Fed’s Goolsbee Says He’s Watching Tighter Credit Economy Impact

(Bloomberg) — Federal Reserve Bank of Chicago President Austan Goolsbee said he was still waiting to see if the fallout from the recent failure of two US banks could cause the economy to slow more than expected.

Most Read from Bloomberg

“How much squeezing is going to be coming from the bank side I think is going to matter for whether this economy is going to slow down,” Goolsbee said Wednesday in an interview on NPR’s Marketplace. “Everybody is forecasting some growth slowdown for the second half of the year. How intense that will be is going to depend a lot on the financial part.”

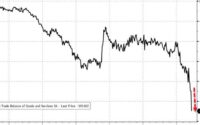

The failure of Silicon Valley Bank last month, and the resulting market turmoil, have increased bets that banks will pull back credit to businesses and consumers. Those tighter financial conditions could help cool the economy, which the Fed is trying to do in order to bring down high inflation.

‘Be Patient’

“My message is be prudent, be patient,” Goolsbee said. “if banks are pulling back it behooves us to pay attention to the data and ask how much of our normal monetary policy job is getting done for us by the credit conditions.”

Policymakers have raised rates aggressively in the last 12 months from near zero to a current target range of 4.75% to 5%. They are expected to lift rates by 25 basis points at their upcoming May 2-3 meeting.

“The job market is by far the strongest part of the economy. Still getting really unprecedented numbers,” he said. “Inflation — there’s been some improvement, but in a way that’s the worst part of the economy,” Goolsbee added, noting that it has been “more persistent than we wanted.”

The Chicago Fed chief on April 11 said that officials should exercise “prudence and patience” in raising rates in remarks that were viewed by some Fed watchers as signaling he was open to a policy pause next month.

But Goolsbee on Wednesday said that he had not been intending to declare his policy preferences prior to the meeting early next month.

“We’ve still got a couple of weeks before the actual meeting. So if anybody imputed some specific basis points of what I was for, that would be inaccurate.”

(Updates with additional Goolsbee comment in final paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]

Source link