Cable Crushed As UK Inflation Unexpectedly Hits 30 Year High

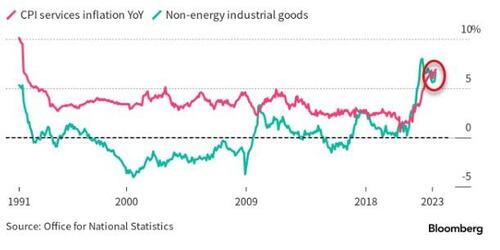

Stagflation is taking hold in Britain as inflation printed much hotter than expected this morning with services and core CPI at their highest since 1992.

Headline CPI printed 8.7% in April, higher than any of the 36 estimates from economists or the 8.4% reading forecast by the central bank (though admittedly back in single-digits from the 10.1% print in March).

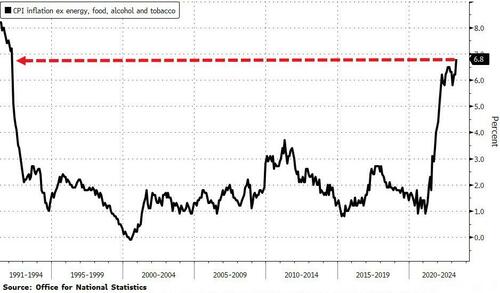

However, core prices excluding food, energy and tobacco accelerated to 6.8% last month from 6.2% in March.

Source: Bloomberg

There are signs that inflation is becoming embedded…

Source: Bloomberg

The reaction – after a kneejerk bid – was selling of sterling, pushing cable back to its lowest in six weeks…

Source: Bloomberg

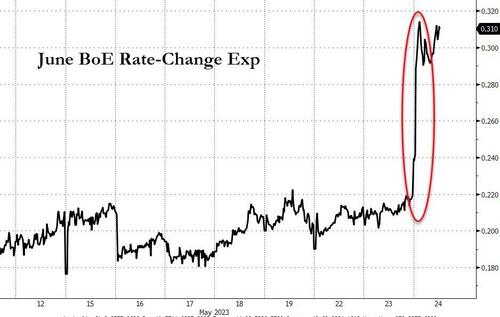

Rate-hike expectations for June spiked…

Source: Bloomberg

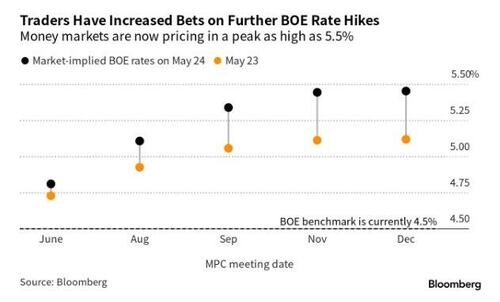

With traders now betting that the BoE will hit a terminal of 5.5% (up from 5.1% yesterday)…

Source: Bloomberg

Today’s data was very unwelcome, given Governor Andrew Bailey only on Tuesday remarked inflation “had turned a corner”.

“With inflation proving stickier than the Bank expected, it now seems all-but certain that the Bank will raise interest rates from 4.50% to 4.75% in June and perhaps a bit further in the months after,” said Paul Dales, chief UK economist at Capital Economics

Which will only squelch growth more and drive the nation into a deeper stagflationary spiral – every central banker’s worst nemesis.

Loading…

[ad_2]

Source link