Gold Will Be The Blowoff Valve

Submitted by QTR’s Fringe Finance

A long time ago, in a different lifetime, I used to work at an industrial plant that operated several 20-ton chemical processes. Our processes operated using a closed-loop system, in the absence of oxygen, and were not pressurized.

We monitored each aspect of our processes using an array of gauges, pressure sensors, thermocouples, and other devices to make sure things were running smoothly at any given point.

Near the midpoint of each process, we had a blowoff valve — a long piece of piping that led to the outside of the building, fitted with a seal that was set to blow out when it reached a certain pounds per square inch (PSI) threshold. The valve was meant to be a safety mechanism so that if, inadvertently, pressure started to build up inside of the process, it would “blow off” outside the building, instead of turning our process into a 20-ton pressure bomb waiting to explode. It’s the same principle that causes a kettle to scream when the steam reaches a certain pressure inside: the whistle only goes off once the water gets hot enough to create enough steam.

Our economy nowadays is similarly a process with lots of variables — though far more toxic than our green process used to be. Regarding our economy, you could throw a dart and pick any variable to monitor: CPI, GDP, the money supply, the price of equities, the price of commodities, or even things like average number of potato chips contained in a $0.99 bag. Just like the economy is trillions of transactions taking place every day, there are similarly an endless number of variables that one could monitor to try and forecast the health of our financial closed loop process.

Two “variables” that happened to catch my eye on Friday were (1) another regional bank collapsing, and being put into receivership and (2) the price of equities continuing to move higher as though nothing is wrong. Each of these effects had their causes: the bank collapsed because, like Silicon Valley Bank, it lost confidence when it announced it would likely need to sell billions in assets, and the price of equities moved higher because of skewed behavioral market psychology that’s a residual effect of 15 years of horrifically arrogant monetary policy and easy money policies.

The juxtaposition of these two variables — the fact that markets didn’t care and/or notice that another bank had just collapsed — is tough to overlook.

It’s especially tough when put into context. Since March, five major banks have collapsed: Silicon Valley, Silvergate, Signature Bank, Credit Suisse and now First Republic.

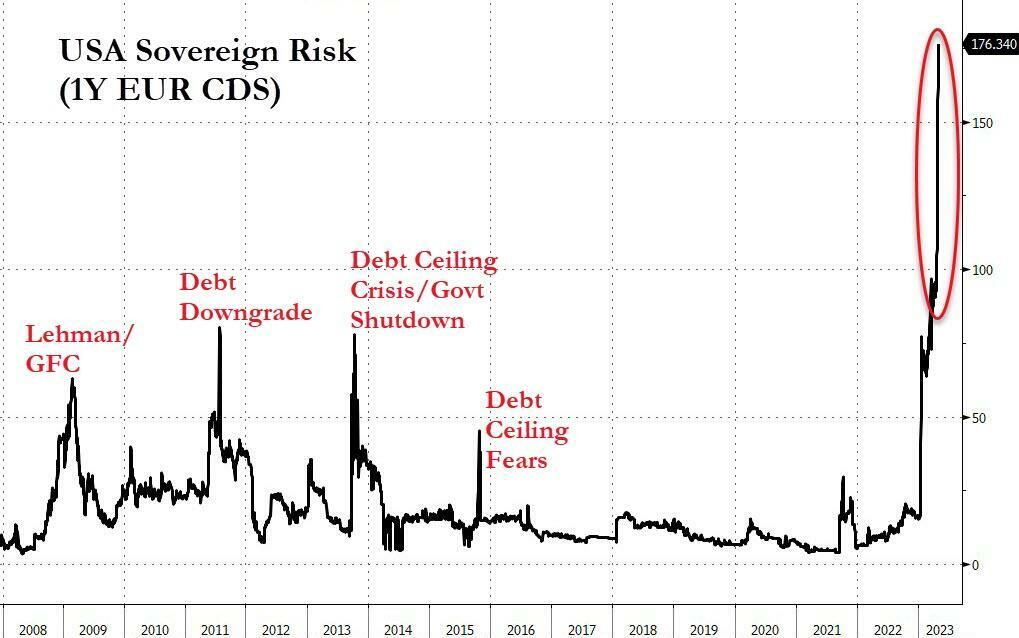

For 10 years, I’ve been ranting about how the stock market isn’t the economy, and laying out why one can move without affecting the other, but this odd relationship between equity markets and economic reality just seems like an insult to the natural laws of economics and free markets. The CDS market seems to understand this.

Chart: Zero Hedge

But I digress, I’m not here to fight the trend of markets or claim that I’m right when the market is clearly proving me wrong. Rather, what I reminded myself of on Friday, is that there are an infinite number of other economic “blow off valves” that can bear the dire reality of the economic disaster that is unfolding, and that equity prices seem to be eluding.

What I mean is that equity prices could remain high, but something else is going to have to give if that’s going to be the case, as I’ve written about in the past.

Put it this way: if interest rates and equity prices were the only two economic variables in the entire macro system, the market would be down 80% off its highs by now, at least. But they’re not. Instead, we have to contend with things like the money supply and market psychology, not to mention commodities, Fed bond buying (and selling), and numerous other “wild cards”. This never-ending list of things we must contend with also means there is a never-ending list of alternate items where the turmoil that should be showing up in equity markets will be diverted to.

The most likely candidates to “blowoff” are…(READ THIS FULL ARTICLE, FREE, HERE).

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link