Battered By BidenInflation, 90 Million Americans Struggle Paying Bills As Credit Card Usage Spikes (Biden/Yellen/Schumer Dither As Debt Hits $32 TRILLION With $188 TRILLION In Unfunded Liabilities) – Confounded Interest – Anthony B. Sanders

Reminder, the US already has $32 TRILLION in debt and politicians have promised $188 TRILLION in entitlement spending. yet we are sending billions to Ukraine, etc. Yet Biden is visiting Japan (hide your little girls, Hiroshima!) and Biden/Congress still haven’t solved the debt limit crisis and Biden’s insane budget yet. Meanwhile, Americans are suffering from Biden’s inflation (aka, Bidenflation) and bad economic policies.

A large swath of American consumers are facing financial hardship as they grapple with elevated living costs, record-high credit card use, and two years of negative real wage growth. This perfect storm could decimate financially fragile households in the next downturn. (Zero Hedge).

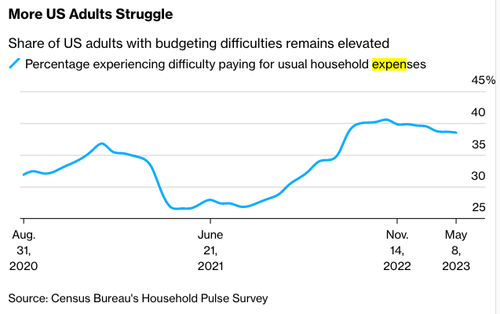

As many as 89.1 million American adults (or about 38.5%) were found to experience some form of difficulty in covering expenses between April 26 and May 8, according to Bloomberg, citing new data from the Household Pulse Survey. This is up from 34.4% in 2022 and 26.7% during the same period in 2021.

The rising trend is alarming but not surprising. Consumers have been battered by two years of negative real wage growth.

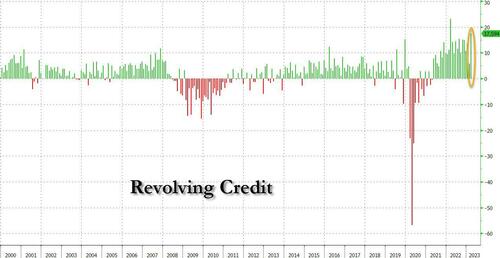

As wages fail to outpace the cost of living, many consumers have burned through savings and resorted to credit cards. The latest revolving credit data shows consumers appear to be ‘strong,’ but that’s only because they use their plastic cards more than ever to survive.

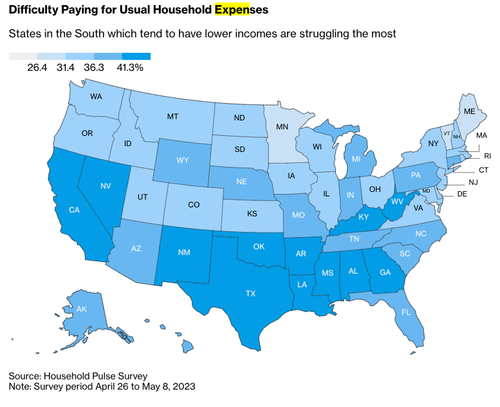

The Household Pulse Survey found struggling households were primarily based across West Coast and the South.

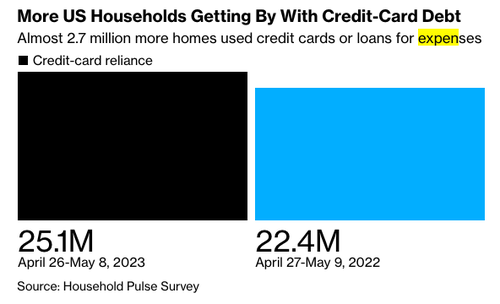

Compared with the same period last year, the survey found 2.7 million more households were relying on credit cards to cover expenses.

Consumers have record card debt and ultra-low savings rates and are paying some of the highest borrowing costs in a generation (the average interest rate on cards now exceeds 20%). This debt is becoming insurmountable for some as delinquencies rise.

And what we have now is new debit and credit card data published by the Bank of America Institute that shows not just spending slowdown for lower-income consumers, but also the upper-income cohort is finally starting to crack.

However, it is appropriate that Biden is visiting Hiroshima Japan where a nuke was detonated to help end World War II.. Biden is doing the same to the US.

[ad_2]

Source link