Spring Selling Season Already Goes to Heck, Pending Home Sales Plunge. Banking Crisis to Blame?

A harbinger for closed sales in April and May.

By Wolf Richter for WOLF STREET.

March is with both feet in the spring selling season, when home sales jump and when prices move higher, and where everything looks rosy for a few months, no matter what, after the dreariness of winter.

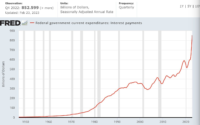

So, well then, here we go again. Pending home sales – which are “a forward-looking indicator of home sales based on contract signings” – fell by 5.2% in March from February, according to the National Association of Realtors today, thereby annihilating the little-bitty gain in February that had sent all the headlines abuzz with hype.

The index value was set at 100 for contract signings in 2001. Today’s value of 78.9 is down 21.1% from the index average in 2001. Compared to prior Marches, the index value of contract signings plunged…

- By 23.2% from March 2022

- By 30.2% from March 2021

- By 25.1% from March 2019.

By the way, as you can see in the chart above (data via YCharts), that little bitty gain in February that had sent all the headlines abuzz with hype was revised away in today’s release, and February was now flat with January.

The NAR defines a “pending sale” as a transaction where the contract was signed but has not yet closed. Deals can fall through for a variety of reasons. If all goes well, the sale usually closes within a month or two of contract signing. So this is a harbinger for closed sales in April.

Banking crisis to blame?

Pending home sales by region, compared to March a year ago, plunged by the most in the West.

The National Association of Realtors didn’t say, but the banking crisis burst on the scene in early March. Silicon Valley Bank imploded on March 10, which shook up the entire startup ecosystem not only in Silicon Valley but across the US. The run on the bank had started weeks earlier, the startup scene was atwitter with it, so to speak; it just culminated in the final few days.

And First Republic in San Francisco hasn’t quite imploded yet, it’s still standing, knock on wood, but it’s in huge trouble after a massive run on its uninsured deposits. It has been teetering for weeks, and its stock price collapsed.

The banking crisis has rattled a lot of nerves not only in the region, but in the overall banking sector, on Wall Street, and among regulators. And for regular people, it turned into a messy spectacle played out in the media in front of them, and some may have gotten cold feet again.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link