ECB Official Fabio Labels Crypto As “Deleterious” With “No Societal Benefits” In Scathing Speech (The Fed And ECB Are The Deep State’s Own Printing Presses And Don’t Want Competition!) – Confounded Interest – Anthony B. Sanders

Yes, the ECB’s own Fabio … Panetta wants to ban any competition to Central Bank printing presses. Of course, like Elizabeth Warren (D-MA) and SEC’s Gary “The Ghoul” Genslar, he wants to protect The Deep State’s monopoly on money printing by banning competition.

According to Fabio Panetta, crypto volatility and aspects of blockchain technology made digital assets only suitable for gambling…

Fabio Panetta, an executive board member of the European Central Bank (ECB), has suggested a dark future for cryptocurrencies, in which digital assets may be used for little more than gambling among investors.

In written remarks for a panel at the Bank for International Settlements Annual Conference on June 23, Panetta said crypto’s perception among investors as a “robust store of value” began to dissipate in late 2021 and into 2022, when the total market capitalization fell by more than $1 trillion. According to the ECB official, the “highly volatile” nature of crypto assets made them suitable for gambling, and should be treated as such by global lawmakers.

“Due to their limitations, cryptos have not developed into a form of finance that is innovative and robust, but have instead morphed into one that is deleterious,” said Panetta.

“The crypto ecosystem is riddled with market failures and negative externalities, and it is bound to experience further market disruptions unless proper regulatory safeguards are put in place.”

He added:

“Policymakers should be wary of supporting an industry that has so far produced no societal benefits and is increasingly trying to integrate into the traditional financial system, both to acquire legitimacy as part of that system and to piggyback on it.”

Panetta claimed the “security, scalability and decentralisation” of crypto transactions was “not achievable,” saying the immutability of blockchains is a negative aspect of the space due to transactions often being unable to be reversed. He cited the collapse of FTX, as well as a recent lawsuit brought by the United States Securities and Exchange Commission again Binance, as “fundamental shortcomings” of the ecosystem.

“Crypto enthusiasts would do well to remember that new technology does not make financial risk disappear,” said the ECB official.

“It is like pressing a balloon on one side: it will change in shape until it pops on the other side. And if the balloon is full of hot air, it may rise for a while but will burst in the end.”

Panetta has previously backed parts of the ECB’s plans for a potential digital euro, currently being researched by the central bank.

He has also proposed banning crypto assets with an “excessive ecological footprint” as part of efforts to address risks to the environment.

Panetta is similar to anti-competition Statists like Senator Elizabeth Warren and SEC’s Gary “The Ghoul” Genslar who don’t want competition for The Fed’s massive printing press.

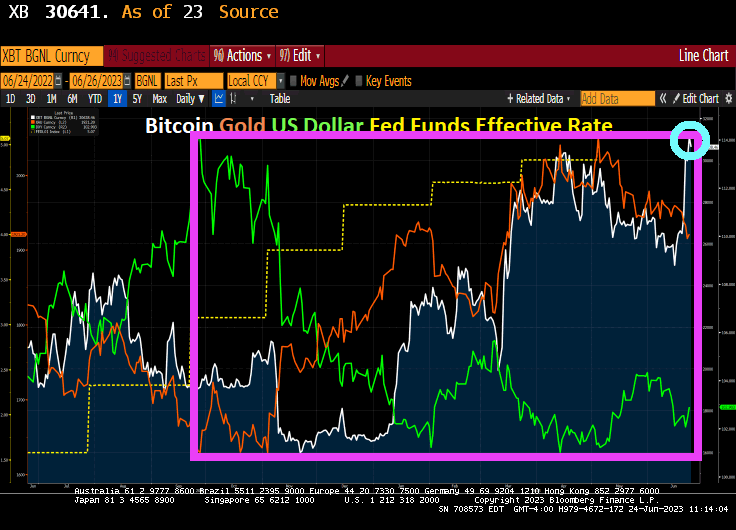

We know that Bitcoin along with Gold and Silver have done well the September 2022 when the US Dollar began to lose value.

Today, we are seeing a slight up-tick in Bitcoin (+0.05%) and Ethereum (+0.60%).

Not this Fabio.

[ad_2]

Source link