Definite Debt Default – by Quoth the Raven

It’s pathetic that we do this song and dance about raising the debt ceiling every couple of years.

It’s about as hollow, inane and meaningless as both our monetary and fiscal policies in this country — so, in that respect, it fits. It’s also great fodder for the two-party political pissing match that takes place on the daily, so as to keep us peons distracted from the ugly reality of many of the decisions our country collectively makes.

The idea being pushed by both parties — that a default would be catastrophic for markets — is meaningless for several reasons. First, we’ve been in a perpetual state of “default”, as measured by unsustainable fiscal and monetary policy, for decades now. Second, the shock to our financial system that would result from finally calling our ongoing default by its name publicly, is long overdue and could oddly be one of the best things that could happen to us. And I’m not trying to be sensational, I swear.

I’ll say up front that I don’t expect a default to happen, though I am intrigued by the facts that (1) my friend Larry Lepard told me over the weekend “they are going to default” and (2) the results of a Twitter poll that I put up a couple days ago show he isn’t alone in his thinking.

The debt ceiling was put in place for a reason: to stop us from spending beyond our means, which is exactly what we’re doing. Just like the gold standard, it was supposed to be a guardrail that we implemented to prevent our own destruction. Instead, it has become one of many deckchairs on the financial Titanic that we continued to shuffle around, proudly and in the absence of real solutions, while our capsized ship slowly sinks into the ocean of inevitability.

As House Speaker McCarthy has repeatedly noted, the issue for the U.S. is more about spending than generating revenue. If you’re interested in visualizing the conundrum the U.S. has gotten itself in, this slide deck from the Peter G. Peterson foundation is well worth a review. For brevity, here is a key visual of as how askew spending and revenue are, with spending very clearly above historical norms, outpacing revenue which also is above historical norms.

While both parties generally act irresponsibly, our nation’s spending addiction can be more directly attributed to Democrats’ obsession with larger government and more control. The political left is too ignorant to understand that they can grip power and spending so tightly that it will slip out from underneath their fingers. Is it any wonder they also can’t seem to grasp the Laffer curve?

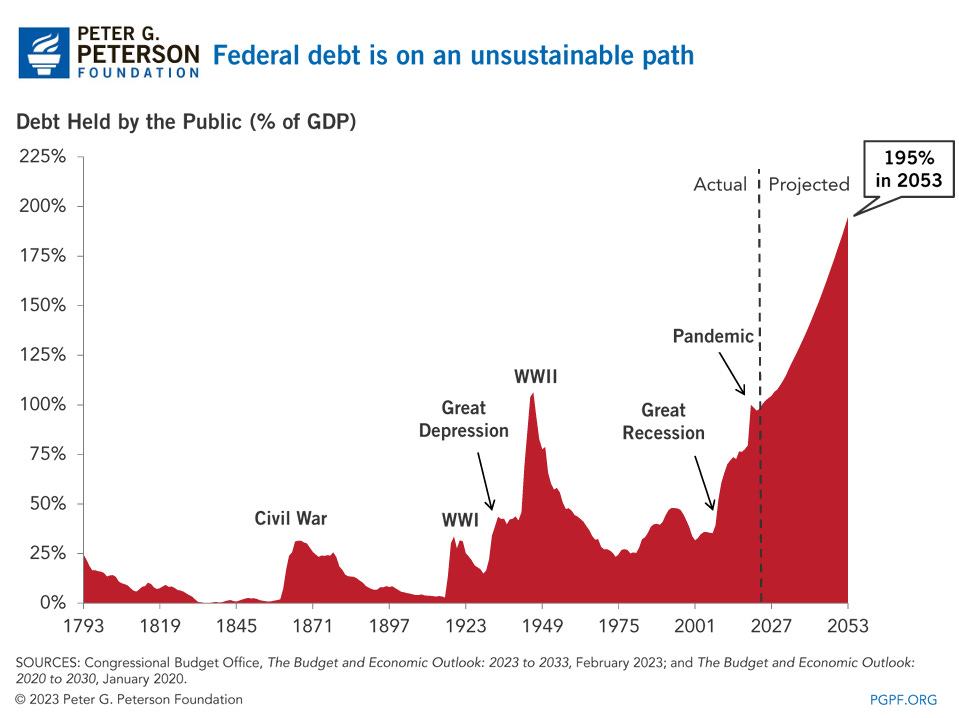

And so, this is the trajectory we find ourselves on:

Anyone who looks at the above two charts and advocates for more spending regardless of revenue, as the Biden administration has done, is equal parts grossly negligent and grossly incompetent.

As everybody knows, the secret to “paying off the credit card” is never to simply raise your limit again and again — it is to manage spending and start to pay it down — and there is no amount of bullshit PhD economic jargon that is going to change this basic economic law.

One of the leading arguments for raising the debt ceiling is that it’s simply “something we’ve just always done”, as though making a terrible decision consistently somehow roots it in reason and bestows upon us carte blanche to repeat our grievous error in perpetuity.

This argument has been the reason we have already been in a state of default — unable to balance our budget or pay our bills and printing new money as often as Sam Brinton brings home a new piece of luggage.

Little do we understand: this debt ceiling discussion is not us tossing around the question of whether or not we’re going to default, it’s a discussion of whether or not we’re going to finally acknowledge the longstanding default we’re already immersed in.

For that reason, one could make the argument that Republicans holding the line all the way up to the last minute may be the best course of action. Ultimately, the Biden administration doesn’t want a default on its watch, so it’ll cave to whatever Republicans demand. It isn’t just great leverage in terms of negotiating, as an added bonus it also happens to be the right thing to do.

And both sides of the aisle are correct in suggesting that failure to reach a deal would likely result in a massive shock to global economic markets. But looking back over the last few decades, the only thing our financial system has been screaming for that hasn’t happened yet is such a shock — “taking the medicine” to correct a half century of flawed policy.

Again, I don’t believe that politicians won’t get a deal done, mostly because their own retirement savings depends on it, but I also don’t think a shock from a default would be as catastrophic over the long-term as we think. In fact, it would force us to examine the dire, pressing questions about the state of our country’s fiscal and monetary policy that we have been ignoring for too long. In other words, it would be the check finally coming due.

It may sound absurd, but it isn’t. Compared to many European countries, the U.S. is already in a very precarious position, as Jesse Felder on Palisades Gold Radio detailed (a must listen) a couple of days ago. Compared to Europe, we are only behind Greece and Italy and, in general, we are one of the most indebted countries in the world.

We need to face reality — this ride could be nearing its end. And when you think of it that way, it becomes clear that the sooner we face our spending and printing addiction, the sooner the healing can begin.

“But Chris,” you’ll say, “it’ll destroy the wealth of so many Americans, resulting in a massively lower quality of life for the entire country if we default! How can you suggest this misery and austerity is a good idea?”

To which I respond: “I’m not arguing with that, but one could make the case that a lower quality of life and financial pain are on their way anyway, so we might as well pull them forward now so we can at least start to change course as a country.”

After all, with 6% inflation and an economy about to slam head-first into recession, it’s not exactly like we’re living the vibrant financial highlife at the moment anyway.

Yes, the pain from a default would be significantly worse, but it would force feed all of our elected politicians, government officials and citizens the long-ignored truth about how mismanaged our country has truly been financially.

Another reason that the “it’s what we’ve always done” argument doesn’t make sense is that the U.S. has never been in the economic crosshairs of the rest of the world the way we are now.

“When you look at countries that have expressed interest in joining BRICS, they all have substantial gold holdings,” Andy Schectman told me several weeks ago about the global economy. “The numbers are increasing among those who want to join, there’s over 60 countries they have lined up in a queue [to join BRICS].”

“I do believe it’ll be a Sunday night. OPEC, the BRICS nations, Saudi Arabia – they come out and say on a Sunday night, we’re taking other currency for oil – and everything blows up Monday morning. It’s a tsunami of dollars,” Andy concluded.

“The pieces are being put into place right now. Nobody is going to have time to react.”

If he’s right and our hand is going to be forced, we have to get real and ask if we want the rest of the world to force it for us, or if we can save face slightly by admitting to ourselves that it’s time to eat our own economic cooking.

Markets may dip this week in turmoil, but the volatility will likely ratchet up pressure on politicians to get a deal done, which is the most likely outcome before the treasury runs out of cash.

Given the political climate in the country, I do think we are probably more susceptible now than we’ve ever been to default, but at the end of the day, politicians on both sides of the aisle are common cowards, and so I’m near-certain they will collectively acquiesce towards getting a deal done.

Regardless of the “deal or no deal” style headline that’ll pop up this week, there are two certainties most of us realists have already come to understand:

-

The country has essentially defaulted already, and so this week’s outcome is pointless.

-

We’ll have to “take the medicine” at some point, no matter how many times Paul Krugman invokes “underwear gnomes” and other rock solid methods of publicly justifying our financial irresponsibility.

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. In pieces that I did not write, but that I aggregated from other sources, I did not personally fact check them and am republishing them, with permission, because I found the content useful and believe my readers will too. This is not a recommendation to buy or sell any stocks or securities or any asset class – just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

[ad_2]

Source link