The Fed isn’t done breaking things

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Ethan here; Rob is away. Thanks to everyone who wrote in about Tuesday’s letter on US equity valuations. One reader, Paul OBrien, made an important point that I missed: what if stocks are fairly priced for a lower-returns world? Could well be, though it would mean the popular Shiller p/e ratio, which is very high now, has misfired. BCA Research’s Irene Tunkel notes that Prof Shiller’s measure did accurately call the 2000 and 2008 bear markets. Any further thoughts are welcome at the email below.

In other news, Fitch has put the US on “negative watch”, its equivalent of a stern talking-to. I’ve somehow managed to line up my long-planned summer holiday with the drop-dead date. You’ll be in Jennifer Hughes’ capable hands tomorrow, and Rob’s next week. But you can still email me: [email protected].

More things are bound to break

One question hangs over this remarkably stable cycle: can the US return to some kind of low-inflation normal without breaking the economy in the process? Three recent pieces of Federal Reserve research offer hints and, I think, some reasons for worry.

The first, published by the New York Fed, focuses on the natural rate of interest, or R-star. This is the theoretical interest rate that balances the economy, neither stoking inflation nor stifling growth. Monetary policy is only “tight” if the policy rate is well above the natural rate. If R-star were 4.5 per cent, as it was in the 1960s, today’s 5 per cent fed funds rate scarcely looks tight at all. Annoyingly, though, it is unobservable. The late economist John Henry Williams, as quoted last week by New York Fed president John Williams, wrote in 1931 that R-star is “an abstraction; like faith, it is seen by its works”.

The New York Fed has just restarted publishing estimates of R-star, which were suspended after the pandemic made a hash of its models. Not a whole lot has changed; the economy’s equilibrium interest rate has stayed low:

Many economists, including Jay Powell, have noted how imprecise measuring R-star is, so scepticism is due. But as Williams put it last week, the bottom line is: “There is no evidence that the era of very low natural rates of interest has ended.” Policy right now is very tight.*

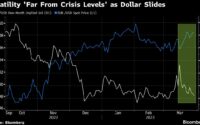

The second bit of research also comes from the New York Fed, and concerns a newer idea called the financial stability interest rate, or R-double-star. This is the theoretical rate that tips the financial system into crisis. In his excellent write-up over at FT Alphaville, Robin Wigglesworth explains:

The idea is that there is also a neutral level of interest rates for financial stability, and, crucially, it is not the same as R*. Basically, R** is a measure of an economy’s financial sturdiness. When it’s low, a country is vulnerable to financial shocks from rate increases, and when it is high it can more easily shrug them off without major mishaps.

Crucially, if R** drifts lower than R* — for example, if prolonged low interest rates encourage leverage, risk-taking and general stupidity — a central bank’s rate increases can cause financial calamities long before it gets to the point where rates really start to contain inflation.

That the Fed’s rate increases precipitated a banking crisis before they got inflation down to even vaguely near their target looks like a good example . . .

In a pair of blog posts this week, New York Fed researchers lay out how lower-for-longer rates can make the economy fragile. It’s a familiar story, but one worth rehearsing. In the short run, low interest rates are good for financial stability. Asset prices rise, leverage (ie, assets over equity) falls and everyone is happy. But over time as financial institutions, with their now-healthier balance sheets, search for new investments, low interest rates push them towards ever riskier stuff — a classic reach-for-yield dynamic. They get overextended, leaving the real economy “at greater mercy of luck”. It only takes one wrong move to get a crisis, including a rates shock meant to curb inflation.

The final piece of research, released by the Kansas Fed yesterday, makes a simple point: financial crises are not very deflationary. Since financial stresses hurt both demand (through tighter credit conditions) and supply (through lower capital investment), the hit to growth is big but the drag on inflation is small to non-existent. The Kansas Fed’s chart below shows the average effect on inflation, unemployment and investment in the months following past systemic financial crises. Surprisingly, inflation (blue line) tends to tick up as unemployment surges (green):

Taking stock, we have:

-

The natural interest rate still looks low, suggesting the past year of rate increases has delivered a big negative shock.

-

An economy that has been through a decade of low rates is probably one bad shock away from a financial crisis.

-

Financial crises are poor anti-inflation measures.

You can imagine how this ends badly. Inflation stays stubborn but the financial system is so fragile that rates must be cut. Inflation then becomes baked into expectations and the Fed has to raise rates yet again. A deep recession ensues. Powell gets awarded the Arthur Burns Memorial Dunce Cap for Easing Too Early.

There are still reasons to feel sanguine. The economy has so far withstood the banking mini-crisis. The Fed’s lending facilities are doing their job. Shelter inflation, the hottest bit, is coming down. Leverage in the system is low. But remember that cycles don’t often end smoothly. More things are bound to break, and the economy’s remarkable stability probably cannot last.

One good read

The lame walk. A welcome break from all the recent AI techno-doom.

*This article has been amended to remove an inaccurate comparison of R-star and the Fed’s policy rate

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

The Lex Newsletter — Lex is the FT’s incisive daily column on investment. Sign up for our newsletter on local and global trends from expert writers in four great financial centres. Sign up here

[ad_2]

Source link