Don’t Let Month-To-Month Data Distract From Recession Signal

Authored by Simon White, Bloomberg macro strategist,

The trends in retail sales, Fed regional surveys and claims are recessionary, adding to the case that after a pause the next move from the Fed will be a cut, rather than another hike.

Monthly or weekly data are fine if you want some trading volatility, but not helpful when trying to discern the path of the economy.

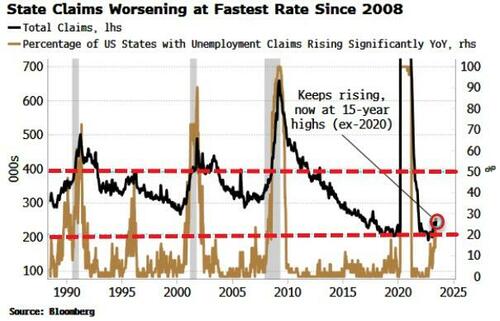

In this week’s data we saw another rise in unemployment claims to almost two-year highs. But it’s the underlying picture that’s sending the ever-stronger recessionary signal. The number of states with deteriorating claims continues to rise and is consistent with a near-term downturn.

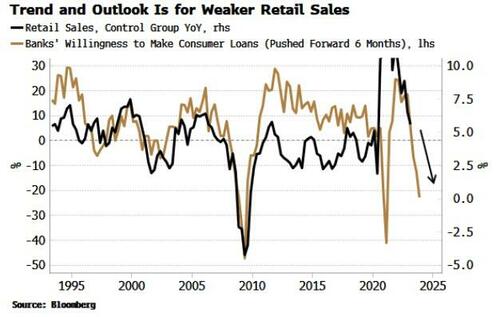

We also saw May’s retail sales data. The month-on-month figures beat or met expectations, but that should not distract from their clear downward trend. Moreover, trying to figure out what is going to happen has more utility than focusing on a short-term volatile figure. Tighter credit conditions posit that retail sales will continue to weaken through the rest of the year.

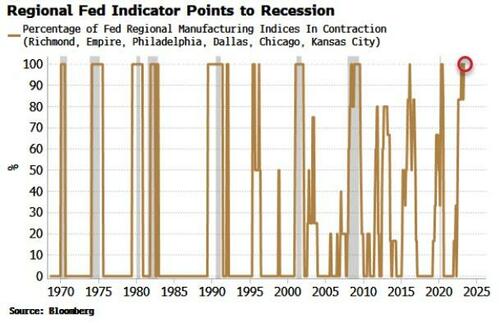

The Empire manufacturing survey was also released and beat expectations. This number on its own is less than useless if you’re trying to build a picture of where the economy is headed. A better signal can be gleaned from combining all the Fed regional manufacturing surveys into one signal.

As the chart below shows, all of them are contracting on a three-month smoothed basis. Bar two false positives, this has always coincided with a recession.

The signal from this week’s data is enough to deter the Fed from further hikes, especially as slowing inflation in the coming months will take real rates considerably tighter even if the bank holds rates steady.

Loading…

[ad_2]

Source link