With Mortgage Rates Stuck at 6.5%, Spring Selling Season Turns into Dud

But unlike homeowners, homebuilders know how to sell into a down-market: by cutting prices. So a shift to new home sales.

By Wolf Richter for WOLF STREET.

The housing market is now in peak spring selling season. This is when sales volume surges and when home prices rise and when everything is rosy no matter what else is happening. But not this year, and we’ve already seen that with pending home sales that plunged 23% year-over-year in April, and we’ve seen it with closed sales in March that plunged 22%, and we’re now seeing that the situation got worse into late April and early May.

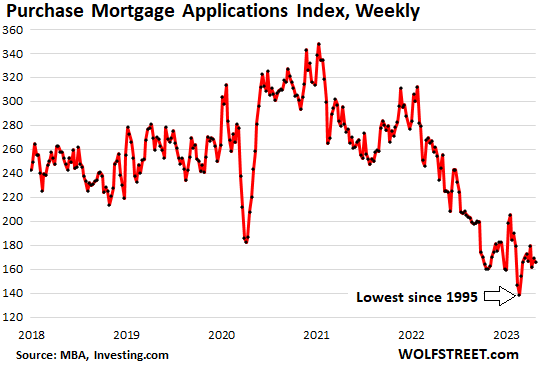

Applications for mortgages to purchase a home, a leading indicator of home sales, dropped again in the latest week, and have remained solidly below the lockdown lows in April 2020, according to data from the Mortgage Bankers Association today. Compared with the same week in prior years, purchase mortgage applications were down:

- By 32% from the same week in 2022

- By 40% from the same week in 2021

- By 36% from the same week in 2019

The MBA’s purchase mortgage index has now been hovering for weeks at the lows last seen during the bottom of Housing Bust 1. During the last week of February, it hit a 28-year low.

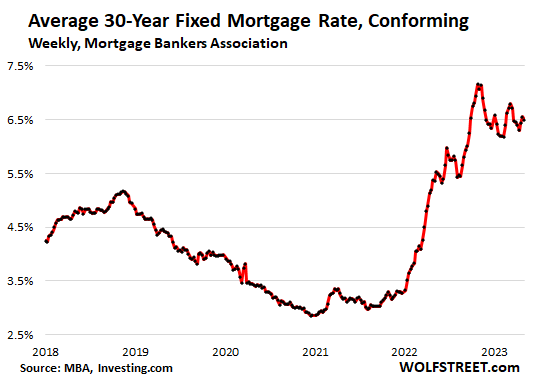

Mortgage rates really haven’t budged off the 6.5% range since coming down from the 7% range in November last year, with the average contract interest rate for conforming 30-year fixed-rate mortgages at 6.50% in the latest week, according to the Mortgage Bankers Association today:

So the housing market is not thawing out at 6.5% mortgage rates. A healthy housing market needs to have sellers and brokers that are in touch with reality, and the reality is set by potential buyers who’re waiting for prices to come down further.

Which has led to an interesting shift: from buying used homes to buying new homes, because there is a large supply of new homes, and homebuilders – unlike homeowners – are data-driven pros, they know how to sell into a down-market: by cutting prices. And they’re doing it, and buyers are flocking to it.

They’re offering lower price points, and they’re buying down mortgage rates for a set period, such as the first two years of the mortgage, which for buyers translates into a lower mortgage payment, which effectively feels like a price cut. Homebuilders can afford to because their costs have come down.

But homeowners are still stuck with in March 2022 pricing ideas. Those prices are now history, but potential sellers are having trouble adjusting, and so they’re not putting their homes that they have already moved out of on the market, hoping for better times, hoping for lower mortgage rates, while muttering, “and this too shall pass.”

For homebuyers, new houses may offer a better deal, and so there has been some shift in that direction.

But accepting a mortgage-rate buydown is risky if the buydown is only for a limited time, such as one year or two years, and then the mortgage reverts to a higher rate, and therefore a higher monthly payment that the buyer may have trouble making. Buyers are betting that by then mortgage rates will have dropped back to 4% or 3% or whatever, and that they can refinance at a rate similar to the buydown rates. That is a risky bet. If inflation stays high, rates won’t go back down, and then the mortgage payments jump, but so be it. That’ll be a problem for another day.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link