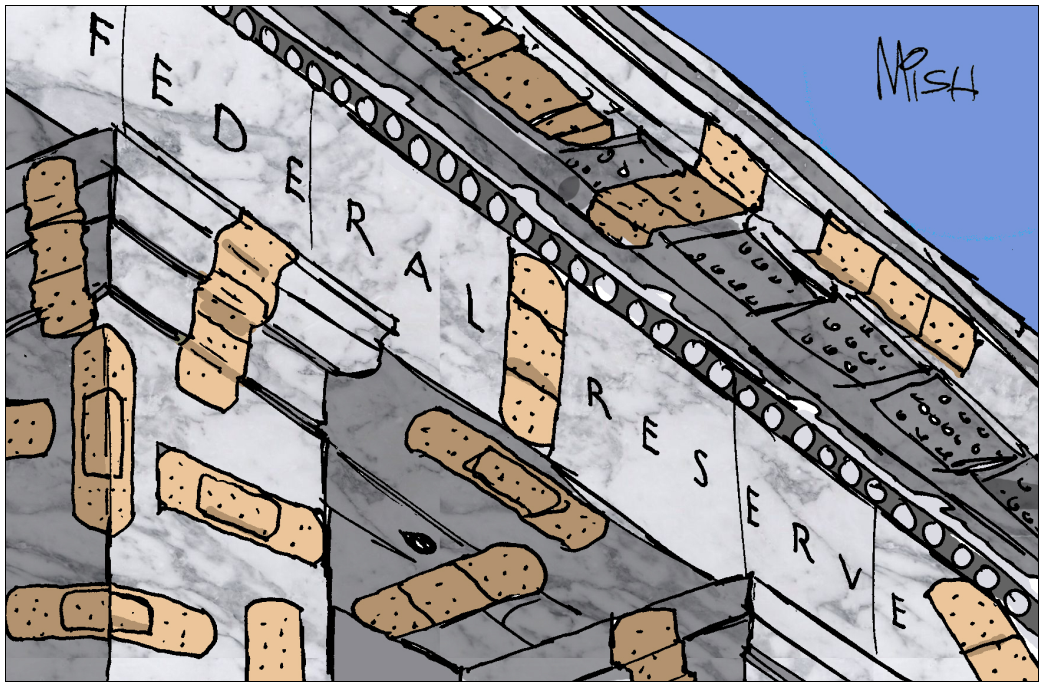

Dear FDIC and Fed, We Need a Genuine Safekeeping Bank, Not Band-Aids

Dear FDIC, CFPB, and Federal Reserve

The FDIC Proposes a Special Deposit Insurance Assessment on Large Banks to reimburse the FDIC for the losses due to rapid flight of “uninsured” depositors at Silicon Valley Bank.

CFPB Director Rohit Chopra says “the FDIC Board is proposing a special assessment to require the banking industry to pay for that extra cost. I support the proposed special assessment because it makes large banks — the firms that overwhelmingly benefited from this action — foot the bill.”

However, the problem is not the number or size of uninsured deposits. Nor is the problem capital flight from one bank to another. That large banks benefitted from the capital flight has nothing to do with the real problem either.

Understanding the Real Problem

The 2023 bank failures arose from what the banks did with those uninsured deposits, not the fact that the deposits were uninsured.

Banks could easily have parked the money back at the Fed collecting generous amounts of free money because the Fed pays interest on reserves.

Instead, the banks made enormous bets that interest rates would not rise rapidly. When rates rose, paper losses soared, and the banks became capital impaired.

This borrow-short, lend-long issue applies to all banks, not just the troubled banks that failed.

The Fed’s Role in the Problem

Via QE policy and by setting interest rates at an absurdly low level thereby creating a housing bubble, deposits soared.

Neither the Fed nor the FDIC took pertinent actions in time.

The Fed’s actions and inactions aside, banks had no legitimate business making massive interest rate bets, with customers’ money, on what would happen with Fed policy.

Attacking Symptoms

The proposal by the FDIC board of directors and the Consumer Financial Protection Bureau Director cannot accomplish much because it does nothing to address the problem.

Special assessments amount to little more than putting Band-Aids on a symptom of the problem, that being capital flight to big banks.

Pertinent Question

Why are banks allowed to gamble on interest rate policy with deposits allegedly payable on demand?

Logically, money cannot be available on demand while simultaneously parked in long-term treasuries, but that is precisely what FDIC and Fed regulations allow.

That banks do speculate with interest rate bets on deposits highlights repeat failures by the Fed, by the FDIC, and the Consumer Financial Protection Bureau.

The Fed and FDIC let this obvious problem brew for decades through multiple recessions. The Fed and FDIC learned nothing from past mistakes.

Chopra says “We need simpler rules to prevent future disasters. Large, riskier banks should pay more and small, simpler banks should pay less.”

The first sentence is true, the second isn’t because it addresses bank size, not actions. A size-based FDIC assessment would not have prevented the disaster at SVB.

“I am looking forward to reviewing the comments received in response to the proposal before finalizing the rule,” said Chopra.

OK, here goes.

Ten-Pronged Solution

- Require all demand deposits be parked overnight at the Fed or in the shortest available treasury bills, currently 4-weeks.

- Require all time-duration deposits like CDs be parked in same-duration US Treasuries.

- Customers cashing out bank CDs before term have a potential capital gains loss for which the customers should be held fully accountable.

- The FDIC needs to charge banks a risk-based FDIC fee based on an assessment of a bank’s lending standards, capital ratio, and the bank’s bondholder backing, not deposits which have no risk under this proposal.

- Bondholders and bank management need to bear the risks of bad bank decisions, not the depositors.

- The FDIC pool of insurance money would only come into play in cases where bank losses on loans exceed bank capital.

- Banks should be able offer competitive interest on checking accounts, but no higher than the 4-week T-Bill rate. Otherwise, banks are making speculative bets they have no business making.

- The Fed needs to explicitly rule out negative interest rates.

- In cases where the Fed funds rate is zero or near-zero, banks can charge safekeeping fees (not interest) on deposits.

- There should be no capital requirements on deposits because under these rules only loans have risk, not deposits.

Items one and two above eliminate all duration mismatches on deposits and CDs.

Points three through ten provide the necessary details on how everything ties together.

Nothing above prevents bank loans from going sour, but charging risk-based FDIC fees would reduce excessive bank speculation. And the proposed solution would easily have prevented every bank run in 2023.

It’s important to note that nothing in this solution would curtail lending, Deposits don’t fund lending. Rather, lending creates deposits.

Genuine 100 Percent Safekeeping Bank

A 100 percent safekeeping bank, one that did not make any loans but only parked money at the Fed, in T-Bills, or in time-matched treasuries as suggested, would have no discernable risk.

However, creation of a 100 percent safekeeping bank would in and of itself cause a stampede to safety if the proposal was implemented immediately. We can address the stampede concern easily.

How to Get There

I suggest phasing in the solution over time until 100% of deposits in demand accounts are parked in short-term T-Bills and all CDs are backed by duration-matched US Treasuries, at every financial institution in the country.

Six Clear Benefits

- The need for FDIC on deposits would vanish.

- All demand deposits and all term deposits held to term would be 100% guaranteed because they are indeed riskless under the proposal.

- Capital flight from small banks to large banks would stop.

- Banks could still fail due to bad loans, but demand deposits in any size would never be at risk.

- Bondholders would bear the risks of bad bank decisions, not the depositors, as it should be.

- The solution favors neither large banks nor small banks. Instead, it favors depositors by removing their worries about having deposits over the current $250,000 FDIC limit.

It’s long overdue the Fed and FDIC take steps to eliminate bank failures caused by various borrow-short, lend-long schemes by banks.

My 10-point proposal does that. It also put the risk of bank failures on bondholders and the banks, the latter by risk-based, rather than size-based funding of FDIC.

Finally, the construct of too big to fail goes away, at least from the point of view of depositors.

Sequel

The Wall Street Journal and the Hill both turned down this article.

In case you missed it, Interesting Groupthink Dovish Nonsense from the New York Fed on Neutral Interest Rates

This post originated at MishTalk.Com

Please Subscribe!

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Subscribers get an email alert of each post as they happen. Read the ones you like and you can unsubscribe at any time.

If you have subscribed and do not get email alerts, please check your spam folder.

Mish

[ad_2]

Source link