Financial Times/Ruchir Sharma/4-23-2023

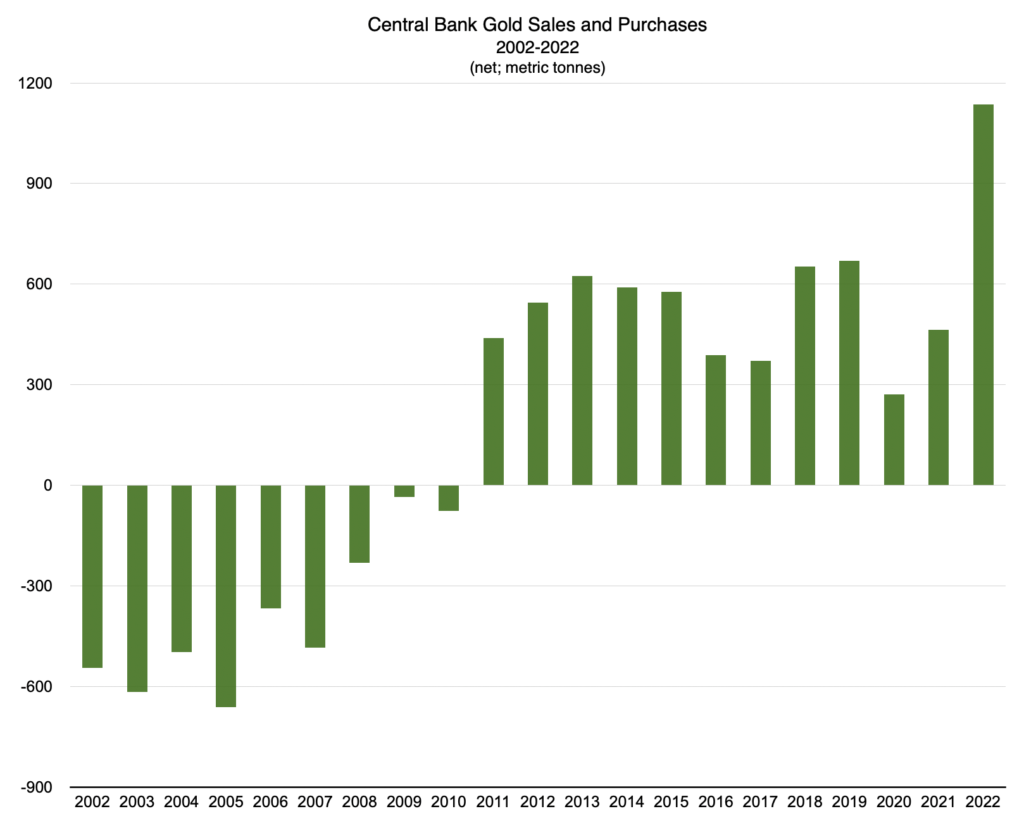

“The prime example right now is gold, up 20 percent in six months. Surging demand is not led by the usual suspects — investors large and small, seeking a hedge against inflation and low real interest rates. Instead, the heavy buyers are central banks, which are sharply reducing their dollar holdings and seeking a safe alternative.”

USAGOLD note: Sharma explains why central banks are moving out of the dollar and into gold. “[T]he oldest and most traditional of assets, gold,” he says, “is now a vehicle of central bank revolt against the dollar.” He sees the strong central bank demand as “something new” in the gold market. The World Gold Council, we will add, reports the strongest start to a year in 2023 since “at least 2010.”

Chart by USAGOLD [All rights reserved], Data source: World Gold Council