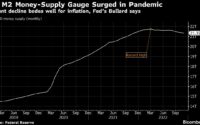

Conference Board Confidence Slumps In April, Inflation Expectations Remain High

After a brief rebound in March, The Conference Board consumer confidence index slipped lower (lowest since June) as expectations sank back near 9 year lows while current conditions were modestly higher…

Source: Bloomberg

The Expectations Index has now remained below 80 – the level associated with a recession within the next year – every month since February 2022, with the exception of a brief uptick in December 2022.

The survey was fielded from April 3 – about three weeks after the bank failures in the United States – to April 19.

“While consumers’ relatively favorable assessment of the current business environment improved somewhat in April, their expectations fell and remain below the level which often signals a recession looming in the short-term,” said Ataman Ozyildirim, Senior Director, Economics at The Conference Board.

“Consumers became more pessimistic about the outlook for both business conditions and labor markets. Compared to last month, fewer households expect business conditions to improve and more expect worsening of conditions in the next six months. They also expect fewer jobs to be available over the short term. April’s decline in consumer confidence reflects particular deterioration in expectations for consumers under 55 years of age and for households earning $50,000 and over.”

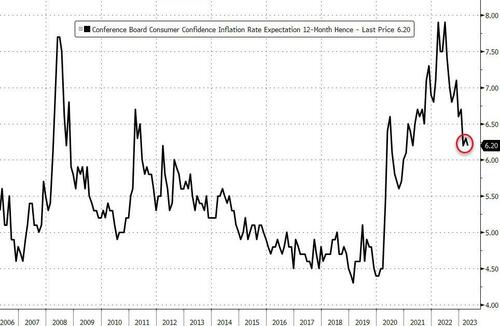

Meanwhile, April’s results show consumer inflation expectations over the next 12 months remain essentially unchanged from March at 6.2 percent – although that level is down substantially from the peak of 7.9 percent reached last year, it is still elevated…

Source: Bloomberg

Overall purchasing plans for homes, autos, appliances, and vacations all pulled back in April, a signal that consumers may be economizing amid growing pessimism.

Finally, the Conference Board’s measure of labor market tightness worsened (less jobs plentiful vs hard to get) in March…

Source: Bloomberg

Slowly but surely Powell is getting his way on employment… but crushing the economy and sentiment on the way.

Loading…

[ad_2]

Source link