Traders ramp up bets on 0.5 point interest rate rise

The Bank of England will increase interest rates by 0.5 percentage points either tomorrow or at its following meeting, markets predict, as policymakers fight to bring down inflation.

Traders are betting the Bank will have to accelerate the pace of interest-rate rises after inflation remained unchanged at 8.7pc in May, according to the Office for National Statistics.

Government borrowing costs have surged and the pound has fallen as much as 0.5pc today as core inflation, which strips out volatile elements like food and energy prices, increased to its highest level since 1992.

The Bank of England is expected to raise rates by 25 basis points to 4.75pc tomorrow but the risk of a larger half-point increase is growing, and is now fully priced by August.

Traders have also lifted expectations for rates to peak at 6pc, which would be the highest since February 2001.

Charles White Thomson, chief executive at Saxo Capital Markets UK, said: “Inflation is an elusive, wily and powerful foe especially when it builds up momentum, as it is now.

“There is a strong argument for a 50-basis point hike at tomorrow’s Bank of England’s meeting.

“The Bank needs to take the initiative quickly. The risk for further policy failure is real and the stakes are getting increasingly high.”

06:16 PM BST

Signing off

That’s all from us. Join us again tomorrow as we bring you the latest coverage of the Bank of England’s highly anticipated interest rates decision.

Until then, here’s why failure to control inflation leaves the Conservative Party staring into the electoral abyss, according to chief city commentator Ben Marlow…

06:13 PM BST

Volkswagen pins future growth on China and North America

The boss of Volkswagen has pinned the German carmaker’s future growth on China and North America.

Chief executive Oliver Blume said Volkswagen’s “growth engines of the future” lie outside of Europe, where most of its revenues are currently generated.

He said that Volkswagen is determined to retain its near 15pc market share of electric vehicles in China, despite competition from local manufacturers.

The carmaker also plans on significantly expanding its US market share, boosted by its planned battery factory in Canada.

Mr Blume said: “We want to grow our sales by on average five to seven percent per year until 2027.”

The group – which also owns Porsche, Audi and Skoda – hopes to further increase sales between 9pc and 11pc by 2030.

05:56 PM BST

Drivers are ‘risking lives’ by forgoing new tyres amid rising costs

Drivers are putting off replacing their tyres until they are in “critical” condition as squeezed consumers are forced to cut costs, Halfords has warned.

Senior business reporter Daniel Woolfson reports:

The cycling and motoring retailer said a combination of people driving less post-Covid and cost-of-living pressures had “temporarily extended the life of tyres and forced consumers to delay replacing until critical”.

How long a tyre lasts depends on numerous factors including speed, driving style, and the weight of the car and its load. Drivers can generally get around 20,000 miles out of front tyres and 40,000 from back tyres before they need to be changed, according to the AA.

However, the AA warned people risked damaging their vehicles, or, in worst case scenarios, endangering themselves and other drivers, if tyres are left on cars for too long.

Nick Powell of the AA, said: “Tyres are one of the most common causes of car breakdowns the AA attends, if they are in poor condition it’s only a matter of time before you see a blowout on a motorway in the hot weather or a hefty bill after striking a pothole.”

Read the full story here…

05:23 PM BST

Bitcoin nears $30,000 for the first time in two months

Bitcoin has extended its overnight gains and is edging towards $30,000 for the first time since April.

The crypto asset traded as high as $29,789 today, as major players from the traditional financial sector have announced crypto initiatives.

Deutsche Bank is seeking regulatory permission to look after cryptocurrency on behalf of clients, while money manager BlackRock is poised to offer the first spot bitcoin exchange traded fund in the US.

The surge comes despite a US regulatory crackdown on cryptocurrency exchanges, including Coinbase and Binance.

04:39 PM BST

FTSE 100 finishes in the red

The FTSE 100 has closed lower as today’s inflation data deepened concerns that the Bank of England may need to raise rates higher.

Pressured by a strong pound, the export-oriented FTSE 100 closed 0.13pc lower at 7,559.18. The FTSE 250 mid-cap index shed 0.93pc to finish at 18,571.45

03:59 PM BST

Disney warns UK laws will let viewers binge-watch TV shows for free

TV viewers will be able to “game” streaming services and binge-watch shows for free under new laws aimed at clamping down on tech giants, Disney has warned.

Our senior business reporter James Warrington said:

New rules proposed by the Government would force streaming companies to give customers a 14-day cooling-off period during which they can cancel their subscription without charge.

But Disney said this would allow people to sign up to a streaming service and binge-watch programmes free of charge, before repeating the process with other providers.

This in turn could force companies to push up prices for genuine subscribers, it added.

Here’s what Disney told the House of Lords…

03:33 PM BST

Handing over

It has been a hectic day and I’ll leave you in the hands of Adam Mawardi as the markets continue to react to the higher-than-expected inflation figures for the UK.

It feels like we need something to cheer us up, so here is a picture of Domino’s first ever pizza delivery by jetpack at Glastonbury festival today, ahead of Rocket Man Elton John’s headline set at the Pyramid Stage on Sunday.

03:21 PM BST

Bond yields rise as economic outlook darkens

Government borrowing costs are hitting fresh 15-year highs as markets continue to digest higher than expected inflation in Britain.

However, it is not only UK gilt yields which are on the rise.

Eurozone government bond yields rose after Federal Reserve Chair Jerome Powell said the US’s fight to lower inflation to its 2pc target “has a long way to go.”

Germany’s 10-year government bond yield, the euro area’s benchmark, rose 2.5 basis points to 2.43pc.

The country’s two-year bond yield, the most sensitive to policy rates expectations, rose to its highest since March 10 at 3.235pc. It hit its highest level since October 2008 at 3.385pc on March 9.

Italy’s 10-year bond yield rose three basis points to 4.06pc, with the spread between Italian and German 10-year yields at 162 points.

03:10 PM BST

Pound ‘could plunge’ in UK recession

Pound traders are their most negative on the outlook for the currency in nearly five months as inflation maintains its grip the UK economy.

Typically, faster inflation would point to higher interest rates and burnish the appeal of the currency.

However, climbing prices are proving so persistent that rates traders are betting the Bank of England will have to ultimately be forced to raise interest rates to 6pc to get prices under control — which some analysts say could plunge the economy into recession.

Roberto Cobo Garcia, head of G10 strategy at Banco Bilbao Vizcaya Argentaria, said:

The higher the inflationary context, the bigger the risks of a deep recession.

If the macro outlook darkens significantly, demand for pound assets could plunge and sterling would also suffer.

The pound has lost 0.3pc to hit its lowest level against both the dollar and the euro in a week.

02:58 PM BST

NatWest becomes first lender to increase rates after inflation shock

NatWest has become the first lender to confirm it will increase its mortgage rates after today’s shock inflation data.

For new customers, it will increase its rate by 30 basis points on selected two-year and five-year deals for buyers and those remortgaging.

Its switcher rates for existing customers will jump by up to 75 basis points.

Customers will be able to submit applications online for existing deals until 10.30pm this evening.

02:44 PM BST

Gilt yields climb after inflation shock

To summarise what has happened on this eventful day for the markets, government borrowing costs have climbed as economists warned that the Bank of England may be forced to plunge Britain into recession to regain its grip on inflation.

The yield on two-year gilts – the return promised by the Treasury when it wants to borrow money – briefly reached a fresh 15-year high at 5.09pc after data showed underlying inflation hit its highest level in 31 years last month.

The overall consumer prices index remained unchanged at 8.7pc, while core inflation, which strips out volatile food and energy prices, increased to 7.2pc in May, according to the Office for National Statistics.

JP Morgan’s Karen Ward, an adviser to Chancellor Jeremy Hunt and former Bank of England rate setter, inflation might stick around for much longer unless weakness can be created in the economy.

She said there are “certainly signs” in the economy of a so-called price-wage spiral, where companies hike prices and as a result workers demand pay rises, which leads to companies raising prices again.

Speaking to BBC Radio 4’s Today programme, Ms Ward said: “The difficulty for the Bank of England – I mean, no-one envies them their job at the moment – is they have to therefore create a recession.

“They have to create uncertainty and frailty, because it’s only when companies feel nervous about the future that they will think ‘Well, maybe I won’t put through that price rise’, or workers, when they’re a little bit less confident about their job, think ‘Oh, I won’t push my boss for that higher pay’.”

Stuart Cole, chief macro economist at Equiti Capital in London, said: “It is looking increasingly likely that it will require a recession to finally get the inflation genie back into the bottle.”

02:34 PM BST

US markets fall after opening bell

Wall Street slumped after Federal Reserve chairman Jerome Powell said the fight to lower inflation back to its 2pc target “has a long way to go”.

The Dow Jones Industrial Average has fallen 0.4pc to 33,909.34, while the broad-based S&P 500 has dropped 0.3pc to 4,373.63.

The tech-heavy Nasdaq Composite has slipped 0.4pc to 13,617.19.

02:17 PM BST

Mortgage crisis: how much more you will pay when rates hit 6.5pc

Interest rates are expected to hit 6pc by the end of the year after underlying inflation hit its highest level in 31 years in May.

Alexa Phillips and Ben Butcher examine how it will impact mortgage holders:

Rising rates will push up mortgage rates to a peak of 6.5pc, according to forecasts from Capital Economics.

The average two-year fixed-rate has already reached 6.15pc, while five year deals are averaging at 5.79pc, according to data analyst Moneyfacts.

The consumer price index (CPI) measure of inflation remained flat at 8.7pc in May, defying economists’ expectations of a fall to 8.4pc.

The headline figure was pushed up by rising core inflation, which strips out volatile measures like food and energy prices. It climbed from 6.8pc to 7.1pc.

Use our calculator to work out how recent shocks might impact your monthly payments.

01:56 PM BST

Oil dips as Powell hints at more US rate rises

Oil has fallen after the Federal Reserve chairman said he expects interest rates will need to move higher to reduce US growth if inflation is to be contained.

Brent crude, the industry benchmark, has slipped 0.4pc below $76 a barrel while West Texas Intermediate slipped 0.3pc below $71.

Jerome Powell will later tell Congress that reducing inflation will “likely require a period of below-trend growth and some softening of labour market conditions”.

He added that nearly all members of the Federal Open Market Committee which sets rates think more rate rises will be “appropriate” by the end of the year.

A stronger dollar weakens oil prices, which are measured in the reserve currency.

Oil has already been declining as China’s reemergence from its strict zero-Covid policies have failed to gain traction.

Meanwhile, global crude supplies, including from Russia, have proved abundant.

01:40 PM BST

Powell: Inflation fight has ‘a long way to go’

The Federal Reserve’s fight to lower inflation back to its 2pc target “has a long way to go,” Chairman Jerome Powell will tell Congress later today.

Mr Powell will tell the House Financial Services Committee that “inflation has moderated somewhat since the middle of last year”.

The Fed’s preferred measure of inflation has fallen substantially from a peak around 7pc last year to 4.4pc as of April.

Mr Powell will say: “Inflation pressures continue to run high, and the process of getting inflation back down to 2pc has a long way to go.”

He will add that “nearly all” participants of the Federal Open Market Committee meeting last week expect further rate increases will be appropriate by the end of the year.

Investors broadly expect interest rate increases to resume at the Fed’s July meeting, though financial market indicators reflect doubts that the Fed will deliver more increases beyond that meeting.

The hearing, the first of two Capitol Hill appearances this week as part of his twice-yearly reports to federal lawmakers, is set to begin at 3pm UK time. Mr Powell will appear before the Senate Banking Committee on Thursday.

01:32 PM BST

Surging interest rates to batter incomes of more than 1.4m people

Surging interest rates will hammer the disposable incomes of almost 1.4 million people as mortgage rates jump, the Institute for Fiscal Studies (IFS) has warned.

Our deputy economics editor Tim Wallace has the latest:

A rise in the cost of mortgage mean hundreds of thousands of middle class earners will suffer a fall in their disposable incomes – the money they have left for discretionary spending after tax and housing costs – slashed by more than one-fifth, the think tank estimates.

Tom Wernham, economist at the IFS, said it will be a “serious shock” for families with the worst affected facing “eye-watering” increases in their bills.

He said: “Many families bought homes – often with sizable mortgages – when interest rates were very low.

“As people’s fixed term offers come to an end they are going to be exposed to much higher interest rates.

“For many, the increase in monthly repayments is going to come as a serious shock.”

Read what the average mortgage borrower is on track to lose.

01:24 PM BST

PM on course to halve inflation, No 10 insists

Downing Street has insisted Rishi Sunak is still on course to fulfil his pledge of halving inflation by the end of the year despite it remaining stubbornly high.

The Prime Minister’s official spokesman said: “That remains the target.”

Asked if they are on track to fulfil the promise, the spokesman said:

Yes. Despite some of the coverage at the time (of the announcement of the pledge) this was never something that was straightforward.

It was rightly an ambitious target that we remain committed to and it can only be achieved with fiscal discipline.

In the Commons at Prime Minister’s Questions, Rishi Sunak claimed the Government is “on track to keep reducing” inflation, despite warnings that a “mortgage catastrophe” will hit millions of homeowners.

01:12 PM BST

Vegan foods maker Meatless Farm rescued from administration

Plant-based meat manufacturer Meatless Farm has been rescued from administration by rival vegan food business VFC.

The company, which makes vegan sausages, mince, and burgers, made the majority of its staff redundant earlier this month amid a drop in demand for vegan products.

It hired restructuring specialists Kroll in May in hopes of finding a buyer for the business as it faced running out of cash, before filing a notice that it planned to appoint administrators on 31 May.

The Meatless Farm brand will be retained by VFC, the maker of “Vegan Fried Chick*n,” which launched during the pandemic and landed its first major listing in Tesco in 2021.

VFC Foods chief executive David Sparrow said:

We are delighted to announce this strategic acquisition, whilst being extremely mindful of the business’ challenges and the impact on the people involved.

Meatless Farm has built strong consumer awareness, which aligns with our core values, and their exciting product portfolio enhances our existing range.

By integrating both brands, we can utilise numerous synergies with valued customers and suppliers, thus driving innovation and extending customer choice.

12:51 PM BST

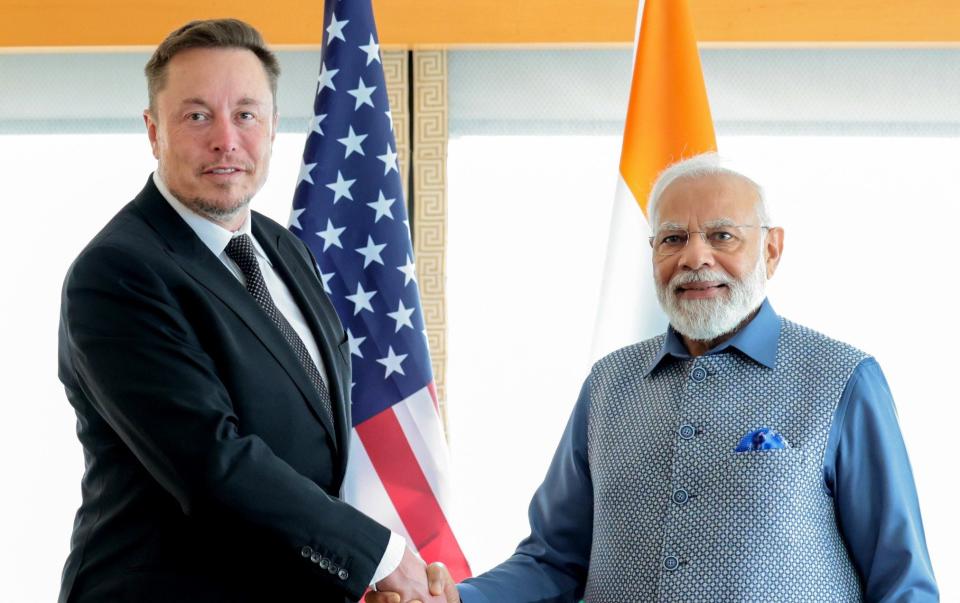

Tesla investment in India ‘quite likely’ says Musk

Tesla is likely to make a significant investment in India, its chief executive Elon Musk has said after meeting with Narendra Modi during the Indian Prime Minister’s US visit.

Tesla and India have revived discussions in May following a year-long stand-off.

While Tesla executives talked about the domestic sourcing of parts and incentives with government officials during a recent India visit, it did not culminate in a proposal to set up a plant.

After meeting Mr Modi, Mr Musk said:

I’m confident that Tesla will be in India and we’ll do so as soon as humanly possible.

We don’t want to jump the gun on an announcement, but I think it’s quite likely that there will be a significant investment, a relationship with India.

Mr Musk, who has been the frequent target of pitches from Indian officials to make electric cars locally, said he plans to visit the country in 2024.

12:21 PM BST

Wall Street poised for lacklustre open

US markets are expected to change little at the opening bell in cautious trading ahead of Federal Reserve chairman Jerome Powell’s congressional testimony later today.

Mr Powell is due to deliver his semiannual monetary policy testimony in Congress, which will be scrutinised for clues on how long the central bank will keep its restrictive policy in place.

However, Tesla gained 1.3pc in premarket trading as Texas outlined that it will require state-backed charging stations to include the electric vehicle-maker’s plug.

On Tuesday, Wall Street’s main indexes fell as investors booked profits in the wake of a sustained market rally amid signs of weakening global demand. The benchmark S&P 500 has advanced 14.3pc so far this year.

Before markets opened, the Dow Jones and S&P 500 were flat, while the Nasdaq 100 was down 0.1pc.

12:07 PM BST

‘Never easy to root out inflation,’ says Sunak

Rishi Sunak is beginning what looks like a very difficult Prime Minister’s Questions after today’s inflation figures.

He said he has “always been very clear” that “inflation is putting pressure on family budgets” and said the Government is taking “decisive action to support households”.

Asked by Labour leader Sir Keir Starmer if he agrees that Britain faces a “mortgage catastrophe”, the Prime Minister said “it is never easy to root out inflation” but the IMF described the Government’s actions as “decisive and responsible”.

For the very latest on Prime Minister’s Questions, follow our politics live blog.

11:54 AM BST

Revolution Beauty blasts ‘opportunistic’ Boohoo coup

Cosmetics brand Revolution Beauty has blasted the “opportunistic and self-serving” move of its shareholder Boohoo to oust its bosses, accusing the fashion retailer of attempting to engineer a cheap acquisition.

The troubled make-up business hit back at what it described as a coup and insisted it was on the road to recovery.

It followed Boohoo, which owns a 26.6pc stake in Revolution Beauty, revealing on Monday plans to vote against the reappointment of the company’s chief executive Bob Holt, chairman Derek Zissman and chief financial officer Elizabeth Lake at its upcoming annual general meeting (AGM) on June 27.

Boohoo called for a separate meeting to oust the three bosses and replace it with its own directors. Revolution Beauty has been stabilised under their leadership but it now needs to focus on growth, it argued.

“The approach taken by Boohoo towards Revolution Beauty is nothing short of value-destructive, opportunistic and self-serving”, the make-up brand responded.

The company went on to say the timing of the move is “perhaps no coincidence”, being three days before Boohoo’s own AGM and “amid reports of widespread shareholder opposition resulting from Boohoo’s persistent management and corporate governance failures over a prolonged period”.

Boohoo declined to comment.

11:38 AM BST

Halfords hit as consumers cut back spending on tyres

Halfords has revealed plunging profits after it was knocked by soaring costs and as customers cut back their spending, but forecast a return to earnings growth over the year ahead.

The retailer posted a 55pc tumble in pre-tax profits to £43.5m in the year to March 31, while underlying profits were 43pc lower at £51.5m.

However, shares in the group rose more than 5pc as it said it was on track to grow underlying profits in line with market forecasts to £53.3m over the year ahead, with trading having been good so far in the first quarter and like-for-like sales higher.

The group said its costs surged by around £68m over the year as goods and shipping prices jumped higher.

It also faced a hit to the sales of so-called big ticket items, such as bikes, as customers reined in their spending amid the wider cost-of-living crisis.

Chief executive Graham Stapleton said consumers were cutting back on discretionary spending, but also some essential spending, such as on tyres.

11:15 AM BST

US pledges extra £1bn to rebuild Ukraine

US Secretary of State Antony Blinken has pledged an additional $1.3bn (£1bn) in assistance to help Ukraine rebuild following the Russian invasion.

Most of the funds will be directed to restoring the country’s battered energy grid and critical infrastructure ranging from ports to rail lines and border crossings.

Mr Blinken announced the new funds in London, where he is attending the Ukraine Recovery conference, hosted by Britain.

The meeting aims to unite allies behind an organised effort to help Kyiv sustain its economy as it presses forward with a counteroffensive to reclaim territory from Russian forces.

At the conference also attended by Rishi Sunak, Mr Blinken said:

Recovery is about more than just ensuring people have what they need to survive — food to eat, water to drink.

Recovery is about laying the foundation for Ukraine to thrive as a secure, independent country fully integrated with Europe, connected to markets around the world.

11:00 AM BST

Core inflation must be controlled before rate pause, says ECB chief

The European Central Bank can only pause interest rate increases at its September meeting if it is certain that core inflation is under control, a policymaker has said.

Governing Council member Peter Kazimir said there will be more monetary tightening if the pace of underlying price increases persists.

It comes as traders increased bets on the ECB raising rates to a record 4pc by the end of the year following the data showing inflation remaining strong in the UK.

Slovak central bank governor Mr Kazimir said:

We must have a high level of certainty, based on actual data, showing that we have core inflation under control in the near future.

If core inflation continues to be stubborn, I think it’s logical that voices that want another increase in September will prevail.

Core inflation is impacted by secondary factors — wage growth and profit margins — that could lead to a persisting price growth spiral, which we fear the most.

We must act regardless of what it does to economic growth or unemployment.

10:51 AM BST

Britain ‘requires recession’ to control inflation, Bank of England warned

The Bank of England may be forced to plunge Britain into recession to regain its grip on inflation, economists have warned.

Stuart Cole, chief macro economist at Equiti Capital in London, said: “It is looking increasingly likely that it will require a recession to finally get the inflation genie back into the bottle.”

Charles White Thomson, chief executive at Saxo UK, said:

There is a strong argument for a 50-basis point hike at tomorrow’s Bank of England’s meeting.

The bank needs to take the initiative quickly. The risk for further policy failure is real, and the stakes are getting increasingly high.

10:33 AM BST

Why inflation is worse than anyone expected – and what comes next

Climbing core inflation suggests there are months of more pain ahead for the British economy.

Deputy economics editor Tim Wallace has been analysing the outlook for the UK:

Three shocks have stalked the British economy and sent inflation through the roof, in Andrew Bailey’s reading of the crisis.

The first was the Covid pandemic, which shattered supply chains, disrupted trade and sent more money chasing fewer products. Prices jumped.

The second was the war in Ukraine. Vladimir Putin’s invasion forced the price of crucial commodities, including energy, food and metals, through the roof.

The third would normally look like a blessing: Britain’s very low unemployment rate.

But the extremely tight jobs market means companies are struggling to find the workers they need, strangling their growth and forcing them to offer bigger pay packets to get the staff, which in turn feeds more inflation.

Read the possible outcomes for the big threat facing the Bank of England.

10:21 AM BST

Mortgage crisis fears overblown, says Bank of England official

Most UK mortgage borrowers can cope at current interest rates and warnings of a housing crisis are overblown, according to a top Bank of England official.

David Roberts, chair of the court of directors and a former chair of lender Nationwide Building Society, told a House of Lords committee that “some of the press headlines are a little bit over where my own judgment would be about what I think could happen – or quite a lot over.”

Consumer champion Martin Lewis has warned of a mortgage “time bomb” that will trigger a recession as borrowers refinance at rates as high as 6pc.

The Resolution Foundation has estimated the average UK mortgage will cost £2,900 a year more in 2024 than today.

However, Mr Roberts told the Lords’ Economic Affairs Committee that confidence should be taken from the fact that “the vast majority of borrowers have been stress tested at 6pc or 7pc, certainly 5pc.”

He added that fixed-rate terms will have given many households time to prepare, saying:

Consumers and businesses are not stupid. They’ve seen the stresses coming.

They are able to take actions within their own discretion to change their expenditure patterns or income patterns.

10:08 AM BST

Tax cuts in doubt as UK debt passes 100pc of GDP

Rocketing interest rates and inflation drove UK government debt above 100pc of GDP for the first time since 1961, dealing a blow to Rishi Sunak’s pledge to get it falling and denting hopes for tax cuts next year.

The bleak milestone was passed as spending exceeded revenue by £20bn in May, more than private-sector economists and the independent Office for Budget Responsibility had forecast.

Ruth Gregory, deputy chief UK economist at Capital Economics, said the figures “cast further doubt on the Chancellor’s ability to unveil big pre-election tax cuts while still meeting his fiscal rules” and that any giveaway “may be modest or swiftly reversed”.

Martin Beck, chief economic advisor to the EY ITEM Club, said a Conservative government was likely to pile on austerity in the years following the election, which must be held by January 2025 at the latest.

He said:

The Chancellor would likely respond by adding more post-election spending cuts on top of a spending squeeze that already looks challenging.

So the true medium-term path for fiscal policy is unlikely to emerge until the first Budget after the election.

09:54 AM BST

Gas prices remain volatile after energy shock

The impact on inflation from the energy crisis caused by Vladimir Putin’s war in Ukraine has been easing, the latest data show.

However, the energy market is far from stable.

European natural gas prices fluctuated today as volatility continued to reverberate through the market with traders weighing weak demand against short-term supply risks.

Benchmark futures swung between gains and losses this morning, after settling 11pc higher on Tuesday.

Gas consumption has been slow to recover after an historic energy crisis last year hit Europe’s industries, and the demand outlook remains uncertain.

On the other hand, traders continue to keep a close eye on tightening supply.

Flows from Norway, Europe’s top gas provider, dropped again today, with two fields reporting unplanned outages.

Dutch front-month gas, Europe’s benchmark, last traded 0.3pc lower at €38.61 a megawatt-hour. The UK equivalent contract rose 0.1pc.

09:41 AM BST

House price growth slows as values fall below September peak

Average house prices increased by 3.5pc in the 12 months to April, slowing from 4.1pc in March 2023, according to official figures.

The average UK house price was £286,000 in April, which is £9,000 higher than the same month a year earlier, but £7,000 below the recent peak in September 2022, the Office for National Statistics said.

Average house prices rose over the 12 months to £306,000 in England (a 3.7pc annual increase), £213,000 in Wales (2pc), £187,000 in Scotland (2pc) and £172,000 in Northern Ireland (5pc).

09:26 AM BST

Pound falls amid gilts sell-off

The pound has slipped further today after gaining as much as 3.8pc since the start of June after the surprisingly strong inflation data.

Sterling has fallen 0.3pc against the dollar toward $1.27 have tipped above $1.28 for the first time since April earlier this month.

It comes amid a sell-off in UK gilts as traders expect interest rates to surge toward 6pc by the end of the year.

Against the euro, the pound has lost 0.3pc, with the single currency nearing 86p.

09:19 AM BST

Hunt rules out mortgage support for families

Jeremy Hunt has acknowledged the pressure rising interest rates were causing for mortgage holders but insisted he would not take any action which could risk driving up inflation.

Mr Hunt is expected to meet lenders on Friday to urge them to support customers struggling with rising costs.

The Chancellor said:

We know that there is enormous pressure for families’ mortgages and it’s a really big deal for family finances.

The one thing that would not help those families is to step in with short-term support that meant that inflation stayed higher for longer and those mortgage rates stay higher for longer.

So, I’m meeting the mortgage lenders later this week to ask what else can be done to relieve pressure in very difficult times.

But we won’t do anything that means that high inflation stays around for longer because that is the root cause of the pressure.

09:12 AM BST

‘We won’t be pushed off course,’ insists Hunt

Chancellor Jeremy Hunt said the Government would “stick to its guns” and insisted patience was needed for Bank of England rate rises to curb inflation.

He told broadcasters:

Today’s figures strengthen the case for the Government to stick to its guns.

No matter what the pressure from left, right or centre, we won’t be pushed off course.

Because if we are going to help families, if we are going to relieve the pressure on people with mortgages, on businesses, we need to squeeze every last drop of high inflation out of the economy.

If you look at what’s happening in other countries, you can see that rises in interest rates do bring down inflation over time.

That will happen here but we need to be patient, we need to stick to the course and then we’ll get to the other side.

09:08 AM BST

Bank of England must ‘create a recession,’ says Hunt adviser

A member of Chancellor Jeremy Hunt’s economic advisory council has called for the Bank of England to “create a recession” to curb inflation.

JP Morgan’s Karen Ward told BBC Radio 4’s Today programme there are “certainly signs” that a price-wage spiral is emerging, which the Bank “has to nip in the bud”. She said:

The difficulty for the Bank of England – I mean, no-one envies them their job at the moment – is they have to therefore create a recession.

They have to create uncertainty and frailty, because it’s only when companies feel nervous about the future that they will think ‘Well, maybe I won’t put through that price rise’, or workers, when they’re a little bit less confident about their job, think ‘Oh, I won’t push my boss for that higher pay’.

It’s that weakness in activity which eventually gets rid of inflation.

Ms Ward also said the Bank of England has “been too hesitant” about raising interest rates.

09:05 AM BST

Gilts hit new 15-year high

The amount the Government pays to borrow has surged after inflation proved more persistent than expected.

The interest rate for two-year gilts peaked at a fresh 15-year high of nearly 5.09pc, increasing by 14 basis points.

Gilts are essentially IOUs issued by the Treasury when it wants to borrow money.

Longer-term 10-year gilts also rose during the morning by nine basis points to 4.43pc.

It came as consumer prices index inflation remained at 8.7pc in May, unchanged from the month before. Experts had expected it to drop to 8.4pc.

08:55 AM BST

Food inflation falls as economists predict ‘worst is over’

Today’s inflation figures are clearly a real blow but there are some glimmers of hope in there.

Although headline inflation remained at 8.7pc, the Office for National Statistics revealed that food inflation fell to 18.4pc in May.

This was down from 19.1pc in April and from 19.2pc in March, which was the highest annual rate seen for over 45 years.

Helen Dickinson, chief executive of the British Retail Consortium, said:

It is a really positive sign that food inflation has fallen for the second consecutive month, the first time this has happened since the Ukraine war began.

While some prices continue to rise, we are now seeing regular news reports of falling prices on many essential products, such as loo rolls and vegetable oil.

It has been good to see larger drops in inflation rates for flour, milk and eggs as retailers continue to invest heavily in lower prices for the future and locking the price of many essentials, helping the UK to deliver some of the cheapest groceries in Europe.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, suggested that producer price data – which measures the price changes of goods bought and sold by UK manufacturers – showed the “worst is over”:

08:43 AM BST

UK inflation more than double US levels

Britain remains an outlier among major economies in terms of inflation, with prices rising more than four times faster than the Bank of England’s 2pc target.

While inflation stood at 8.7pc in the UK in May, in the US it fell to 4pc and in the eurozone it stood at 6.1pc.

Governor Andrew Bailey is concerned about signs inflation is remaining more persistent despite the quickest round of rate hikes in four decades.

The Bank of England has raised rates at 12 consecutive meetings from 0.1pc to 4.5pc and is expected by economists to lift them by at least a quarter point to 4.75pc tomorrow.

Yael Selfin, chief economist at KPMG UK, said:

High headline inflation piles on the pressure for more rate hikes.

Today’s data will likely leave the Bank of England with no choice but to opt for another increase in the base rate tomorrow.

08:37 AM BST

Markets predict half a point rate rise by August

Traders are now pricing in that interest rates will rise by 0.75 percentage points by August after today’s inflation shock.

It implies there will be one half a point rise from the Bank of England either at tomorrow’s meeting or the next one.

It would take interest rates from 4.5pc to 5.25pc within the next two months.

08:29 AM BST

FTSE 100 hit by stronger outlook for the pound

Shares have fallen as the latest inflation data deepened concerns that the Bank of England may need to raise rates higher.

Investors are also awaiting fresh clues on the Federal Reserve’s policy tightening plans from Chair Jerome Powell, who appears in front of Congress later.

Pressured by a strong pound, the export-oriented FTSE 100 has fallen 0.5pc. The FTSE 250 mid-cap index has shed 0.9pc.

After data showed consumer inflation was unchanged at 8.7% in May, contrary to expectations of a slight fall, traders ramped up their bets of a 50 basis point rate increase from the Bank of England on Thursday.

In a testimony later in the day, Mr Powell is poised to be questioned on the future of rate hikes by the world’s most influential central bank.

Bucking a weak broader market trend, energy stocks gained 0.4pc, tracking higher crude oil prices

Halfords gained 5.4pc on plans to grow its bikes and car parts’ market share to boost profits, while Berkeley Group Holdings dropped 2.3pc after the high-end homebuilder warned of demand concern.

08:21 AM BST

‘This is a disaster,’ warn mortgage brokers

Mortgage brokers have warned today’s inflation data is “terrible news for the property market”.

Lewis Shaw, founder of Mansfield-based Shaw Financial Services said:

This is a disaster. With CPI having stayed the same and core CPI rising, we can expect to see gilt yields spike as investors look for higher returns from government debt.

This spells terrible news for the property market because the Bank of England will be under enormous pressure to hike rates tomorrow, almost certainly by 50 basis points.

The knock-on effect is mortgage rates will continue to soar and the pain for households will intensify.

With mortgage rates already at the most painful level since the 90s, we can expect a slowdown in the property market and house prices are well and truly in the crosshairs.

Justin Moy, founder of Chelmsford-based mortgage broker EHF Mortgages: “This is a disaster for inflation and the government this morning, and pretty much guarantees a 0.5pc increase in base rate this week.

“The Bank of England has no other tools or means to attempt to reduce inflation, and lenders have already priced their products for this. The fear of god has already been put into borrowers this month, and there are plenty of panicking borrowers already this morning in my inbox screaming for help.”

08:09 AM BST

Bond yields surge as core inflation highest since 1992

Government borrowing costs have surged after underlying inflation hit its highest level in 31 years, as official data showed public sector debt reached more than 100pc of GDP for the first time since 1961.

Money markets shifted as inflation in Britain remained higher than expected for a fourth month, sending expectations for interest rates higher.

The yield two-year UK gilts, which are susceptible to changes in interest rates, jumped nearly 15 basis points after markets opened to 5.07pc, while on 10-year UK bonds jumped 10 points to 4.43pc.

Traders now expect the Bank of England to raise interest rates to 6pc by December, which would mean another 150 basis points of increases this year.

08:02 AM BST

FTSE 100 slumps at the open

The gloomy inflation data has not been received well on the stock markets as confidence weakens in the UK economy.

The FTSE 100 has begun the day down 0.5pc to 7,530.52 while the midcap FTSE 250 has slumped 0.9pc to 18,679.87.

07:59 AM BST

Inflation ‘continues to confound expectations’

Neil Birrell, chief investment officer at Premier Miton Investors, said:

Inflation in the UK continues to confound expectations, having come in above expectations for four months in a row.

Core inflation in particular is not falling as fast as hoped, which makes the Bank of England’s decision easier in some ways; a rate rise is certain, all they have to do now is decide how big it will be.

Beyond that, while rates are likely to continue up, it’s the trajectory that’s the debate, with a peak of 6pc a real possibility.

07:52 AM BST

Traders predict 50pc chance Bank of England raises rates by half point

Traders think there is a 50pc chance that the Bank of England will raise rates by 0.5 percentage points tomorrow.

They have fully priced in an increase in rates to 6pc by the end of the year.

Traders have also raised bets on further European Central Bank interest-rate hikes after the hotter-than-expected inflation data in the UK bolstered the case for more tightening.

Money markets are fully pricing in a 4pc terminal rate by October, with a quarter-point hike at next month’s meeting seen as almost a done deal, according to swaps tied to policy-meeting dates. The last time such a level was priced was in March.

ECB Executive Board member Isabel Schnabel that officials cannot afford to be complacent about inflation and should not worry about raising borrowing costs too far.

Goldman Sachs, UniCredit and BNP Paribas are among banks that have changed their outlook to forecast a 4pc terminal rate in the wake of the most recent quarter-point hike to 3.5pc.

07:46 AM BST

Higher rates risk ‘deepening the financial pain’

Responding to the higher than expected inflation figures for May, ICAEW economics director Suren Thiru said:

May’s hotter than expected outturn suggests that the fight against inflation is far from over, particularly given sky-high food bills and rising core inflation.

The UK’s inflation trajectory over the summer is largely locked in, with lower gas and electricity bills from July set to drive notable falls in the headline rate.

While core inflation is proving troublesome, the painful squeeze on consumer spending from soaring mortgage costs and higher taxes should soon put it on a downward path.

Although another interest rate rise on Thursday looks inescapable, further tightening will do little to address current inflationary pressures and instead risks deepening the financial pain facing people and businesses.

07:38 AM BST

The Bank of England needs help, warns economist

Melissa Davies, chief economist at Redburn, said described the inflation numbers as “truly unfortunate”. She said:

Inflation in the UK remains ‘hot’ across the board, with both consumer goods and services keeping up the pressure on prices.

One of the reasons US inflation is so much lower, for example, is that durable goods inflation has dropped to zero, but not so for the UK, where core goods and services CPI are both running in the high single-digits.

The lagged effects of energy price changes are worth around one percentage point on the headline rate now, which will largely come through in July, but this still leaves the economy with a serious inflation issue (the contribution from fuel prices is already negative).

It is easy to point fingers at the Bank of England for ‘missing’ the inflationary surge, but the reality is that fiscal policy has also arguably been too loose for too long in the UK in the wake of the pandemic.

With wage inflation running at around 7pc and underlying services and goods inflation still running at intolerably high rates, there is a long way to go to rein UK inflation to heel.

The Bank of England needs help from both government policy and wage-setters, and the journey is unlikely to be a pleasant one.

07:35 AM BST

‘Possible’ Bank of England will go for 50 basis point increase

The increase in core inflation puts more pressure on the Bank of England to get control of the economy as price rises persist.

Paul Dales, UK chief economist at Capital Economics, said:

The problem is that the recent surge in core inflation and the reacceleration in wage growth shows that domestic inflationary pressures are still strengthening.

This suggests the Bank may have more work to do than the Fed or ECB.

We think a 25bps rise in interest rates tomorrow alongside some hawkish noises will be followed in the coming months by two more hikes to a peak of 5.25pc.

But it is possible that the Bank will raise rates by 50bps tomorrow and will need to hike rates above 5.25pc to get on top of core inflation.

07:27 AM BST

Pound makes gains as core inflation rises

The pound spiked as data showed core inflation accelerated in May, but then reversed gains as concerns flared over the Bank of England’s ability to protect the economy from stagnating.

Sterling has risen 0.1pc against the dollar at $1.276, have spiked above $1.279.

Against the euro, the pound was up 0.1pc on the day at 85p.

Official data showed consumer inflation rose by 8.7pc year on year in May, showing no change from April’s figure, but above expectations for an increase of 8.4%.

But the core rate, which excludes food, energy, alcohol and tobacco, rose by 7.1pc, above expectations for a reading of 6.8pc.

It keeps the Bank of England under pressure to deliver a big rate rise when it meets later this week, but not so large it tilts the economy into recession.

07:20 AM BST

Benefits bill drives up Government borrowing

The Office for National Statistics has also released data on Government borrowing this morning.

Economics editor Szu Ping Chan has the details:

Britain’s soaring benefits bill drove up public borrowing to its highest May level outside of lockdown, according to official figures, pushing the UK’s debt share above the annual size of the economy for the first time since 1961.

The Government borrowed £20bn to plug the gap between tax receipts and public spending in May.

This is more than double the £9.4bn borrowed in the same month a year ago, according to the Office for National Statistics (ONS).

It is also the second highest May borrowing since monthly records began in 1993, only behind the first Covid lockdown in May 2020.

The ONS also said the UK’s total debt mountain is now 100.1pc of gross domestic product (GDP) exceeding 100pc for the first time since March 1961.

07:12 AM BST

Airfares and second-hand cars keep inflation high

As underlying inflation increased, the Office for National Statistics’ chief economist Grant Fitzner said:

After last month’s fall, annual inflation was little changed in May and remains at a historically high level.

The cost of airfares rose by more than a year ago and is at a higher level than usual for May.

Rising prices for second-hand cars, live music events and computer games also contributed to inflation remaining high.

These were offset by a fall in the cost of petrol.

Food price inflation remains high, but the rate has eased slightly this month with costs rising more slowly than this time last year.

07:10 AM BST

‘We know how much high inflation hurts families,’ says Hunt

After the latest inflation data was released, Chancellor Jeremy Hunt said:

We know how much high inflation hurts families and businesses across the country, and our plan to halve the rate this year is the best way we can keep costs and interest rates down.

We will not hesitate in our resolve to support the Bank of England as it seeks to squeeze inflation out of our economy, while also providing targeted support with the cost of living.

07:09 AM BST

Core inflation at highest level since 1992

The rate of Consumer Prices Index inflation remained unchanged at 8.7pc in May, the Office for National Statistics said.

But the concern for households up and down the country is the increase in core inflation to 7.1pc, which is closely watched by the Bank of England.

It is at its highest level since 1992.

07:06 AM BST

Good morning

Mortgage holders have been dealt a blow after underlying inflation increased last month, putting pressure on the Bank of England to continue raising interest rates.

The consumer prices index was flat at 8.7pc in May but the all-important core inflation figure watched by policymakers came in at 7.1pc – ahead of market expectations.

5 things to start your day

1) Downing Street dismisses Gove’s call for long-term mortgage deals | Government says that it is up to lenders to decide on products amid rising interest rates

2) Why a 25-year fix is not a silver bullet for the mortgage crisis | Gove’s proposal would likely lead to higher costs and require fundamental market reform

3) Mortgage bailout demands prove Covid left us addicted to welfare | Panic-stricken calls to raid the state’s coffers ignore Britain’s real crisis

4) Starmer must drop support for flagship £20bn nuclear power station, says former Gordon Brown adviser | Nick Butler urged the Labour leader to instead back the use of British-designed nuclear tech

5) ‘New Concorde’ edges closer to first flight after round of deals | Boom jets could cut journey times between London and New York to under four hours

What happened overnight

Asian stocks struggled on Wednesday as a lack of new stimulus steps from Beijing frustrated investors, who were also wondering just how hawkish the world’s most powerful central banker would be later in the session.

Federal Reserve chairman Jerome Powell is scheduled to give his semi-annual report to Congress later in two days of testimony and is sure to be questioned on whether rates will really rise again in July and peak in a 5.5pc to 5.75pc range as projected.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.8pc, with South Korea off 0.6pc.

Japan’s Nikkei added 0.7pc as the market consolidates three months of hefty gains. A survey showed morale at big Japanese manufacturers firmed in June to stay in positive territory for a second straight month.

Chinese blue chip stocks eased 0.6pc with investors still disappointed by the extent of Tuesday’s rate cuts, which also saw the yuan hit its lowest for the year.

Wall Street stocks retreated Tuesday in their first day of trading after a US public holiday.

All three major US equity indexes ended the session in the red amid signs of weakening global demand.

The Dow Jones Industrial Average shed 0.7pc to 34,054.07. The broad-based S&P 500 dipped 0.5pc to 4,388.73, while the tech-rich Nasdaq Composite Index lost 0.2pc at 13,667.29.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month, then enjoy 1 year for just $9 with our US-exclusive offer.

[ad_2]

Source link