Powell Says Wall Street Faces Higher Capital Requirements

(Bloomberg) — Wall Street’s biggest banks will bear the brunt of US regulators’ moves to raise capital requirements for lenders, according to Federal Reserve Chairman Jerome Powell.

Most Read from Bloomberg

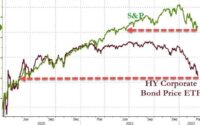

The largest lenders could face an increase of about 20% in what they have to set aside, Powell told members of the Senate Banking Committee on Thursday. He added that details were still in flux and specifics could change. The KBW Bank Index slid during the hearing, and was down 1.9% at 12 p.m. in New York.

“The capital requirements will be very, very skewed to the eight largest banks,” he said. “There may be some increase for other banks. None of this should affect banks under $100 billion in assets.”

The long-awaited changes are part of an international overhaul of capital rules that started more than a decade ago in response to the financial crisis of 2008. The issue became more stark — and political — this year with the collapse of several banks in the US.

The havoc they caused reignited debate on whether the largest regional banks should face tougher standards, while the biggest US lenders argue that capital rules that go too far will hinder economic growth.

Specific increases will depend on a lender’s business model, and banks with at least $100 billion in assets may have to adhere to the new requirements, Bloomberg News has reported. That’s far lower than the existing $250 billion threshold where many of the toughest rules kick in, which means dozens of regional US banks might have to meet the new standard.

Separately, Martin Gruenberg, chairman of the Federal Deposit Insurance Corp., said Thursday that US banks with at least $100 billion in assets would face new rules to put aside more capital in the event of unexpected stress. He said the failure of Silicon Valley Bank in March demonstrated the need for tougher requirements.

(Updates with comment from FDIC chairman in final paragraph. An earlier version corrected a Powell quote on scope of banks that may be affected.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]

Source link