World Gold Council/Krishan Gopaul/4-4-2023

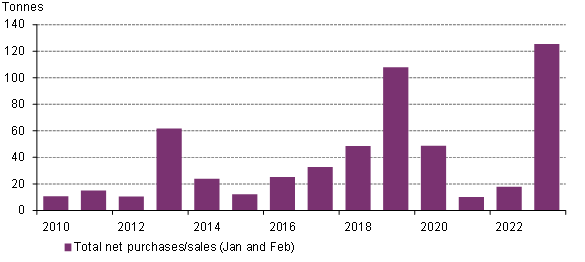

“Central bank gold buying momentum showed no signs of stalling in February. Reported global gold reserves rose by 52t during the month – the eleventh consecutive month of net purchases – following January’s 74t. This excludes updated data for Russia (more on that below ), but still maintains the upward trend (based on the 12-month moving average) since June 2022.”

USAGOLD note: Much of the publicity of central bank involvement in the gold market has had to do with the record offtake in 2022. Gopaul reports that the record pace has continued into the early months of 2023. Central bank purchases of 125 tonnes in the first two months of 2023 are “the strongest start to a year back to 2010 – when central banks became net buyers on an annual basis.”

Central bank gold demand

(First two months of the year, 2010-2023)

Source: World Gold Council, IMF IFS, respective central banks