Central Bank Gold Buying At Highest Since 1950s, As 30% Of World Economies Are Now Sanctioned By The G7

By Michael Every of Rabobank

ARS-sault and Barter-y

Optimists were assaulted by Friday’s data, the Eurozone manufacturing PMI down to 45.5 despite subsidies, stimulus, and lower energy, and the US only 50.4 despite being ‘back in the factory business’. Services PMIs were better but that’s where much core CPI is located, so suggested stagflation; as did Japan’s core CPI at 3.8% y-o-y; as did UK retail sales with food prices at a 45-year high – as the Financial Times noted, the BOE won’t get CPI back to 2% until that is back under control: but it can’t control it. There was also a battering from the geopolitical sphere:

-

The G7 may ban all exports to Russia; Russia warned the Black Sea Grain Deal will end if G7 approves ban on exports to Russia. The G7 ignores this threat requires closing third party loopholes, as with Russian imports.

-

Russian state TV discussed plans to rule the world after winning a nuclear war’, saying, “the territory of the former Ukraine… should be simply liquidated as a nation…. Then it can be decided what to do with the lands and the people,” and that Moscow must train new European leaders favoring Russia(!) Russia also warned South Korea if it arms Ukraine, it will arm North Korea.

-

Head of the US Joint Chiefs of Staff stated the US will have to double its military spending if Russia wins in Ukraine, calling into question the rules-based world order.

-

The US said it will introduce capital controls on investments into China. So, tariffs > inward capital controls > outward capital controls, as predicted in 2017. Expect these to widen from initial AI/tech over time, as tariffs and sanctions both did.

-

Treasury Secretary Yellen stated: “We do not seek to “decouple” our economy from China’s. A full separation of our economies would be disastrous for both countries… the world is big enough for both of us,” and not “zero sum.” However, she also said the US would always put its national security first, even at an economic cost. To her, this was olive branch; but Beijing still sees it as a stick, saying the US wants to strip it of its right to development to maintain global hegemony.

-

A US Congressional committee claimed a war game on China invading Taiwan shows the need for ‘decisive action’ to boost arms, and its head stated “The business community is not taking the threat of a Taiwan crisis seriously enough… [verging] on dereliction of fiduciary duty“.

-

Logistics magazine gCaptain says ‘China’s Plan For Taiwan Invasion Is Not A Secret’, as projected 2030 US – China navy strength from @Tshugart3 shows the US little changed but the PLAN 50% larger in vessel count, if not total tonnage.

-

China’s ambassador to France stated no post-Soviet states have status under international law. That contradicts Beijing’s official position but raises questions if “legitimate security interests” now do exactly that. A joint Baltic-states protest to China will be made today; even beforehand, Italy was planning to distancing itself from China’s Belt and Road.

-

’Chile will nationalise its huge lithium industry. Like Indonesia and the Philippines (nickel), OPEC+ (oil), and China (rare earths), Chile is intent on controlling supply and moving up the value chain. Which way will Chile lean if there is a geopolitical choice of export destination?

-

The Central Bank of Argentina is, by some reports, out of dollars and might even have dipped into private-sector dollar accounts. USD/ARS was 218.51 Friday (and more than double that on the black market), +979% since 2018, with CPI over 100% y-o-y and rates at 81%. President Fernández’s announced Friday that he won’t seek re-election this year, so the future is uncertain. Could new leadership see Argentina shift from USD to CNY, or to dollarize?

-

Egypt, home of the Suez Canal, is on the same crisis path, with no dollars and local hyperinflation, as next-door Sudan sees Western nations struggling to evacuate their embassies.

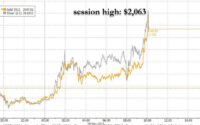

Against this, the Financial Times notes central bank gold buying at its highest since the 1950s, as 30% of world economies are now sanctioned by the G7, and the US debt ceiling looms, arguing dollar hegemony is in trouble. However, it errs in saying the US relies on foreign capital inflows to supplement its local capital stock when, as Michael Pettis puts it, those flows supplant it, forcing up either debt or unemployment. Larry Summers also just defended the dollar on Bloomberg, asking if China is really somewhere people want to hold their reserves, and arguing capital –and people– are flooding out. Even Russia’s central bank says CNY isn’t a good option.

More broadly, what are gold buyers going to sell it for or price it in? Worse, gold either forces barter trade to balance, so the end of our global system of large imbalances, or a 19th century zero-sum imperialism to force people to let you run trade surpluses. As Dr. Pippa Malmgren says on this ‘new’ anti-US market meme: “Tactics without strategy leads to disaster. This is not about de-dollarisation. This is about replacing the medium of exchange from dollars to violence.”

Indeed, if the US is talking about a world where it doubles its defence spending, buy the buck and buckle up. As Yellen noted in her speech: “It’s important to know this: pronouncements of US decline have been around for decades. But they have always been proven wrong. The US has repeatedly demonstrated its ability to adapt and reinvent to face new challenges. This time will be no different.” Many would feel more confident if it weren’t Yellen saying it; but Foreign Policy’s ‘The Myth of Multipolarity: American Power’s Staying Power’ makes the same case.

Could the US afford to spend another $1 trillion a year? Could anyone? It’s all relative. But we are moving closer to a point of praxis on that and many fronts. The US banking sector may see a credit crunch due to rising rates, with auto loans and commercial real estate the core of concerns. That raises the likelihood that we move towards another predicted outcome: higher rates and acronyms, like QE, to reallocate capital from irrelevant to (national security) productive sectors, paid for by central banks, as the ECB’s Lagarde told us last week. In this zeitgeist, a recent Financial Times op-ed talked of ‘The contentious idea that still challenges the Fed’: that there is nothing stopping central banks allocating credit if they want to – they just haven’t wanted to.

Yet the luxury of too-high rates –so no national security spending, just austerity– or too-low rates –so no national security spending, just bubbles– surely cannot be long for this geopolitical world. It makes zero sense to have one base rate, especially if it’s zero, and expecting the economy to make a green transition, or fight a Cold War or a hot one. It’s cut rates and let bubbles rip, as markets keep expecting; or embrace Biden’s national security state capitalism, or the Heritage Foundation’s ‘common good’ capitalism with a moral mission – and higher rates.

The US still has to act in a world of ARS-sault and barter-y where EM want to drop the dollar: to offer carrots, like swap lines or dollarisation *for friends*, and sticks, like tariffs, capital controls, and higher rates to push down commodity prices. That’s realpolitik where economics is not real or political: a colleague and I just laughed at one ‘history of trade’ saying barter was “swapping spears for furs”: if you have spears and the other guy furs, then you have spears *and* furs.

Indeed, why is the US is to now crack down on shadow-bank hedge funds and private equity? Yes, to ensure financial stability. However, also to use the financial system to achieve national goals, while hitting elements that provide nothing useful nationally, China-style; the US already copied tariffs, economic coercion (i.e., sanctions), industrial policy, and capital controls. To quote Fox News: ““I bet right now (Blackstone CEO Steve) Schwarzman is calling everyone he knows in DC to get the Fed to back off. The Fed won’t, of course, because no one is going to bailout a bunch of fat cats.”” Didn’t we also just see the same thing happening in China?

By the way, China also just told its unemployed white-collar students to roll up their sleeves and try blue-collar work. What a shock to some US blue hairs that would be! Or perhaps they might enlist, given recruitment numbers are vastly short of targets, a five-alarm fire in military circles.

Loading…

[ad_2]

Source link