The Great Global Debt Pit

The ‘American Dream’ – Financed By Debt

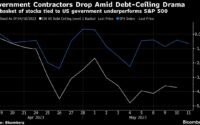

Phew! The USA managed to not go bankrupt on Monday (5 June). But it was a close-run thing. At the last minute, President Joe Biden and Speaker of the House Kevin McCarthy sealed a deal which permitted Congress to raise the federal debt ceiling, in return for promised spending cuts. If the debt ceiling of $31.4 trillion had not been raised then, technically, the US Treasury would not have been able to redeem maturing T-bonds and bills, and the largest economy in the world would have gone into default. That would, as Treasury Secretary Janet Yellen foretold, have had all kinds of ramifications for both the US and global financial markets.

On closer inspection, however, these promised cuts don’t amount to much. They are all related to discretionary spending such as infrastructure, and are scheduled to occur over 10 years, mostly at the end of that period. Moreover, new spending programmes and emergency contingencies are sure to be invoked over the next decade, thus offsetting any anticipated cuts. It proved politically impossible to cut burgeoning entitlement programmes such as retirement pensions, Medicare (health care for the retired), Medicaid (health care for the least well off) and student loans.

The working assumption now is that the US federal fiscal deficit for 2024 will be around the $2trn mark (that’s 2,000 billion greenbacks for the number-blind). Even Goldman Sachs, which is usually soft on big government, opined that: “The spending deal looks likely to reduce spending by 0.1-0.2 percent of GDP year-on-year in 2024 and 2025.”

For 137 years after the Declaration of Independence from King George III in 1776, Americans managed successfully without a central bank and thus without a monopolistic fiat currency and a national debt. But finally, in December 1913, under the presidency of Woodrow Wilson (1856-1924), the Federal Reserve (Fed) was inaugurated. From thereon in, any fiscal deficit incurred by the federal government had to be financed by the issuance of US Treasury Department certificates affectionately known as T-bills and T-bonds.

These days, the US federal government owes more than $30trn in outstanding IOUs – and rising. That is not only a lot of money − it’s an almost unimaginable amount of money. If someone could earn one dollar per second, it would take them over a million years to repay the US federal debt – and that’s without servicing the interest costs. What’s more, as interest rates rise, the interest cost of that debt pile is increasing to previously unparalleled levels. Right now, the US government is paying $61bn in interest payments alone every month. During the years of near-zero rates the interest cost of the federal-debt pile amounted to around 1.5 percent of GDP. Next year it will be around 2.7 percent. And that figure is likely to rise further.

The 10-year plan entails cumulative budget deficits of in excess of $20bn, running at around 6-8 percent of GDP per year. So, by 2033, the US national debt could be more than $50trn. Even given the most optimistic scenarios for GDP growth, that might equate to about 200 percent of GDP. The officially non-partisan Congressional Budget Office (CBO) projects that the US debt-to-GDP ratio will rise from 98 percent in 2023 (a figure some think is an underestimate) to 118 percent in 2033 and to 195 percent in 2053.

Just as in the UK, as I have considered here previously, the welfare budget is growing faster than the economy. Spending on social security and Medicare is projected to rise as a share of annual GDP from 8.2 percent in 2023 to 10.1 percent in 2033 and to 11.9 percent in 2053.

By the late 2020s the US will have overtaken Italy in terms of indebtedness. Its baby boomers are retiring and birth rates are falling. Also, life expectancy and infant mortality in the US are both on negative trends.

How did we get here? The financial crisis of 2008-09 racked up government debt: then came Trump’s unfunded tax cuts; then came Covid-19 – all followed by Biden’s multi-trillion-dollar fiscal splurge. The Inflation Reduction Act alone sets aside $349bn in new green subsidies.

That is why it is now in the interest of the US government – and many other governments, including the UK’s – to ride out inflation such that it erodes the value of the money that must inevitably be repaid. Inflation wipes out the spending power of savers but releases profligate borrowers from their debtors’ prison. There is an American saying that, thanks to inflation, you borrow dollars and repay with dimes.

Add to that the $16trn of US consumer debt which is also at an all-time high. And, as with Treasuries, much of this debt has been extended by foreigners. Foreign-debt exposure to the US amounts to about 62 percent of its GDP. While other nations are building sovereign-wealth funds, the US is building a sovereign-debt pile. But US policymakers don’t seem to worry.

The US is now in unusual economic territory with loose fiscal policy but tight monetary policy driving a sharp retrenchment in the money supply. Some commentators see that as a recipe for a rising dollar. A stronger dollar is bad news for foreign debtors who have taken out loans in dollars which must be serviced with local-currency cash flows. Yields on US T-bills and bonds are already edging upwards in anticipation of a new glut of new issuances.

US retail sales look buoyant in nominal terms but, adjusted for inflation they are negative. It is the same story with real wages. The last set of numbers for jobs – the “non-farm payroll” about which US analysts obsess – was probably surprisingly high because many Americans are taking second jobs to make ends meet.

America The Protectionist

In the view of the historian Adam Tooze, professor of history at Columbia University, US monetary, fiscal and industrial policy have different targets and work according to different logical principles. The Fed pursues technocratic fine tuning; fiscal policy is ideological; and industrial policy is strategic. American society is divided, there is a lack of social solidarity, and the political class is polarised, with each major party being pulled further apart by their extremes.

And yet, curiously, Joe Biden has emerged as the heir to Donald Trump in pursuing essentially protectionist policies to “Make America Great Again.” Right up until the early 20th century the US was strongly protectionist. It was not until FD Roosevelt’s Treasury Secretary Henry Morgenthau (1891-1967) brokered the Tripartite Currency Pact in 1936 that the US entered into formal trade arrangements with friendly powers. This pact stabilised the French franc against sterling and the US dollar after the collapse of the gold standard. It became the blueprint for the Bretton Woods Agreement of 1944 whereby the US dollar became the global reserve currency – and has remained so ever since, even if the gold peg was abandoned in the Nixon Shock of 1971.

In reality, US enthusiasm for free trade and globalisation has been on the wane since China joined the WTO at the end of 2001. The consensus in Washington today, according to Professor Tooze, is that the wave of globalisation of the first decade of this century from which China profited, was a historic mistake. The US is now reverting to its historic agnosticism about free trade.

Entrenched protectionism could accelerate de-dollarisation which is already underway. The crunch will come when foreigners become wary of buying T-bills.

It’s Not Just America

Global debt stands at about $86trn or about 96 percent of global GDP.

The EU is currently wrangling over the fiscal rules that were suspended at the beginning of the pandemic in March 2020. Given higher rates – and even higher rates to come – European governments will have higher debt-service payments going forward. In addition, defence spending will have to rise in a Europe with an angry and volatile ‘bear’ next door. Pension costs are rising across the continent as people live longer and the post-WWII boomers retire. And commitments to decarbonise are going to cost governments in tax revenues foregone, not least from petrol-powered cars.

According to a recently published book by Bob Lyddon, The Shadow Liabilities of EU Member States, the EU and eurozone member states systematically fail to account fully for their liabilities. As a result, Eurostat’s government gross-debt figures, says Lyddon, cannot be considered reliable. “Shadow debts” and unrecognised contingent liabilities arising from debt guarantees are often excluded. Lyddon calculates that EU debt is understated by 44 percent. The complex financial mechanisms designed to shore up the still dysfunctional monetary union have swollen further since the pandemic. And eurozone countries will need to refinance about €11.3trn of government debt this year.

In April, the rating agency Fitch downgraded France to AA-, putting the EU’s second-largest economy in the same club as the UK, the Czech Republic and Estonia. France’s debt-to-GDP ratio is likely to exceed 114 percent by 2027 – about 17 points higher than pre-pandemic levels. If current trends continue, then that ratio will exceed 120 percent in the early 2030s. Standard & Poor has put France on its watch list.

France, like the US, is favoured because many foreign institutional investors buy its bonds. But the Japanese, who owned nine percent of French government debt last year, are now net sellers of foreign bonds: they stopped buying them in the final quarter of last year after the Bank of Japan lifted its cap on 10-year yields from 25 to 50 basis points, as part of its policy of maintaining a positive yield curve. The Japanese loved French government bonds because they offered a 25-50 basis-point spread over German yields. But they are not buying any more. Further, the ECB is no longer hoovering up French government bonds as it abandons quantitative easing. About 10 percent of French government bonds are inflation-linked.

Yields on UK gilts have also spiked of late. The 10-year gilt was yielding 4.263 percent this morning. I’ll have more to say on the UK debt outlook shortly.

Developing countries are already paying higher margins to borrow in the international markets. Many are at risk of a debt crisis in the short term. Moreover, opaque borrowing practices under China’s Belt and Road Initiative have muddied the waters.

Even China’s debt levels have surged, with tranches of “hidden debt” owed by Chinese provinces and municipalities. Infrastructure has been built rapidly to stimulate growth, with dozens of “ghost cities” complete with new apartment buildings, roads and bridges − and no people. All this stimulus has been financed by waves of new debt that Beijing has shown little willingness to reduce. At least, unlike the US, China funds its huge government borrowing from domestic savings.

Governments everywhere are going to have to make hard choices in the years to come – and those which do not are going to be punished by the markets.

Corporate Failures Increase

As interest rates rise so highly indebted companies are likely to go under as they fail to cover their interest costs. Interest cover is still a key ratio in the financial analyst’s toolbox. Such insolvencies tend to begin with smaller companies and then to spread to larger ones.

The recovery specialist Begbies Traynor reckons that there were 5,747 insolvencies in the UK in the first quarter of this year – an 18 percent increase as compared with the year before. Administrations increased by 16 percent to 318. The companies most at risk are independent subcontractors, as well as hospitality and retail businesses.

And then there are the banks. As we know, three medium-sized US banks have collapsed in the first half of this year, and the word is that there will be more to come. That said, if you are invested in high-end chip-makers like Nvidia, which is profiting from the dawning realisation that AI has arrived big-time, you will see things differently. Despite all the political and financial trauma, the equity markets have been doing well. The S&P 500 has gained about 10 percent this year. True, in the US in the 1980s and 90s it used to be the “nifty fifty” – and now it is a tiny clutch of corporations with trillion-dollar-plus valuations which drive the market.

Wolfstreet.com reports that US corporate bankruptcy filings are at the highest level since 2010. In May, 54 companies filed for bankruptcy, lifting the total so far this year to 286. This included SVB Financial, Avaya and Bed Bath And Beyond. Also, amongst recent US companies to succumb to their creditors were Envision Healthcare, Vice Media and Kidde-Fenwal, a manufacturer of fire-control systems. Even in 2016 when many oil-and-gas drillers collapsed there were only 265 filings.

S&P Global forecasts that the 12-month trailing default rate for speculative-grade securities will jump from its current level of 2.5 percent to 4.5 percent. As the default rate rises so banks are obliged to price in additional risk on loans advanced by raising margins. That, in turn will have the effect of increasing interest costs on indebted corporations, more of which will go under.

Some corporations will encounter difficulties when they try to refinance maturing debt. Similarly, yields on junk bonds have more than doubled from less than 4 percent in mid-2021, as measured by Bank of America’s High Yield Index.

Where Does It All End?

The German sociologist Max Weber (1864-1920) defined the state as the monopoly of legitimate violence over a given territory. People tend to think that democratic states are consensual, but taxation is always predicated on the idea that the state has a right to punish those citizens who do not cough up what governments deem to be their fair share.

What is deemed fair of course varies according to your political outlook. Anarchists, after the 19th century pamphleteer Pierre-Joseph Proudhon (1809-65), believe that all property is theft. Contemporary extreme libertarians believe that all taxation is theft and therefore illegitimate. Conservatives (with a small ‘c’) believe that individuals spend their own money providently, while states and state agencies spend other people’s money carelessly. Government spending should be subject – as Gladstone said – to cheeseparing; and taxes should always be as low as possible. Risk takers should be entitled to reap the harvest of their labours, or they shall not resow.

But in the 21st century, states have become the monopolistic consumers of debt finance to fund their ever-increasing largesse. They spend other people’s money and then hand the IOU for the ensuing debt back to the citizens they purport to protect.

The great revolutions of history – one thinks of France in 1789 and Russia in 1917 – take place when previously wealthy states go bankrupt. Periods of hyperinflation are also politically corrosive – Germany’s experience of hyperinflation in the early 1920s ultimately led to the Nazis taking power. Equally, wars break out when one nation determines that its economic interests can be advanced by compromising another’s – as is happening in Ukraine right now.

Global forces are in play which are likely to keep inflation entrenched. One is deglobalisation or reshoring which is undoing the deflationary wave of the first decade of the 21st century. This follows from what I have called The Great Bifurcation arising from intensifying geopolitical rivalry and potential conflict. Another is the so-called green-energy transition which will be hugely costly. Whatever you may believe about climate change, renewable energy will never be as cost-efficient as burning fossil fuels in highly calibrated engines.

As a result, there is no way that we are likely to return to the ‘Alice-in-Wonderland’ world of near-zero interest rates – certainly not in the lifetimes of most people reading this (and this writer’s). And we shall have to get used to entrenched inflation.

Debt has a vital role – it means that surplus funds are recycled to finance new productive economic activity. But, when it gets out of control, there are unpleasant consequences. As a character in Ernest Hemingway’s The Sun Also Rises observed: people go bust in just two ways – “gradually, then suddenly.”

Afterword – AI And Philosophy

Yesterday, I had an exchange with Google’s AI chatbot experiment Bard concerning the philosophy of Ludwig Wittgenstein (1889-1951). His philosophy of mind has fascinated me since I was an undergraduate. I finally asked the machine the following question:

“If Wittgenstein’s theory of the impossibility of private languages is correct, how can I meaningfully talk about remembered mental events such as my dreams, which only I have experienced?”

Its response was sophisticated and interesting. But at the end of an “on the one hand…and on the other” kind of argument in which it used the example of a dream of being chased by a bear, it admitted: “There is no single answer that is universally accepted.”

Later, I submitted a reformulation of the same question and got a much less nuanced response:

“If Wittgenstein’s theory is correct, then it would seem that we cannot meaningfully talk about remembered mental events such as dreams, which only we have experienced. However, there are a few ways to reconcile Wittgenstein’s theory with our ability to talk about such events… remembered mental events are not completely inaccessible to others. We can communicate our experiences of dreams to others through language, art and other forms of expression. In doing so, we are not simply translating our private experiences into a public language. Rather, we are creating new public meanings through our shared experiences…”

I found the second answer persuasive. It is as if, having considered the question the first time, the machine gave it some more thought and came to a more definitive answer. But that’s silly – machines can’t think, as I recently explained.

And yet I’m discussing philosophy with a machine.

[ad_2]

Source link