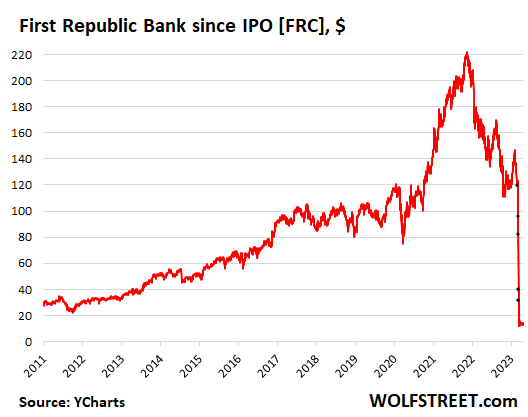

First Republic Discloses it’s a Zombie

Shares, after jumping 12% during the day in anticipation of something wonderful, plunged 22% after-hours, now within a hair of the low in March.

By Wolf Richter for WOLF STREET.

First Republic, the San Francisco bank that started teetering in March when Silicon Valley Bank was felled by its well-connected big depositors, reported earnings this evening. And it looks like it has handled the run on the bank for now: It’s still standing, though its deposits had plunged by 41% (by $72 billion) by March 31, compared to December 31.

But those deposits include the $30 billion that 11 large banks deposited at the bank in March to prop it up and keep contagion from spreading.

Without this influx of $30 billion, deposits would have dropped by 50%. So this was really nip and tuck. The deposits began to stabilize at the end of March and have since then hovered just over $100 billion, it said today.

The bank lined up a lot of cash to cover the past run on the bank and deal with a future run. But it comes at a hefty price: It has to borrow this cash from the Fed and from the Federal Home Loan Banks (FHLBs), and this is expensive money.

For its loans on March 31, the bank’s average borrowing rates were:

- Fed Discount Window: 4.85%

- Fed’s new BTFP: 4.57%

- Short-term FHLB advances: 4.8%

The Fed raised all its policy rates by 25 basis points on March 22, including to 5.0% at the Discount Window, and apparently those new rates have not fully filtered into First Republic’s borrowings by the end of March.

So this is expensive money. And the bank has to post to collateral to borrow this money. In addition, it borrowed from JP Morgan. By contrast, if it borrows from depositors, it doesn’t have to post collateral.

These borrowings combined peaked on March 15 at $138 billion, the bank said in its earnings report. By April 21, these borrowings had dropped to $104 billion.

It had $13 billion in cash and cash equivalent as of March 31, and $10 billion on April 21, up from $4 billion on December 31. Plus it has unused borrowing capacity at the Fed and at the FHLB, giving it a total available liquidity of $45 billion as of April 21, which is more than twice the amount needed to cover the remaining uninsured deposits – those are the ones that are most likely to run.

So apocalypse not now. But the bank is borrowing at high rates and it has to post collateral to borrow at those rates, when in the olden days it was able to borrow from depositors without paying them any or hardly any interest.

In Q1 2022, it paid its depositors 0.09% (near-nothing) on their interest-bearing deposits. For banks, this was truly the free-money era. But it came to an end in 2022, and suddenly money is no longer free, and if a bank wants to attract deposits, or even retain deposits, it must offer higher interest rates.

By December 31, the bank was paying a still ludicrously low 1.63% on average on its interest-bearing deposits.

By March 31, it was paying 2.14%. But that’s still low compared to the rates it is paying the Fed and the FHLB.

For banks, having to suddenly pay interest on at least some of their deposits – they’re still paying near zero on checking accounts – is just a very bitter medicine.

So First Republic’s net interest margin has shriveled to 1.77% in Q1 from 2.45% in Q4 last year. This is the difference between what it pays in interest on its borrowings, such as deposits, and what it earns in interest on its assets, such as loans to customers or Treasury securities it holds. Net interest margin is a key contributor to profit, and it’s shriveling.

But the bank holds low-yielding long-term Treasury securities and MBS that it had bought during the free-money era, and it issued many fixed-rate loans during this era, and their interest rates will not change over the term. But its short-term costs of funding have jumped.

It could issue new loans at higher rates, and it could buy new securities with higher yields, as other banks are able to do, but it doesn’t have the cash to do so.

Instead it will try to shrink its balance sheet and shed assets to use the proceeds to pay down the expensive loans from the Fed and the FHLBs, it said today.

But it cannot sell the long-term securities because that would lock in the unrealized losses and pull the rug out from under it entirely; instead it will have to keep them till maturity, at which point it will get paid face value. But it’s hard to shrink a balance sheet that way. So it’s backing off on lending, and it will focus on loans that it can sell to get them off its balance sheet. This is a long slow process.

And while it’s in that process, it’s essentially a zombie bank. The bank is now looking for “strategic options,” it said. It will lay off 20% to 25% of its workforce in the current quarter, shrink its office space, and trim executive compensation. So the plan is to shrink in order to avoid toppling.

Shares, after rising 12% during the day in anticipation of something wonderful, plunged 22% in after-hours trading, to $12.46, within a hair of the closing low in March.

But after the kathoomph the stock already took, the last step is so small it can’t even be seen on the chart. The stock is down 94% from the dizzying high during peak consensual hallucination in November 2021 and is one of the more spectacular heroes in my pantheon of Imploded Stocks:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link