Gold edges up on weaker dollar as Fed pause hopes linger

Bloomberg / Contributor / Getty Images

Gold prices rose on Monday on a weaker dollar as investors positioned for key U.S. economic data and clues on the Federal Reserve’s interest rate path at its meeting this week.

Spot gold last rose 0.1% to $1,962.50 per ounce. U.S. gold futures were down 0.02% to $1,976.80.

The dollar was down 0.1%, making gold cheaper for holders of other currencies.

“The precious (metal) may display sensitivity to the latest U.S. CPI report and may weaken if the Fed moves ahead with a hawkish pause. A surprise hike may trigger an aggressive selloff,” said Lukman Otunuga, senior research analyst at FXTM.

“Although markets expect the Fed to pause this week, the unexpected rate hikes from the Bank of Canada and Reserve Bank of Australia have left investors on edge,” Otunuga added.

A U.S. consumer price index reading on Tuesday, also on the first day of the Fed’s meeting, is expected to show inflation cooled slightly in May but core prices are likely to have remained elevated.

Traders see a near 75% probability that the Fed will keep its benchmark overnight interest rate in the 5.00%-5.25% range, and a 52% chance of a 25 bps hike in July, according to CME’s Fedwatch tool.

Lower rates lift the appeal of zero-yield bullion.

In other markets, European shares edged higher at the start of a week packed with major central bank meetings, with the European Central Bank and Bank of Japan delivering rate decisions on Thursday and Friday, respectively.

Silver was down 0.75% to $24.0834 per ounce while platinum dipped 1.85% to $989.8459.

Palladium, used in emissions-controlling devices in cars, rose 0.33% to $1,327.7766 after hitting its lowest since May 2019 on Friday.

“Palladium could head back above $1,500 in the fourth quarter of this year owing to improving automotive production, however this is currently under pressure from destocking by the automakers,” said Jacob Smith, Senior PGM analyst at Metals Focus.

[ad_2]

Source link

Related Posts

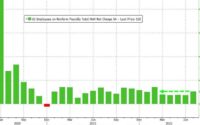

July Payrolls Smash Expectations Soaring To 528K, Wages Come In Red Hot As Unemployment Rate Drops

Cities Where Homes Cost An Average Of $1 Million Or More Have Doubled In The Last 5 Years