Bloomberg/Garfiel Reynolds/4-23-2023

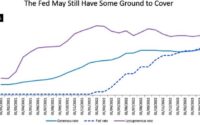

“Hedge funds are betting on higher Treasury yields in a market that’s divided over whether the US economy can avoid recession and Federal Reserve interest-rate cuts. Recent positioning data suggests leveraged investors are about as confident as the central bank is that a slump be dodged even as the past year’s inflation-fighting policy tightening bites on activity.”

“Hedge funds are betting on higher Treasury yields in a market that’s divided over whether the US economy can avoid recession and Federal Reserve interest-rate cuts. Recent positioning data suggests leveraged investors are about as confident as the central bank is that a slump be dodged even as the past year’s inflation-fighting policy tightening bites on activity.”

USAGOLD note: About half of Wall Street believes rates will continue to rise. The other half believes that the Fed will be forced to retreat. The standoff has left markets in an eerie equilibrium with major pain likely in one camp or the other. With leveraged bets so large on both sides, the risk of a black swan event – even multiple black swan events – is highly elevated.