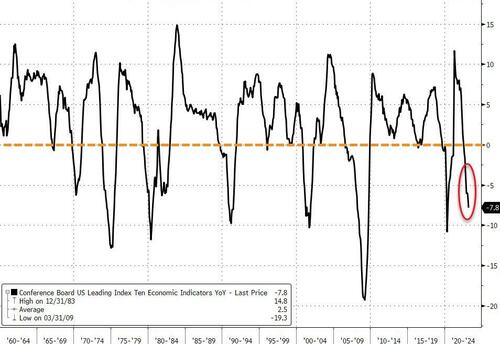

This is the 12th straight monthly decline in the LEI (and 13th month of 15) – the longest streak of declines since ‘Lehman’ (22 straight months of declines from June 2007 to April 2008)

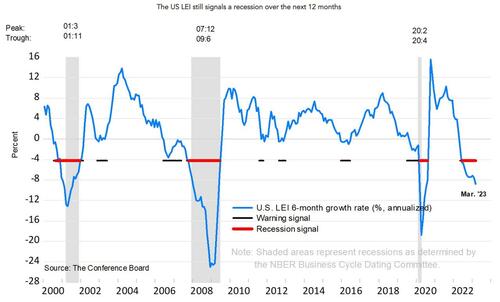

“The U.S. LEI fell to its lowest level since November of 2020, consistent with worsening economic conditions ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“The weaknesses among the index’s components were widespread in March and have been so over the past six months, which pushed the growth rate of the LEI deeper into negative territory.

Only stock prices and manufacturers’ new orders for consumer goods and materials contributed positively over the last six months.

The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023.”

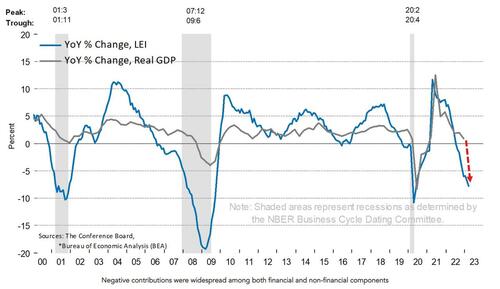

Despite ‘soft landing’ hype, the LEI is showing no signs at all of ‘recovering’, hitting its lowest since Oct 2020…

And on a year-over-year basis, the LEI is down 7.80% (worse than the 6.6% YoY in Febrary) – close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse…

Not a good sign for GDP…

The trajectory of the US LEI continues to signal a recession over the next 12 months

Is this the cleanest view of The Fed’s tightening impact on the US economy?

Loading…

[ad_2]

Source link