Still an Astonishing Labor Market: Very Tight or Getting Even Tighter in Some Sectors, Getting Less Tight in Others, Not Loose Anywhere, Despite the Rate Hikes

Powell is going to mention this with some frustration in his voice.

By Wolf Richter for WOLF STREET.

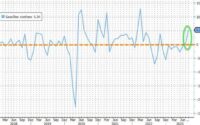

The labor market was supposed to loosen as the Fed hiked rates to tamp down on demand just a little to de-fuel the inflation fire, and the labor market did get a little less tight, but it remains stubbornly tight. Today’s report on job openings, layoffs and discharges, hires, and quits by the Bureau of Labor Statistics hammers this home: while the labor market got a little less tight in some corners, it tightened further in other corners, and job openings “unexpectedly” rose again. Powell is going to mention this at the next post-meeting press conference with some frustration in his voice.

Job openings in April rose by 358,000 to 10.1 million seasonally adjusted; and not seasonally adjusted, they jumped by 1.05 million to 10.6 million. This is not based on job postings, or on fake job postings, or whatever, but on surveys sent to 21,000 businesses, asking them about their actual workforce details.

The three-month average, which eliminates the whiplash-inducing drama of the monthly ups and downs, was roughly unchanged in April from March (not seasonally adjusted) and has remained close to the 10-million range all year. The slowdown occurred last year, with openings dropping sharply from the astronomical zone in April, but then the drop “unexpectedly” fizzled into the end of the year and then stalled. Job openings were still 37% higher than in 2019 at this time.

Layoffs and discharges fell again, after having ticked up from the historic low in April last year, and remain below the pre-pandemic Good Times low.

Companies always discharge and lay off people for a variety of reasons. During the Good Times before the pandemic, actual layoffs and discharges averaged around 1.8 million per month. In April, layoffs and discharges dropped to 1.58 million (from 1.84 million in March). The three-month moving average dipped to 1.66 million

These are actual discharges and layoffs by employers in the US, not announcements of global future layoffs or whatever, that may not even take place in the US.

Hiring ticked up again in April, after some dips in the prior months. The three-month moving average dipped to 6.11 million hires in April, continuing a slow decline, but is still up 5.4% from the same period in 2019:

The churn in the workforce is subsiding. The bombastic media coverage of global layoff announcements by big US tech and social media companies, in combination with less-desperate efforts to hire by them, has had the effect that employees are less confident the grass is greener on the other side of the fence, and they quit their current jobs less frequently, and the massive churn in the labor force has subsided.

In April, 3.79 million workers quit their jobs voluntarily, back to April 2021. The three-month average was still 10% higher than in the same period in 2019. There is still a lot of churn in the labor market, as workers are trying to arbitrage the tight labor market to improve their lot. But the churn is way down from a year ago:

Job openings in major sectors.

In professional and business services (a big category with 22.4 million employees), the three-month moving average of 1.8 million job openings is still up by 39% from the same period in 2019, though it has deflated from the astronomical levels in 2021 and 2022.

This sector includes Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services. Some of the tech and social media companies are included, others are in “information” or in other categories. Included are

“Information” (a small sector with 3 million workers) contains some of the tech and social media companies with big layoff announcements. After a steep plunge late last year through December to the worst levels since the Dotcom Bust, job openings have bounced back some, and the three-month average, at 180,000 openings, is still up 35% from the same period in 2019.

The sector includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

In leisure and hospitality (16 million employees), the three-month average dipped to 1.42 million job openings, still up by 42% from the same period in 2019:

In healthcare and social assistance (21 million employees), the three-month moving average of job openings ticked up to 1.77 million openings, after having fallen for months from the astronomical zone. They’re still 47% higher than in the same period in 2019:

In the retail trade (16 million employees), job openings stabilized at normal levels last year and have stayed in the same range. The three-month moving average of 825,000 job openings was up about 5% from the same period in 2019:

In education/state & local government, job openings have stabilized last year at very high levels, as many school districts still have a hard time recruiting enough teachers. The three month-moving average of 870,000 job openings was 52% higher than in the same period in 2019:

In manufacturing (13 million employees), job openings have steadily decline from the astronomical zone. The three-month moving average of 695,000 openings is still 55% higher than in the same period in 2019:

In construction (8 million employees in all types of construction, from powerplants to single-family housing), job openings bounced off the dip earlier this year that had likely been caused by the horrendous rains, snow, and flooding in the West, particularly in California. The three-month moving average rose to 367,000 openings, up by 7% from the same period in 2019:

In Arts, Entertainment, and recreation (2.3 million employees in spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar), job openings have shot to record levels, as Americans are now shelling out large amounts of money for experiences they stayed away from during the pandemic, and the sector is trying to staff up for it.

The three-month average rose to 233,000, up by 111% from the same period in 2019:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link